Gap Insurance Providers For Used Cars

Gap Insurance Providers For Used Cars Explained

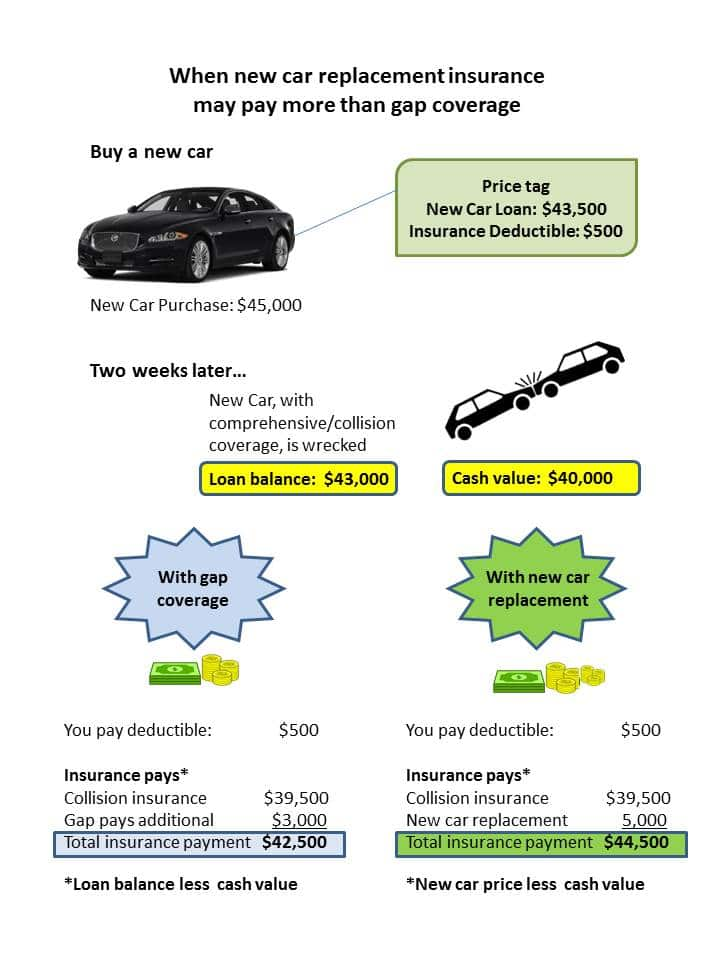

If you’ve recently purchased a used car, you may have heard of gap insurance. The term “gap” refers to the difference between the amount you owe on your car loan and the current market value of your car. In the event that your car is totaled or stolen, gap insurance helps cover the difference. Gap insurance is also known as loan/lease payoff insurance or loan gap coverage. It’s important to understand how gap insurance works before you decide to purchase it.

What Does Gap Insurance Cover?

Gap insurance covers the gap between the amount you owe on the car loan and the actual cash value of the car. If your car is totaled or stolen, your regular auto insurance will only cover the actual cash value of the car. The actual cash value is based on the car’s age and condition, so you may still owe more than the actual cash value. Gap insurance helps you pay off the remaining balance on your car loan. It can also help pay for rental cars, towing, and other unexpected costs.

Who Needs Gap Insurance?

If you’ve recently purchased a used car, you may want to consider gap insurance. When you purchase a new car, the car’s value usually decreases rapidly. This is known as “depreciation.” If you purchased a used car, the car’s value may have already depreciated significantly. If you have a car loan and the car is totaled or stolen, you may owe more than the car is worth. Gap insurance can help you pay off the remaining balance of your car loan.

How Much Does Gap Insurance Cost?

The cost of gap insurance depends on several factors, including the amount you owe on your car loan, the age and condition of your car, and the type of coverage you choose. Typically, gap insurance costs about $20 to $30 per year. You can purchase gap insurance from your auto insurance company or from a third-party provider.

Should You Purchase Gap Insurance?

Gap insurance can be a good investment if you’ve recently purchased a used car, especially if you have a long-term loan. If you have a short-term loan, you may not need gap insurance. You should also consider the amount you owe on your car loan. If the amount you owe is close to the actual cash value of the car, you may not need gap insurance. Ultimately, it’s up to you to decide if gap insurance is worth the cost.

Conclusion

Gap insurance is a type of coverage that can help you pay off the remaining balance of your car loan if your car is totaled or stolen. If you’ve recently purchased a used car, you may want to consider gap insurance. The cost of gap insurance depends on several factors, including the amount you owe on your car loan, the age and condition of your car, and the type of coverage you choose. Ultimately, it’s up to you to decide if gap insurance is worth the cost.

Gap Car Insurance Tips - Can I Buy Gaping Coverage Without Paying More

Do Not Get Taken For A Ride When Looking For Auto Insurance — shaketext5

Buying A Car Gap Insurance ~ designologer

Gap insurance: The ins and outs | Progressive

Gap Insurance for your New or Leased Cars