What Is Motor Vehicle Insurance Policy

What Is Motor Vehicle Insurance Policy?

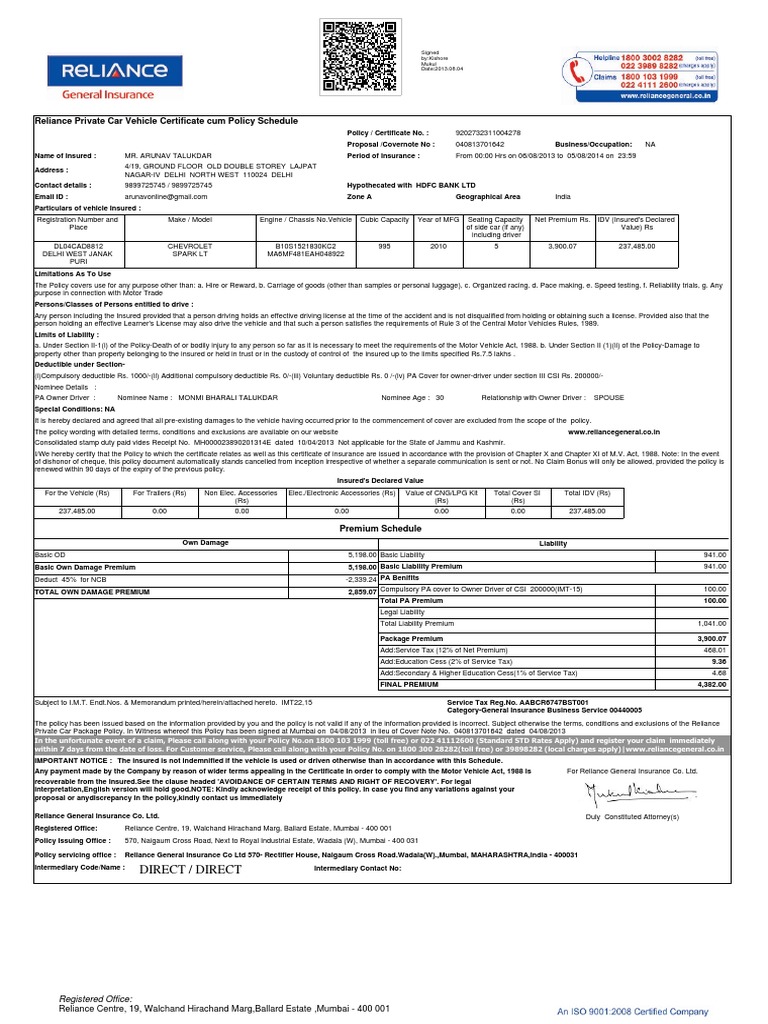

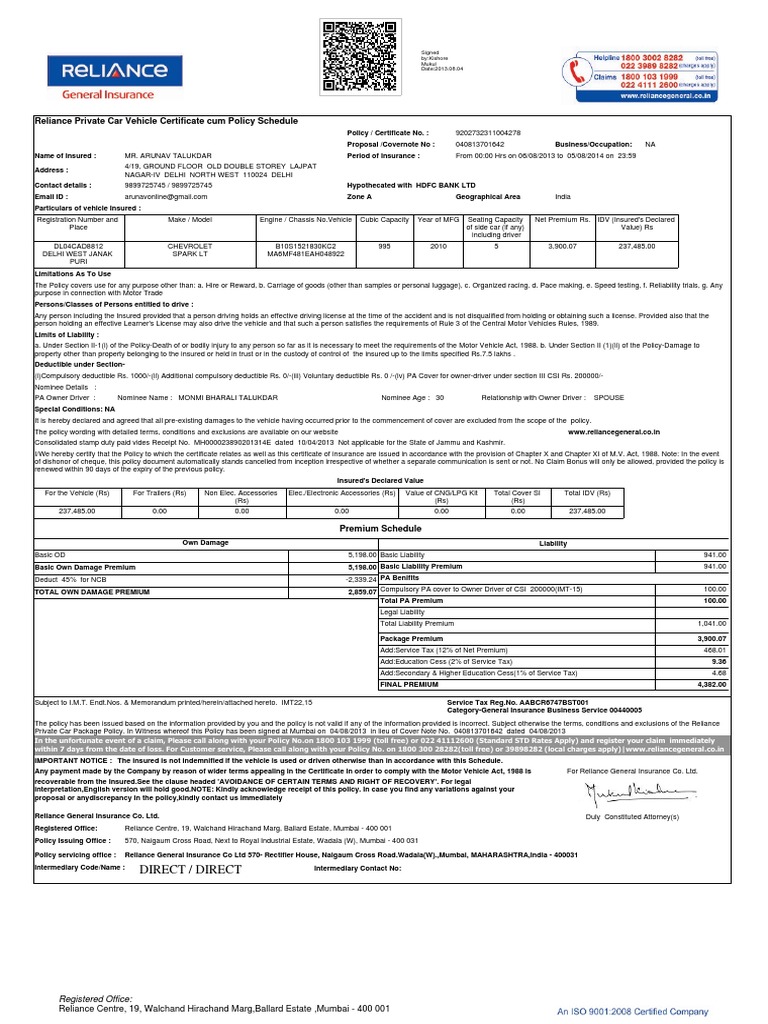

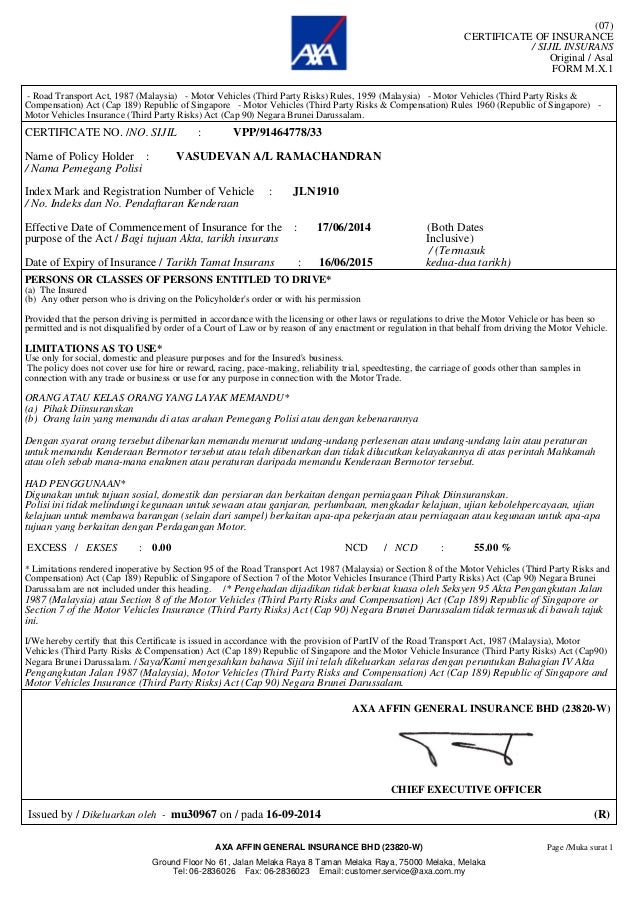

Motor vehicle insurance policy is an agreement between an insurance company and a vehicle owner, which provides financial protection against physical damage or bodily injury resulting from traffic collisions and against liability that could also arise from incidents in a vehicle. Motor vehicle insurance policy covers the cost of repair or replacement of your vehicle in the event of an accident or theft. It also provides protection against medical expenses, legal costs, and other expenses resulting from an accident. Depending on the policy, it may also provide coverage for liability and property damage.

What Is Covered Under Motor Vehicle Insurance Policy?

The coverage of a motor vehicle insurance policy will depend on the type of policy purchased. Generally, it will cover damages caused by an accident, theft, fire, vandalism, and other similar occurrences. It may also provide coverage for medical expenses, legal costs, and other expenses resulting from an accident. Some policies may also provide coverage for liability and property damage.

What Is Not Covered Under Motor Vehicle Insurance Policy?

Motor vehicle insurance policies typically do not cover damages caused by intentional acts, natural disasters, wear and tear, or mechanical breakdowns. Additionally, some policies may exclude coverage for certain types of vehicles, such as collector cars, and may not provide coverage for damages caused by racing or other competitive events. It is important to read and understand the terms and conditions of an insurance policy before purchasing it.

What Is the Difference Between Comprehensive and Collision Coverage?

Comprehensive coverage is designed to provide protection against damage caused by an event other than a collision, such as theft, fire, vandalism, and other similar occurrences. Collision coverage provides protection against damage caused by a collision with another vehicle or object. Both types of coverage are usually included in a motor vehicle insurance policy.

What Deductible Should I Select?

When selecting a deductible, it is important to consider how much financial risk you are willing to assume. Generally, the higher the deductible, the lower the premium. A deductible is the amount you will need to pay out-of-pocket before your insurance coverage kicks in. It is important to select a deductible that is affordable and right for your budget.

What Are the Benefits of Motor Vehicle Insurance Policy?

Having a motor vehicle insurance policy will provide you with financial protection in the event of an accident or theft. It will also provide you with legal protection in the event that you are sued for damages caused by an accident. Additionally, it will provide you with peace of mind knowing that you are covered in the event of an unexpected incident.

Vehicle Insurance Policy Format | Vehicle Insurance | Liability Insurance

When To Get Automobile Insurance coverage?

Motor Vehicle Insurance Act Pdf

Page for individual images - QuoteInspector.com

Motor Insurance Policy – Buy Now