Car And Homeowners Insurance For Veterans

Car and Homeowners Insurance For Veterans

What is Insurance for Veterans?

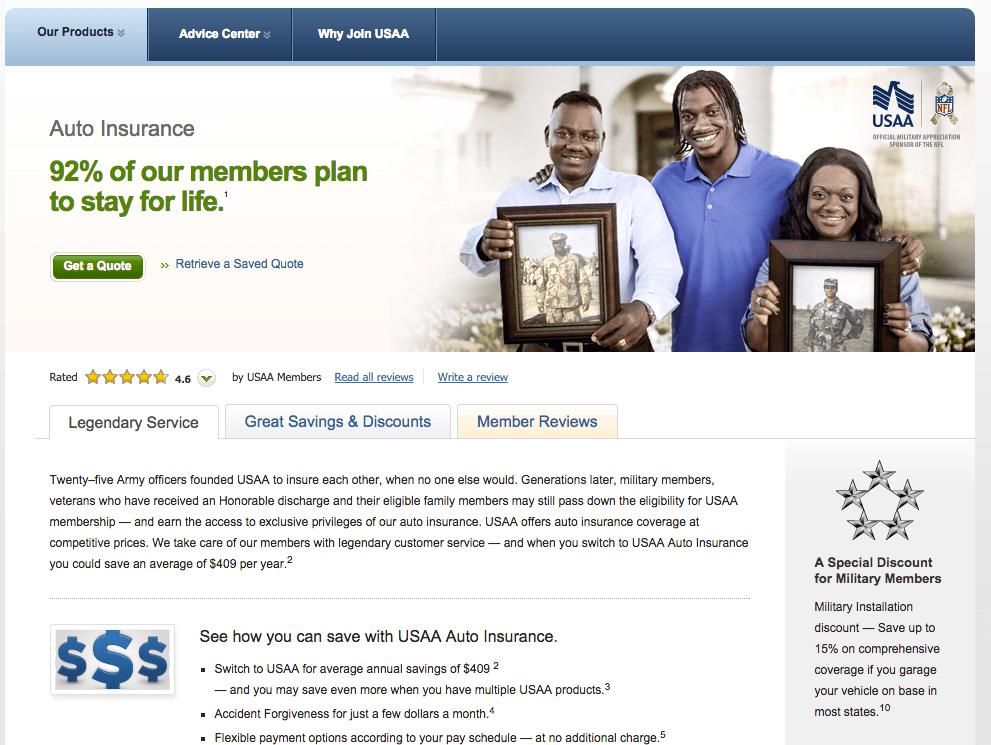

Insurance for Veterans is a type of insurance specifically designed to meet the needs of veterans who served in the military. This type of insurance is unique in that it is tailored to veterans who have served in the military, who may have difficulty finding regular insurance coverage due to their military service. The coverage typically includes a variety of car and homeowners insurance policies, with discounts and benefits that are designed to help veterans save money.

Benefits Of Insurance For Veterans

Insurance for Veterans offers a range of benefits for those who have served in the military. These benefits include discounts on car and homeowners insurance, as well as special coverage for veterans that may not be available with regular insurance providers. Additionally, many insurance companies offer exclusive discounts and benefits to veterans, such as a free car rental after deployment or discounted rates on rental cars. These benefits can make it easier for veterans to save money while still getting the coverage they need.

Types Of Insurance For Veterans

Insurance for Veterans typically includes a variety of car and homeowners insurance policies. Car insurance policies typically cover liability, collision, and comprehensive coverage. Homeowners insurance usually covers property damage, liability, and personal possessions. Additionally, most policies will include some form of medical coverage, such as disability insurance or medical evacuation coverage. These benefits can help veterans save money by providing them with more comprehensive coverage than they would receive from other insurance providers.

How To Find The Best Insurance For Veterans

Veterans can find the best insurance for their needs by doing some research. It is important to compare different insurance policies from different companies to ensure that veterans get the most coverage for their money. Additionally, veterans should consider taking advantage of any discounts offered by their insurance provider. These discounts may include discounts for military service, or discounts for having multiple policies with the same company.

Conclusion

Insurance for Veterans is an important and necessary form of insurance coverage for those who have served in the military. This type of insurance offers discounts and benefits that are tailored to veterans, making it easier for them to save money while still getting the coverage they need. Additionally, veterans should take the time to compare different insurance policies to ensure they get the coverage they need at the best price. By doing so, veterans can be sure they are receiving the best car and homeowners insurance coverage available.

Best Home And Auto Insurance For Veterans - thedesigns24

Homeowners Insurance for Military And Veterans in 2022

Total Care Auto Warranty: Who Is Eligible For Usaa Auto Insurance

Veterans automobile insurance: what is it and hom much cost? | General

Homeowners' Insurance - A Toolkit For Consumers - Cohen Law Group