Car Insurance For A 17 Year Old

Car Insurance For A 17 Year Old

Understanding Car Insurance for 17 Year Olds

It can be daunting for a 17 year old to navigate the world of car insurance. After all, you are just beginning to figure out your finances and car insurance is a major expense. But, unfortunately, it is a necessary one. Car insurance is an important safety net, protecting you and your vehicle from unexpected events. No one wants to think of what could go wrong, but it is important to be prepared.

In the US, all drivers are required by law to carry a minimum level of car insurance. The exact amount of insurance required varies from state to state, so it is important to check your state’s laws and regulations. Generally, the minimum requirements are for liability coverage, which covers the cost of damage you may cause to other people, vehicles, and property. Depending on your state, you may need to add additional coverage for yourself, such as collision coverage, which covers the cost of repairing your car after an accident.

Factors That Affect Your Car Insurance Premiums

When you are a 17 year old, there are a few factors that will affect how much you pay for car insurance. One of the most important is your driving record. If you have had any accidents or traffic violations, your insurance premiums will likely be higher. Additionally, the type of car you drive and the amount of coverage you choose will also affect your premiums. If you have a newer, more expensive car, your premiums will likely be higher than if you have an older, less expensive car.

Your age is also an important factor. Generally, 17 year olds will pay more for car insurance than older drivers. This is because insurers consider young drivers to be higher risk and more likely to get into accidents. Additionally, if you are a student, you may be eligible for discounts with some insurers. Be sure to ask your insurer about any discounts or special offers you may be eligible for.

How to Save Money on Car Insurance

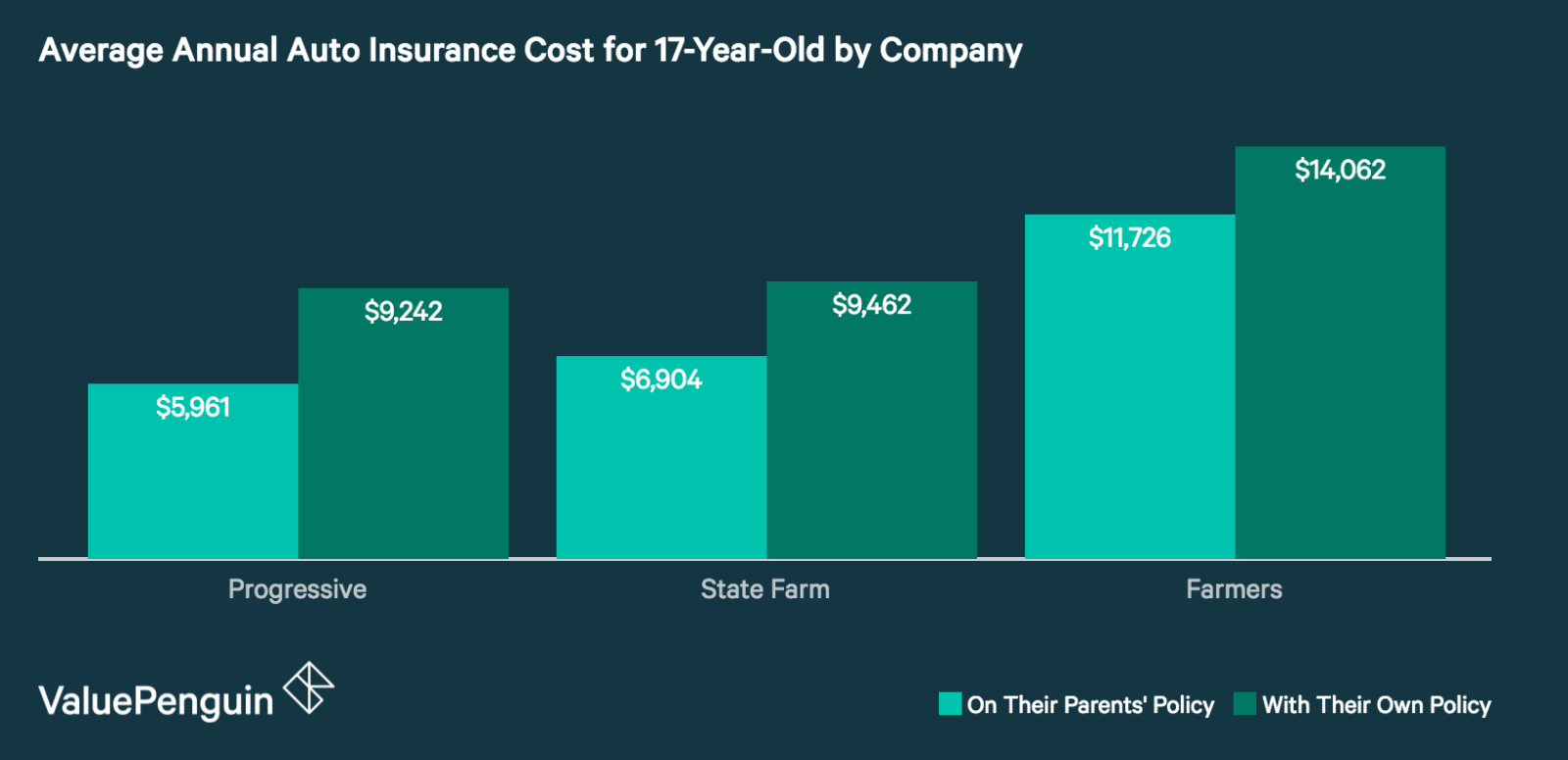

There are a few things you can do to save money on car insurance as a 17 year old. One of the most important is to shop around. Different insurance companies have different rates, so it is worth it to compare rates and find the best deal. You can also look into discounts, such as good student discounts or multi-policy discounts. Additionally, you can consider raising your deductible, which is the amount you pay out of pocket before your insurance kicks in. This can lower your premiums, but it will also mean more expense for you if you do get into an accident.

Finding the Right Car Insurance for You

When you are a 17 year old looking for car insurance, it is important to do your research and find the right policy for you. Make sure to check your state’s laws and regulations to ensure you are meeting the minimum requirements. Then, compare rates and look into discounts to find the best deal. Finally, make sure to read the fine print of any policy you are considering to make sure you understand exactly what is covered and what is not.

How much is car insurance for a 17 year old? by alonzo11218510 - Issuu

77 Best Of Car Insurance Quotes for 17 Year Olds

How Much Is Car Insurance for a 17-Year-Old? - ValuePenguin

How Much Is Car Insurance for a 17-Year-Old? - ValuePenguin

Average Car Insurance Cost for a 17 Year Old - (Male and Female Rates)