How Much Is Car Insurance For A 17 Year Old

The Cost of Car Insurance for 17 Year Olds

Getting Behind the Wheel as a Teenager

For most teenagers, getting a driver's license is a rite of passage. You finally get to be independent and drive where you want. But before you hit the road, you need to consider the cost of car insurance for 17 year olds. Having car insurance is a legal requirement in most states, and it can be very expensive for teenage drivers. Knowing what to expect and how to save money can help you make the best decision for your budget.

Factors That Impact the Cost of Car Insurance

When you are shopping for car insurance as a young driver, there are a few factors that can impact the cost. Your age, the type of car you drive, the type of coverage you choose, and your driving record are all important considerations. Insurance companies usually charge higher rates for teenage drivers because they are more likely to be involved in an accident. Additionally, if you have a poor driving record or a history of citations, this will raise your rates.

The Average Cost of Car Insurance for 17 Year Olds

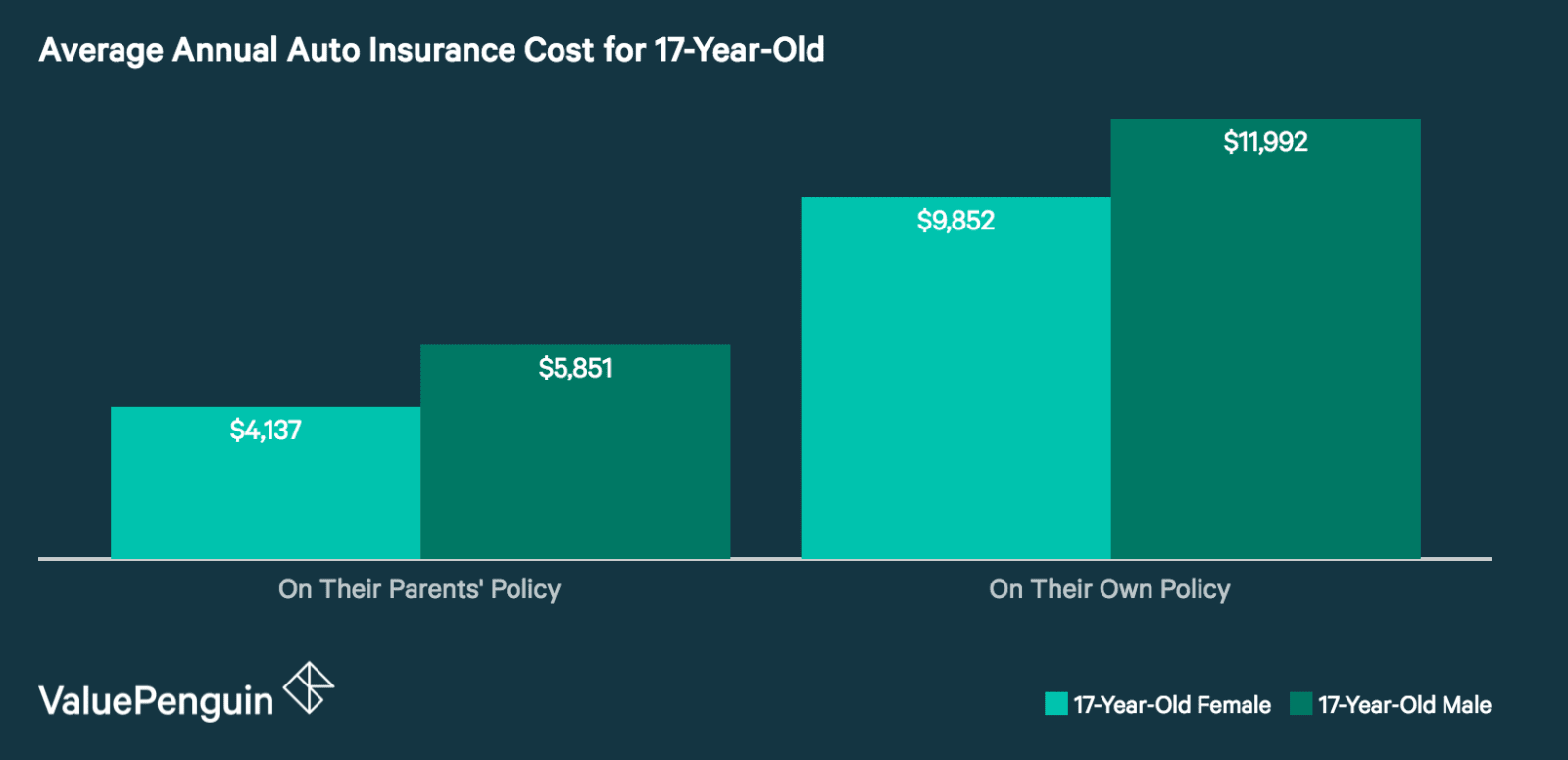

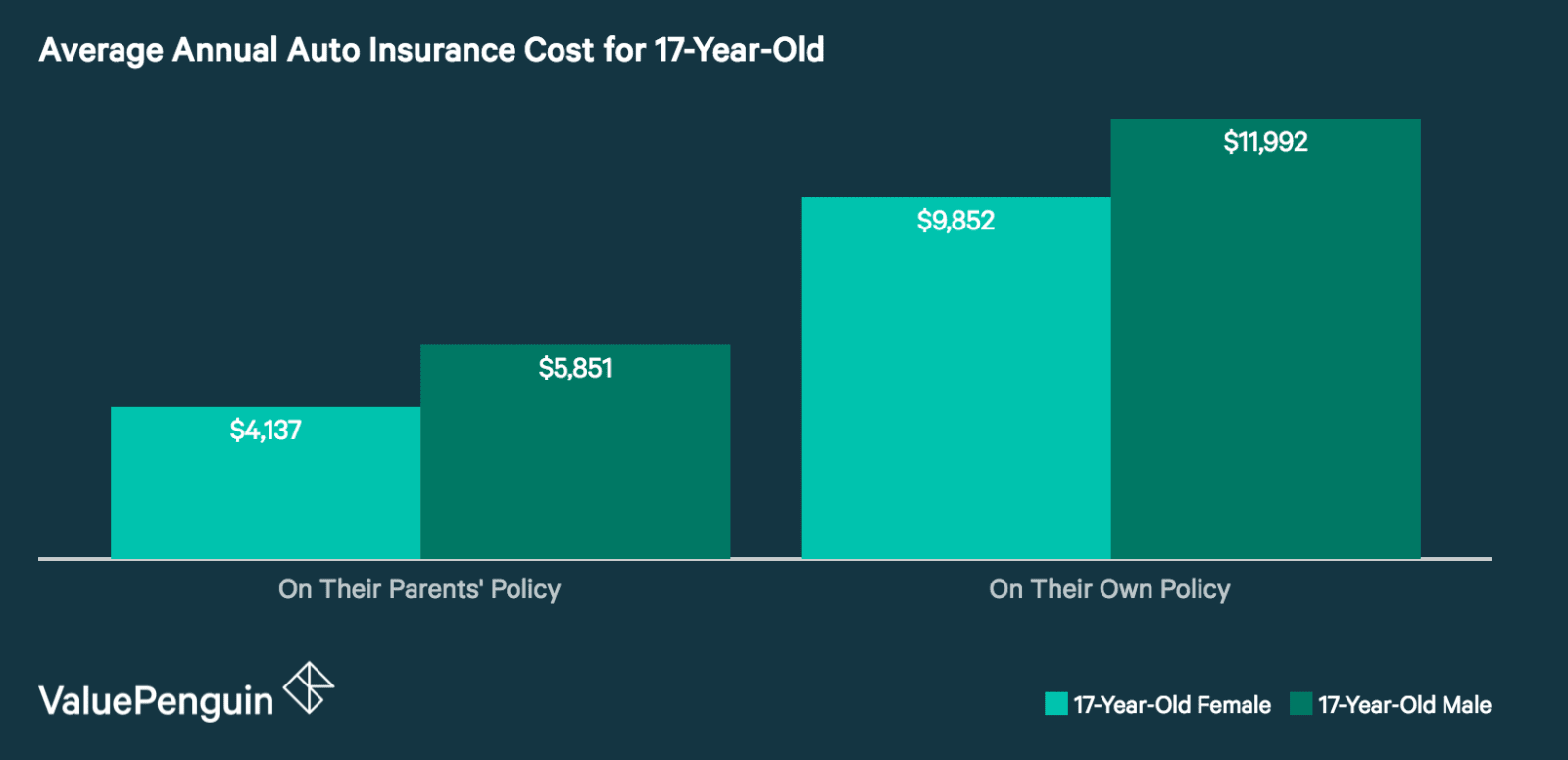

The average cost of car insurance for 17 year olds can vary widely depending on the above factors. Generally speaking, the cost of car insurance for 17 year olds is much higher than for older drivers. According to the Insurance Information Institute, the average cost of car insurance for 17 year olds is $5,429 per year. This figure is based on a full coverage policy, which includes liability, comprehensive, and collision coverage.

How to Save Money on Car Insurance for 17 Year Olds

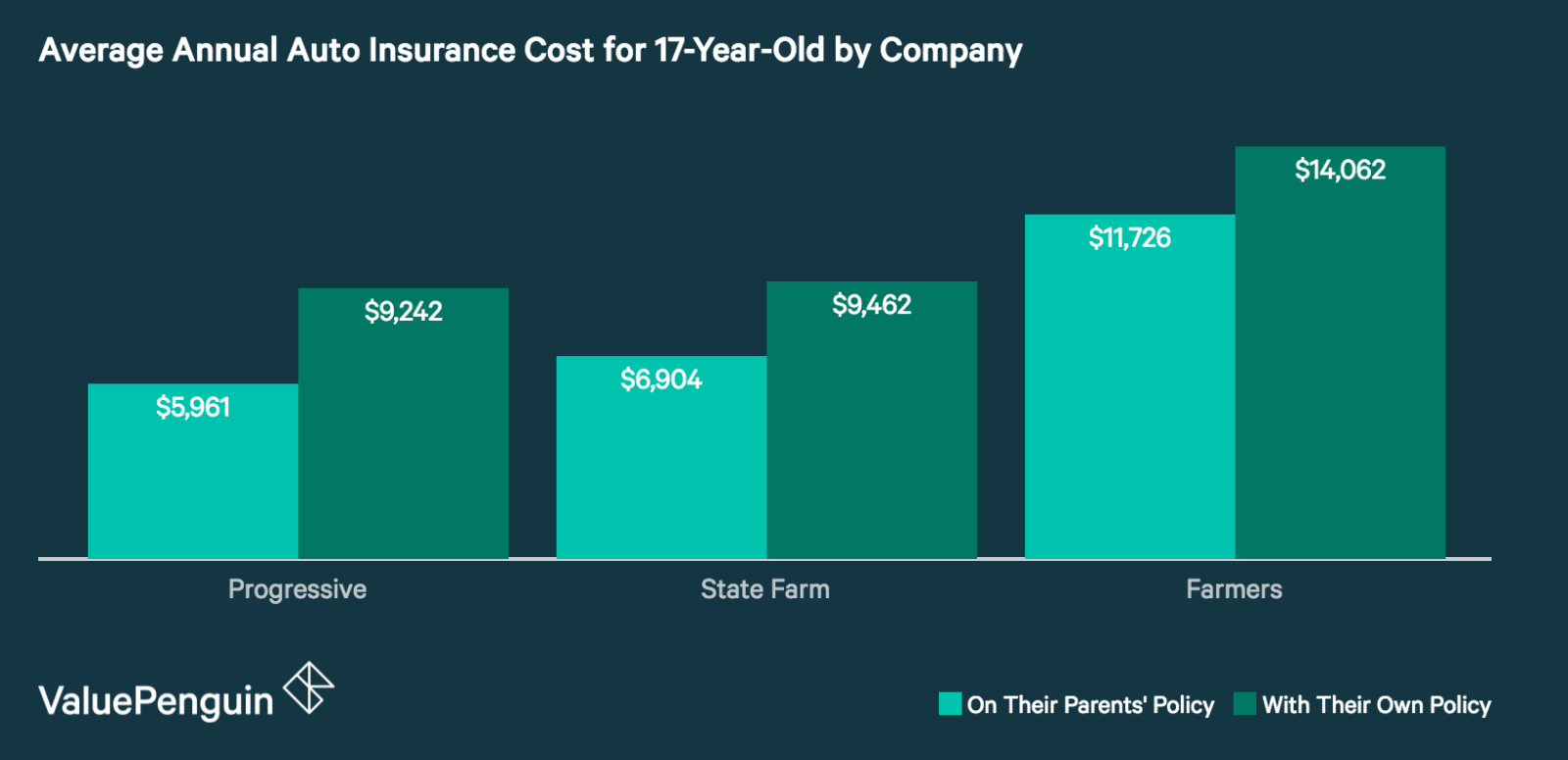

There are a few things you can do to try and save money on car insurance for 17 year olds. The most important thing is to maintain a good driving record. Avoid getting any citations or traffic violations, as this will increase your rates. Additionally, you may want to consider taking a defensive driving class, as this can help lower your rates. Finally, you can try and shop around for the best rates. Different insurance companies offer different rates, and it pays to compare quotes to find the best deal.

Getting the Right Coverage

When you are shopping for car insurance as a 17 year old, it is important to make sure you get the right coverage. Liability coverage is usually required by law, and it is important to make sure you have enough coverage to protect yourself in case of an accident. It is also a good idea to add comprehensive and collision coverage, as this will help protect your vehicle if it is damaged in an accident.

The Bottom Line

The cost of car insurance for 17 year olds can be expensive, but there are things you can do to try and save money. Maintaining a good driving record and shopping around for the best rates can help you get the coverage you need at an affordable price. The most important thing is to make sure you get the right coverage for your needs.

How Much Is Car Insurance for a 17-Year-Old? - ValuePenguin

How Much Is Car Insurance for a 17-Year-Old? - ValuePenguin

How much is car insurance for a 17 year old? by alonzo11218510 - Issuu

I'm 17 years old- how much will it cost me to get my own car insurance?

77 Best Of Car Insurance Quotes for 17 Year Olds