Third Party Liability Insurance Construction

What is Third Party Liability Insurance in Construction?

Third Party Liability Insurance (TPL) is a type of insurance that protects contractors, subcontractors, and other parties involved in the construction industry from potential financial losses caused by the actions of a third party. This type of insurance is designed to cover the costs of damages that occur as a result of an accident or negligence on the part of a third party. It is an important form of protection for contractors, subcontractors, and other parties involved in the industry, as they are often held liable for any damages or injuries that occur on their property or as a result of their services.

Why is Third Party Liability Insurance Important in Construction?

Third Party Liability Insurance is important for a number of reasons. Firstly, it provides a layer of protection for contractors and subcontractors, who are often held liable for any damages that occur on their property or as a result of their services. Additionally, it provides a form of financial protection in the event that a third party is held liable for any damages or injuries that occur. Without this form of insurance, contractors, subcontractors, and other parties involved in the construction industry could be left vulnerable to financial losses.

What Types of Third Party Liability Insurance are Available?

There are a number of different types of Third Party Liability Insurance available for contractors, subcontractors, and other parties in the construction industry. These include general liability insurance, which covers damages that occur as a result of negligence on the part of a third party; product liability insurance, which covers damages caused by a product defect; and professional liability insurance, which covers damages caused by professional negligence. In addition, there are other types of Third Party Liability Insurance available, depending on the specific needs of the contractor or subcontractor.

How Does Third Party Liability Insurance Work?

Third Party Liability Insurance works by covering the costs of damages that occur as a result of an accident or negligence on the part of a third party. In most cases, the insurance company will pay the damages or injuries that occur on the property of the contractor, subcontractor, or other party involved in the construction industry. The insurance company will also cover the legal costs associated with any potential lawsuit that may arise due to the incident.

Do Contractors Need Third Party Liability Insurance?

Yes, contractors, subcontractors, and other parties involved in the construction industry should have Third Party Liability Insurance. This form of insurance provides a layer of protection from any potential financial losses that may occur as a result of an accident or negligence on the part of a third party. Without this form of insurance, contractors, subcontractors, and other parties involved in the construction industry could be left vulnerable to financial losses.

Where Can Contractors Find Third Party Liability Insurance?

Contractors, subcontractors, and other parties involved in the construction industry can find Third Party Liability Insurance through insurance brokers or insurance companies. It is important to compare different policies and prices to ensure that the insurance company offers the best coverage for the best price. Additionally, it is important to read the policy carefully to ensure that the insurance company covers all of the potential damages or injuries that may occur as a result of an accident or negligence on the part of a third party.

(PDF) The legislation approach of the Third Party Liability Insurance

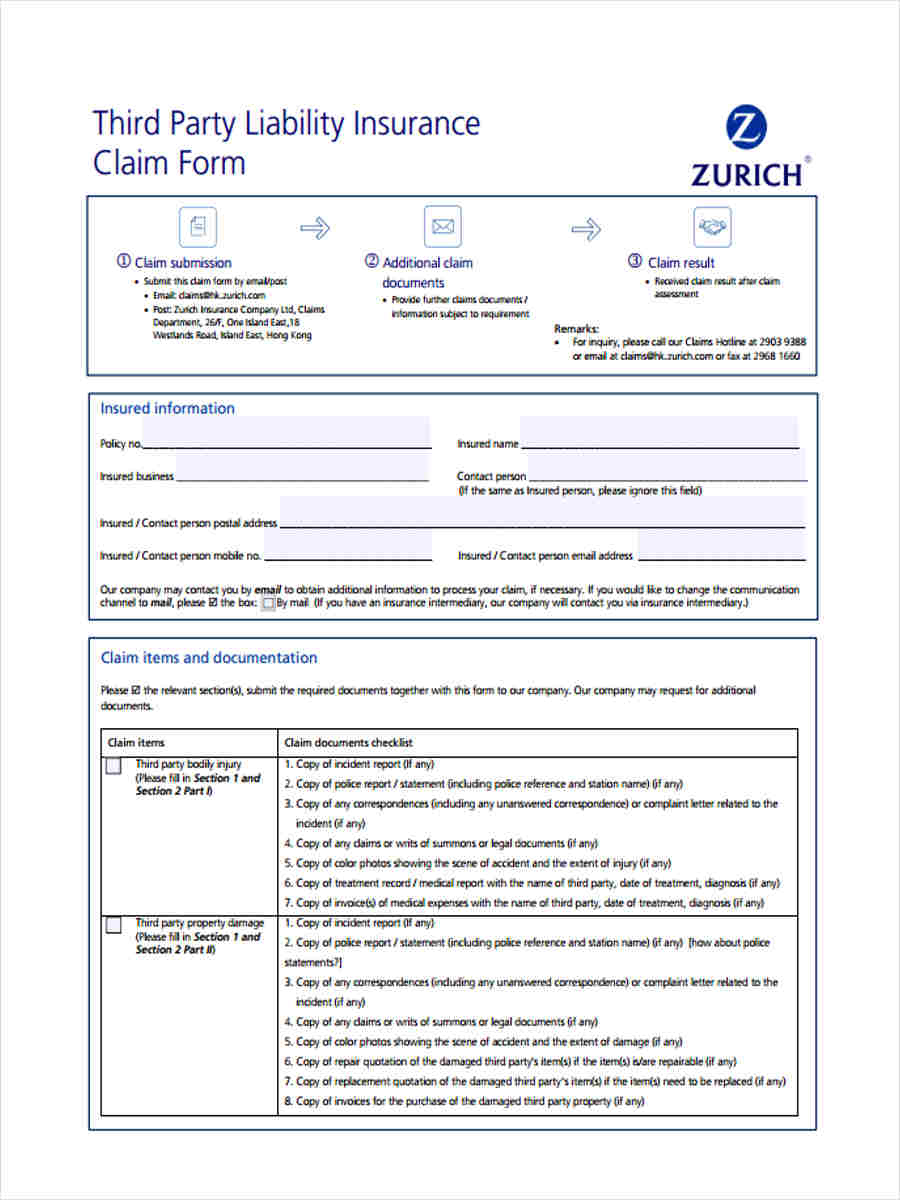

FREE 5+ Third Party Liability Forms in MS Word | PDF

What Is Third-party Insurance?

Liability Insurances

PPT - Third Party Liability PowerPoint Presentation, free download - ID