Does Geico Offer Gap Insurance In California

Does Geico Offer Gap Insurance In California?

What Is Gap Insurance?

Gap insurance, sometimes referred to as “loan/lease gap coverage”, is an optional car insurance coverage that helps protect you in the event that you owe more money on your car than it is worth. It is typically offered by most car insurance companies and is designed to protect you from financial losses in the event that your car is totaled or stolen. In other words, it can help you cover the “gap” between what you owe your lender or leasing company and what your car is worth if it is totaled or stolen.

Does Geico Offer Gap Insurance?

Yes, Geico does offer gap insurance. Geico offers its customers gap insurance coverage as an optional add-on to their existing auto insurance policy. Geico gap insurance can help you cover the difference between the value of your car and the amount owed on your loan or lease if your car is totaled or stolen. It pays out in addition to any other insurance coverage you may have.

What Does Geico Gap Insurance Cover?

Geico gap insurance covers the difference between the amount you owe on your vehicle and the actual cash value of the vehicle if it is totaled or stolen. This coverage is only available if you have an auto loan or lease and is subject to the terms and conditions of your policy. It is important to note that gap insurance does not cover any damage to your car, only the difference between the amount you owe and the actual cash value of the vehicle.

Does Geico Offer Gap Insurance In California?

Yes, Geico does offer gap insurance in California. Geico offers its customers gap insurance coverage as an optional add-on to their existing auto insurance policy. Geico gap insurance can help you cover the difference between the value of your car and the amount owed on your loan or lease if your car is totaled or stolen. It pays out in addition to any other insurance coverage you may have.

How Much Does Geico Gap Insurance Cost?

The cost of gap insurance varies depending on the type of coverage you choose and the value of your car. Generally speaking, gap insurance costs between 4% and 6% of the total amount of your loan or lease. So, if you have a loan of $20,000, gap insurance could cost you between $800 and $1,200. It is important to note that gap insurance can be more expensive if you have a higher loan amount or a longer loan term.

How Do I Sign Up For Geico Gap Insurance?

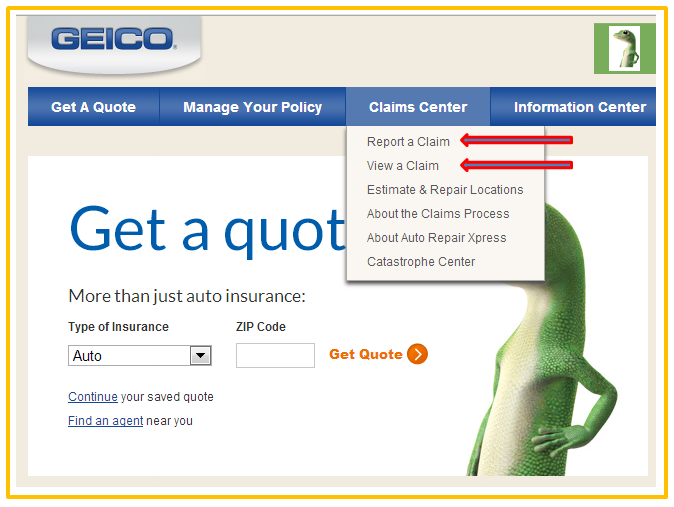

If you are interested in purchasing gap insurance from Geico, you can do so online or by speaking with a Geico representative. You can also add gap insurance to your existing policy at any time. It is important to note that gap insurance does not cover any damage to your car, only the difference between the amount you owe and the actual cash value of the vehicle.

Conclusion

Gap insurance can be a valuable addition to your car insurance policy, especially if you have an auto loan or lease. Geico offers gap insurance coverage as an optional add-on to their existing auto insurance policy, and it is available in California. The cost of gap insurance varies depending on the type of coverage you choose and the value of your car. If you are interested in purchasing gap insurance from Geico, you can do so online or by speaking with a Geico representative.

Do You Really Save 15% with GEICO?

Gap Insurance Geico See Auto Insurance Options From Geico, Plus

GEICO CAR INSURANCE REVIEWS 2017

How good is Geico auto insurance? - Quora

Cancel Geico Insurance : Why Does Geico Ask Me Not To Reveal The Limits