Adding A Person To Auto Insurance Policy

Tuesday, February 6, 2024

Edit

Adding a Person to an Auto Insurance Policy

What Does Adding a Person to an Auto Insurance Policy Mean?

Adding a person to an auto insurance policy means that the person is listed as an insured driver on the policy. It means that the individual is legally covered to drive any of the vehicles on the policy, as long as they have a valid license. The individual will be covered in the event of an accident or other incident that results in a claim. The person being added to the policy will also pay their share of the premium, as determined by the insurance company.

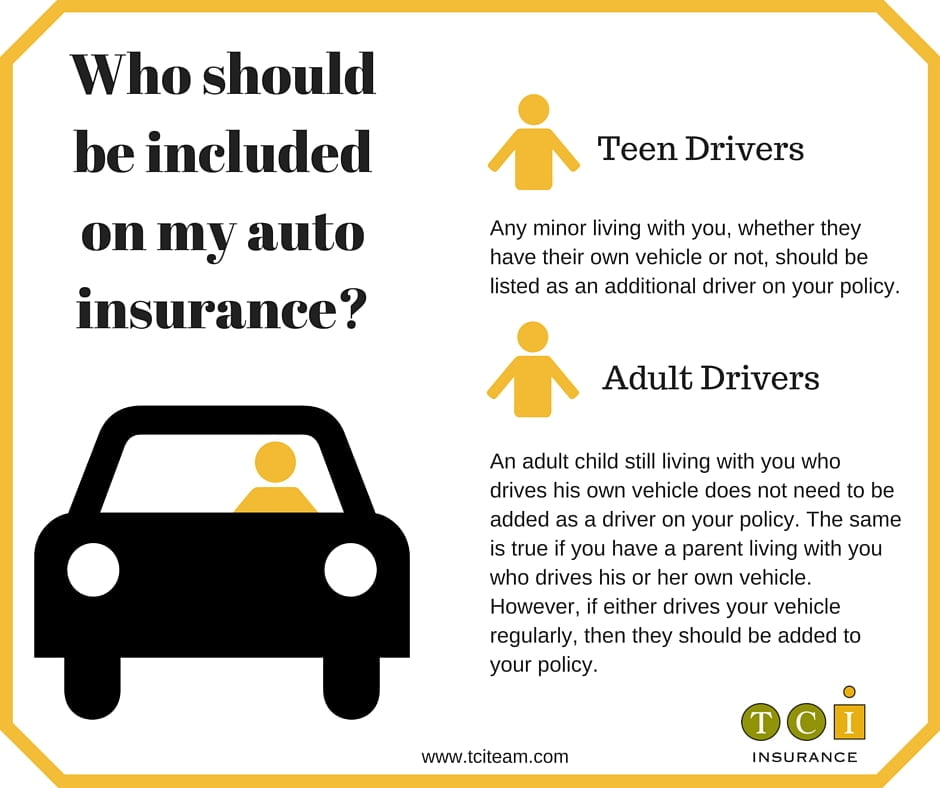

Who Can Be Added to an Auto Insurance Policy?

Generally, any individual who is a licensed driver and lives with the policyholder can be added to the policy. This includes family members, such as spouses, adult children, and sometimes even roommates. A person who is related to the policyholder, such as a parent or sibling, can also be added to the policy, but they must live at the same address as the policyholder.

What Are the Benefits of Adding a Person to an Auto Insurance Policy?

There are several benefits to adding a person to an auto insurance policy. First, it ensures that the person is covered in the event of an accident or incident. Additionally, adding a person to the policy can help to spread the risk among multiple drivers, which can help to keep the cost of the policy lower. It can also help to protect the policyholder from financial losses in the event of an accident or incident.

What Are the Risks of Adding a Person to an Auto Insurance Policy?

Adding a person to an auto insurance policy can also increase the risk of a claim. This is because the person being added to the policy may have a less-than-perfect driving record, or they may be a higher risk driver due to age or other factors. Additionally, if the policyholder is adding a person who does not live with them, the insurance company may require additional information and documentation to prove that the person is a legitimate insured driver.

What Documents Are Required to Add a Person to an Auto Insurance Policy?

In general, the documents required to add a person to an auto insurance policy include the individual’s driver’s license, proof of address, and proof of relationship (if applicable). The insurance company may also require additional documents, such as the individual’s driving record or a signed statement from the policyholder. Additionally, the insurance company may require a signed authorization form from the individual being added to the policy.

How Long Does It Take to Add a Person to an Auto Insurance Policy?

The amount of time it takes to add a person to an auto insurance policy depends on the insurance company. Generally, it takes anywhere from a few hours to a few days. In some cases, it may take longer if the insurance company needs additional information or documents. Additionally, the amount of time it takes to add a person to the policy may be affected by the time of year, as some insurance companies have periods of peak demand.

Adding A Teen Driver To Insurance | TGS Insurance Agency

Adding a Teen Driver to Your Auto Insurance Policy: What You Need to

Adding a Driver To Car Insurance - 2022 Guide : Motorcycling 2022

How to Choose Auto Insurance Coverage in PA - YouTube

Can I Add My Son To My Car Insurance Policy - 2020 - EMK - Insurance