Does Geico Do Gap Insurance

Does Geico Do Gap Insurance?

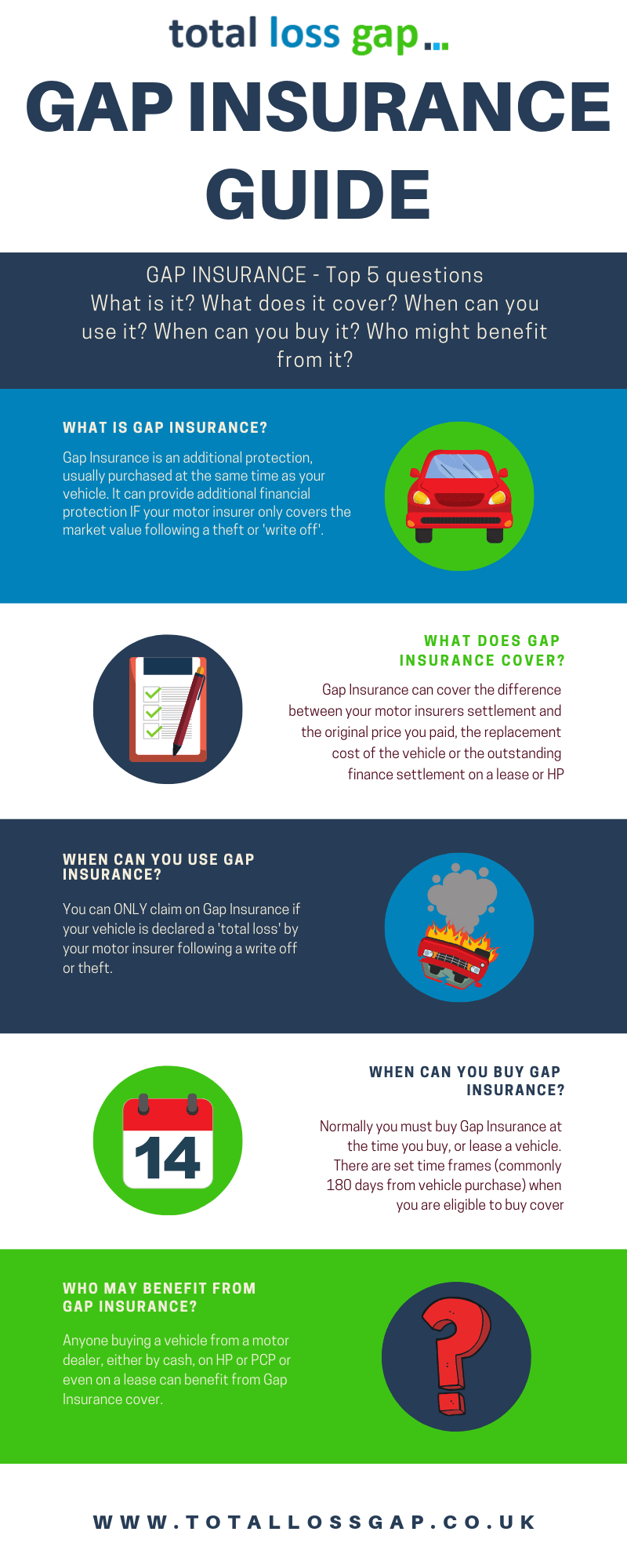

What Is Gap Insurance?

Gap insurance, also known as Guaranteed Auto Protection Insurance or Loan/Lease Payoff Insurance, is a type of insurance coverage that helps to bridge the gap between the cash value of a vehicle and the amount still owed to the lender or leasing company. It provides coverage for the difference between the cash value of the vehicle and the amount that is still owed on the loan or lease of the car. If a vehicle is totaled or stolen, the insurance company will provide coverage for the difference between the cash value of the vehicle and the amount still owed to the lender or leasing company.

Why Is Gap Insurance Necessary?

Gap insurance is important because the value of a vehicle depreciates at a much faster rate than the amount of money owed on the loan or lease. This means that if you have an accident and the vehicle is totaled, the insurance company will only pay the cash value of the vehicle, which may be significantly less than the amount still owed on the loan or lease. Gap insurance helps to bridge this gap and ensures that you do not have to pay out of pocket for the difference.

Does Geico Offer Gap Insurance?

Yes, Geico does offer gap insurance. Gap insurance from Geico is available to customers who purchase a new or used vehicle from a licensed dealer, or who lease a vehicle. Gap insurance from Geico can be purchased as an add-on to a new or existing Geico auto insurance policy. It is important to note that gap insurance is only available to customers who have a loan or lease originated by a financial institution, not to customers with cash purchases.

How Much Does Gap Insurance From Geico Cost?

Gap insurance from Geico is priced according to the value of the vehicle and the amount of coverage you choose. Coverage amounts range from $500 to $50,000, and premiums can range from as little as $25 to as much as $400, depending on the coverage amount and the value of the vehicle. It is important to note that gap insurance from Geico is only available to customers who have a loan or lease originated by a financial institution, not to customers with cash purchases.

Conclusion

Gap insurance from Geico is an important type of coverage for anyone who has taken out a loan or lease on a vehicle. It helps to bridge the gap between the cash value of the vehicle and the amount still owed to the lender or leasing company, ensuring that you do not have to pay out of pocket for any difference. Gap insurance from Geico is available to customers who purchase a new or used vehicle from a licensed dealer, or who lease a vehicle, and premiums can range from as little as $25 to as much as $400, depending on the coverage amount and the value of the vehicle.

20 Things You Didn't Know about Geico Insurance

How to Cancel Geico Insurance - Honest Policy

GEICO Home Insurance Review 2019 (Buyer Beware Before You Buy)

Is It Worth Getting Gap Insurance On A Pcp - TRAVELVOS

Does Geico Have Life Insurance - Keikaiookami