Gap Insurance For Leased Cars

What is Gap Insurance For Leased Cars?

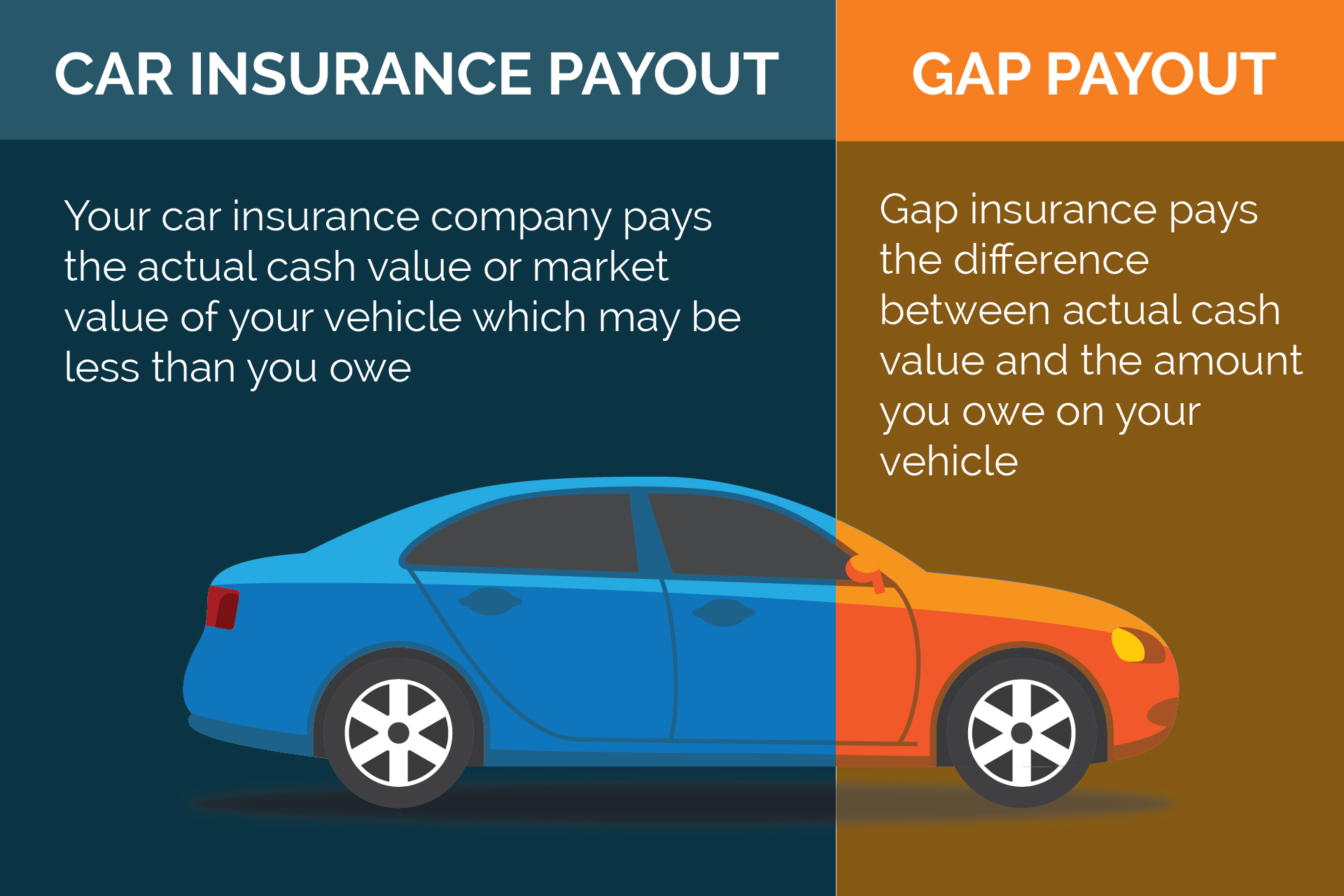

Gap insurance is essential when leasing a car, as it covers the difference between the car’s value at the time of the accident and the amount owed on the lease. In other words, gap insurance protects drivers from the financial losses associated with an accident, theft, or natural disaster. Gap insurance is especially important for drivers who are leasing a car, as they may be liable for the difference between the current market value of the car and the amount still owed on the lease.

Why Do You Need Gap Insurance For Leased Cars?

Gap insurance is important for those who are leasing cars because it covers the difference between the amount owed on the lease and the current market value of the car. Without gap insurance, drivers who are leasing cars may be liable for the difference if the car is totaled in a crash or stolen. Gap insurance is also important for drivers who have a loan on their vehicle, as it will cover the difference between the loan amount and the current market value of the car.

What Does Gap Insurance Cover?

Gap insurance covers the difference between the current market value of the car and the amount still owed on the lease or loan. It also covers the difference between the amount of the deductible and the current market value if the car is totaled in an accident or stolen. Gap insurance is also known as loan/lease gap insurance, and it can be purchased as an addition to an existing auto insurance policy or as a standalone policy.

How Much Does Gap Insurance Cost?

The cost of gap insurance varies depending on the type of policy and the amount of coverage purchased. Generally, gap insurance policies are less expensive than traditional auto insurance policies. The cost of gap insurance is typically a percentage of the amount of coverage purchased, and the cost can range from a few hundred dollars to a few thousand dollars. The cost of gap insurance will also vary depending on the type of car being leased and the amount of coverage purchased.

How Do I Purchase Gap Insurance?

Gap insurance can be purchased from most auto insurance companies. It is important to shop around and compare different policies and coverage levels to ensure that you are getting the best deal for your particular situation. When shopping for gap insurance, it is important to consider the amount of coverage and the type of policy that best meets your needs. It is also important to consider the deductible and other features that may be included in the policy.

Conclusion

Gap insurance is an important form of protection for those who are leasing cars or who have a loan on their vehicle. It covers the difference between the amount owed on the lease or loan and the current market value of the car. Gap insurance can be purchased as an addition to an existing auto insurance policy or as a standalone policy. It is important to shop around and compare different policies and coverage levels to ensure that you are getting the best deal for your particular situation.

What Is Gap Insurance On A Leased Vehicle - IVELTRA

Page for individual images • Quoteinspector.com

Why do You Need Gap Insurance? | Car lease, Insurance, Gap

Do You Need GAP Insurance On A Lease Car? | Moneyshake

Buying A Car Gap Insurance ~ designologer