How Much Does Insurance Cost For Tesla Model 3

How Much Does Insurance Cost For Tesla Model 3?

Insurance Costs for Tesla Model 3

The Tesla Model 3 is one of the most popular electric vehicles on the market today. And with its popularity comes the need for insurance. If you own a Tesla Model 3, you need to know how much it will cost you to insure it. The good news is that, as with any vehicle, insurance rates vary from one insurer to another. So, you should shop around and compare different insurance companies to get the best rate.

In general, the cost of insurance for a Tesla Model 3 will depend on a variety of factors. These include the age and driving history of the owner, the type of coverage, and the deductible amount. Age is a major factor in determining insurance rates, as younger drivers are generally seen as higher risk. Drivers with clean driving records will typically pay lower rates than those with a history of traffic violations. The type of coverage and the deductible amount chosen will also influence the cost of insurance.

Factors Affecting Insurance Costs

In addition to age and driving history, several other factors can affect the cost of insurance for a Tesla Model 3. For instance, the cost of insurance can vary depending on where you live. Some states have higher insurance rates than others, so if you live in an area with higher rates, your insurance costs may be higher. Additionally, the type of car you drive can also affect your insurance rates. For example, luxury vehicles tend to have higher insurance rates than more basic models.

The amount of coverage you select will also have an impact on your insurance costs. Liability coverage is typically required by law, but you may also choose to purchase additional coverage, such as collision and comprehensive. The amount of coverage you opt in for will affect the cost of your insurance.

How to Get the Best Rate

The best way to get the best rate on insurance for your Tesla Model 3 is to shop around and compare different insurers. You should also consider raising your deductible, as this can often result in lower premiums. Additionally, many insurance companies offer discounts for safe drivers and those who bundle their policies. So, if you can demonstrate that you are a safe driver, you may be able to get a better rate.

Conclusion

The cost of insurance for a Tesla Model 3 will vary depending on a variety of factors, such as age, driving history, and the type of coverage selected. The best way to get the best rate is to shop around and compare different insurers. Additionally, many insurers offer discounts for safe drivers and those who bundle their policies. By taking the time to research and compare different insurers, you can be sure to get the best rate for your Tesla Model 3 insurance.

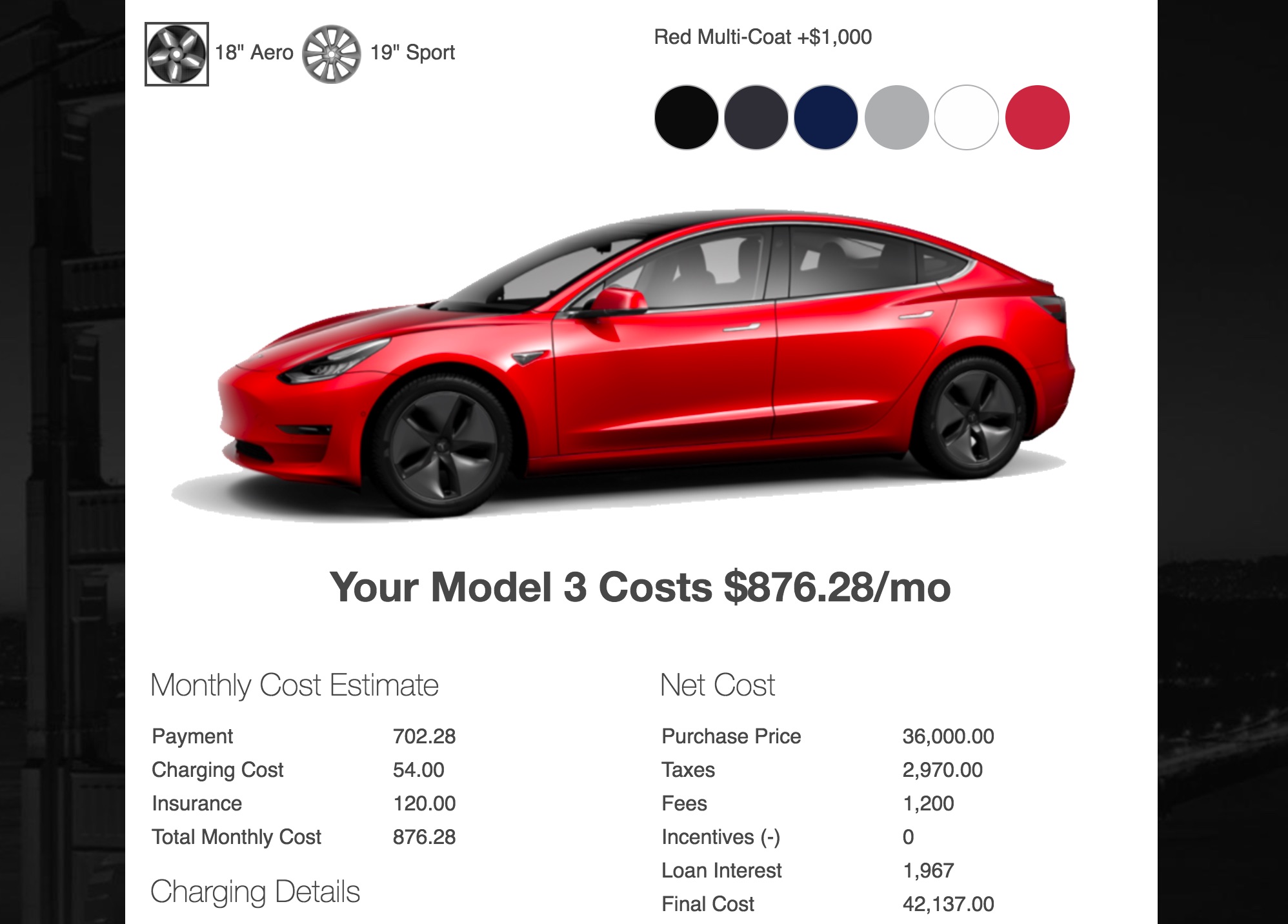

Want a Tesla Model 3? This price calculator will tell you how much it

how much does it cost to fill a tesla model 3 - www.summafinance.com

Tesla Model 3 Insurance Cost for 2021 [Rates + Free Comparison Quotes]

![How Much Does Insurance Cost For Tesla Model 3 Tesla Model 3 Insurance Cost for 2021 [Rates + Free Comparison Quotes]](https://mk0insuravizcom0fmqo.kinstacdn.com/wp-content/uploads/dataviz/model-3-insurance-summary-cid81837.png)

True cost of a Tesla Model 3 after 40,000 miles (charging, insurance

Tesla Insurance Services - Inside Tesla's Model 3 Factory, Where Safety