Ntuc Car Insurance Accident Report

NTUC Car Insurance Accident Report – What You Need To Know

What is NTUC Car Insurance?

NTUC Car Insurance is an insurance policy issued by the NTUC Income insurance company in Singapore. It provides coverage for accidental damage or loss of your car, as well as personal injury and death benefits for the insured individual and their passengers. It also provides coverage for third-party property damage and injuries, as well as uninsured motorist coverage. It is available for cars of all kinds, including private cars, commercial vehicles, motorcycles and motorbikes. The insurance policy is designed to provide the maximum protection for you and your car.

What Does an NTUC Car Insurance Accident Report Include?

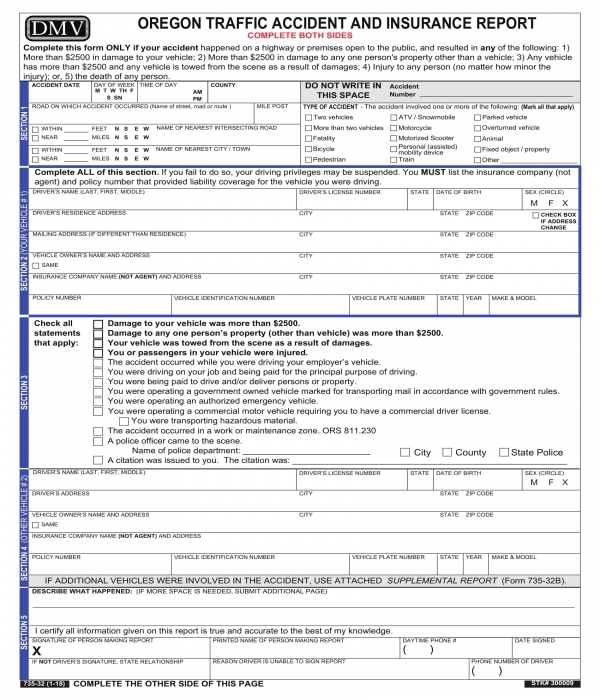

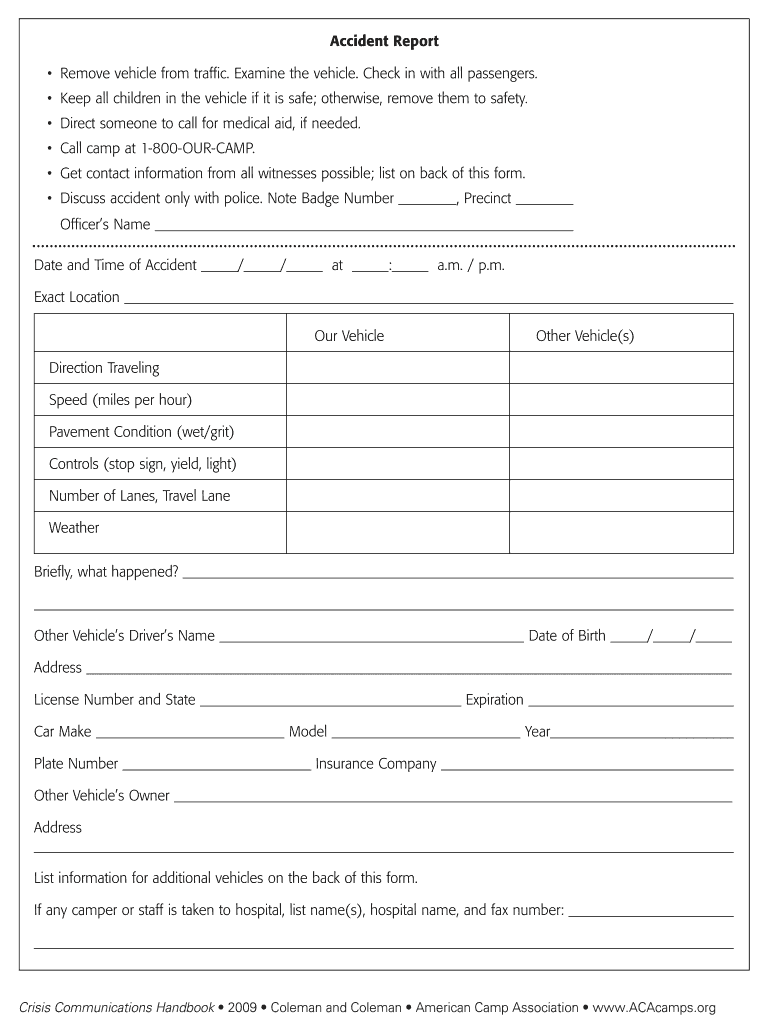

An NTUC Car Insurance accident report includes detailed information about the accident and the damage caused. It will include the date and time of the incident, the location of the accident, the details of the vehicles involved, a description of the damage to the vehicle, and a list of witnesses. It will also include the contact details of the insured individual, their insurance company, and the other driver. The accident report may also contain a summary of the investigation conducted by the insurance company, including any findings of fault.

How Do I Make an NTUC Car Insurance Accident Report?

If you have been involved in an accident, you should immediately contact your insurance company to report the incident. They will then provide you with an NTUC Car Insurance accident report form. You will need to fill out the form accurately and completely. It is important to include all the details of the incident, such as the date and time of the accident, the location of the accident, the details of the vehicles involved, a description of the damage to the vehicle, and a list of witnesses.

What Happens After an NTUC Car Insurance Accident Report is Filed?

Once the accident report has been submitted to the insurance company, they will investigate the incident and assess the damage. They will then determine who was at fault and if the incident was covered by your insurance policy. If the accident is covered, the insurance company will cover the cost of repairs and any medical expenses. If the accident was not covered, the insurance company may still offer to cover some of the costs, depending on the circumstances.

What Should I Do If I Disagree with the Findings of the NTUC Car Insurance Accident Report?

If you disagree with the findings of the NTUC Car Insurance accident report, you can file a complaint with the Singapore Ombudsman. The Ombudsman will investigate the incident and make a decision on who was at fault and if the incident was covered by your insurance policy. You can also file a lawsuit against the other driver if you believe they were at fault and if they were not adequately covered by their own insurance policy.

Conclusion

An NTUC Car Insurance accident report is an important document that provides detailed information about the incident and the damage caused. It is important to complete the form accurately and completely to ensure that all the details of the incident are accurately recorded. If you disagree with the findings of the report, you can file a complaint with the Singapore Ombudsman or file a lawsuit against the other driver.

NTUC SilverCare Review- Why get personal accident for your aged parents!

Vehicle Insurance Pdf File

003 Template Ideas Accident Report Forms Formidable Form with regard to

Summer Camp Incident Report Template Form - Fill Out and Sign Printable

FREE 5+ Car Accident Report Forms in PDF