Gap Insurance On A Used Car Is It Worth It

Sunday, March 31, 2024

Edit

Gap Insurance On A Used Car Is It Worth It?

What Is Gap Insurance?

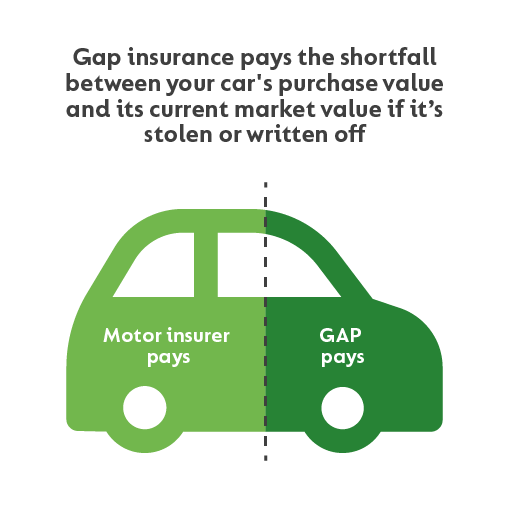

Gap insurance, also known as Guaranteed Asset Protection, is an insurance policy that covers the difference between what you owe on a car loan and the depreciated value of the car in the event of a total loss. It's important to understand that gap insurance only kicks in if your vehicle is stolen or totaled in an accident and your comprehensive or collision insurance doesn't cover the full value of the car.

When you purchase a new car, the value of the car depreciates by a large amount in the first year, and continues to depreciate at a slower rate over time. For example, a new car may depreciate by as much as 20% in the first year. If you have a loan on a car and you total it, your insurance company will only pay out the depreciated value of the car and not the amount that you owe on the loan. This is where gap insurance comes in.

What Does Gap Insurance Cover?

Gap insurance covers the difference between what you owe on your car loan and the depreciated value of your car. It will also cover any negative equity you may have in your car, which is when you owe more on the loan than the car is worth. The coverage is only applicable if your car is totaled or stolen. It is important to note that gap insurance does not cover any other type of damage to your car.

Do I Need Gap Insurance On A Used Car?

Gap insurance is not necessary on a used car if you are financing the car with a loan. This is because the value of a used car depreciates much more slowly than that of a new car, so the difference between what you owe on the loan and the depreciated value of the car is usually much less.

However, if you are financing a used car and you are upside down on the loan, meaning you owe more on the loan than the car is worth, gap insurance may be a good option for you. This is because if the car is totaled, gap insurance will cover the difference between what you owe on the loan and the depreciated value of the car.

Is Gap Insurance Worth It?

Gap insurance may be worth it if you are financing a car and you are upside down on the loan, meaning you owe more on the loan than the car is worth. In this case, gap insurance can provide peace of mind that in the event of a total loss, you will not be left with a large amount of debt.

However, if you are financing a used car and you are not upside down on the loan, gap insurance may not be worth it, as the difference between what you owe on the loan and the depreciated value of the car is usually much less than with a new car.

Conclusion

Gap insurance can provide peace of mind in the event of a total loss and is worth considering if you are financing a car and you are upside down on the loan. However, if you are financing a used car and you are not upside down on the loan, gap insurance may not be necessary.

It is important to shop around to find the best gap insurance policy for you and to understand the terms and conditions of the policy before signing up. It is also important to understand that gap insurance does not cover any other type of damage to your car and only covers the difference between what you owe on the loan and the depreciated value of the car.

Gap Insurance For Cars Is It Worth It - Is Car GAP Insurance Worth It

How Much Car Insurance Do You Really Need? | DaveRamsey.com

Gap Car Insurance Tips - Can I Buy Gaping Coverage Without Paying More

Gap Insurance at GoCompare | What is Gap Insurance and How Does it Work?

Is Gap Insurance Worth It? A Look Into The Cost And Coverage