How Much Does Tesla Model 3 Insurance Cost

How Much Does Tesla Model 3 Insurance Cost?

What is Tesla Model 3?

Tesla Model 3 is one of the most popular electric cars on the market. It was released in 2017, and since then its sales have been skyrocketing. Tesla Model 3 is known for its long range, fast acceleration, and its stylish design. It has become a symbol of modern luxury and status, but how much does it cost to insure?

Insurance for Tesla Model 3

Insuring a Tesla Model 3 is similar to insuring any other car. The cost will depend on the make and model of your car, as well as your driving record. If you have a clean driving record, you can expect to pay a lower rate than someone with a few tickets or accidents. The cost of coverage also depends on the type of insurance you choose. Comprehensive coverage, which covers damage to your car caused by theft, vandalism, and natural disasters, is more expensive than liability coverage, which only covers damage you cause to other people and their property.

Average Cost of Tesla Model 3 Insurance

The average cost of Tesla Model 3 insurance is $1,687 per year. However, this cost can vary significantly depending on your driving record and the type of coverage you choose. For example, if you opt for comprehensive coverage, you can expect to pay up to $2,500 per year. Additionally, if you have a bad driving record, you could be paying up to $3,500 a year for insurance.

Factors That Affect Insurance Cost

There are several factors that can affect the cost of insurance for your Tesla Model 3. Your driving record is one of the most important factors, as it determines how likely you are to get in an accident and how likely you are to file a claim. Additionally, the type of coverage you choose, your age, and the area you live in can all have an impact on your insurance cost.

Tips to Lower Your Tesla Model 3 Insurance Costs

There are a few things you can do to lower the cost of insuring your Tesla Model 3. One of the most effective ways is to maintain a good driving record. Make sure to obey all traffic laws and drive responsibly, as this will help keep your premiums low. Additionally, you can shop around and compare rates to find the best deal. Finally, you can opt for higher deductibles, which will lower your premiums, but you should make sure you can afford the higher out-of-pocket costs if you do have to file a claim.

Conclusion

Insuring a Tesla Model 3 can be expensive, but there are several ways to reduce your costs. Maintaining a good driving record, comparing rates, and choosing higher deductibles are all effective ways to save money on your car insurance. Ultimately, the cost of insurance for your Tesla Model 3 will depend on a variety of factors, so make sure to shop around and compare rates to get the best deal.

how much does it cost to fill a tesla model 3 - www.summafinance.com

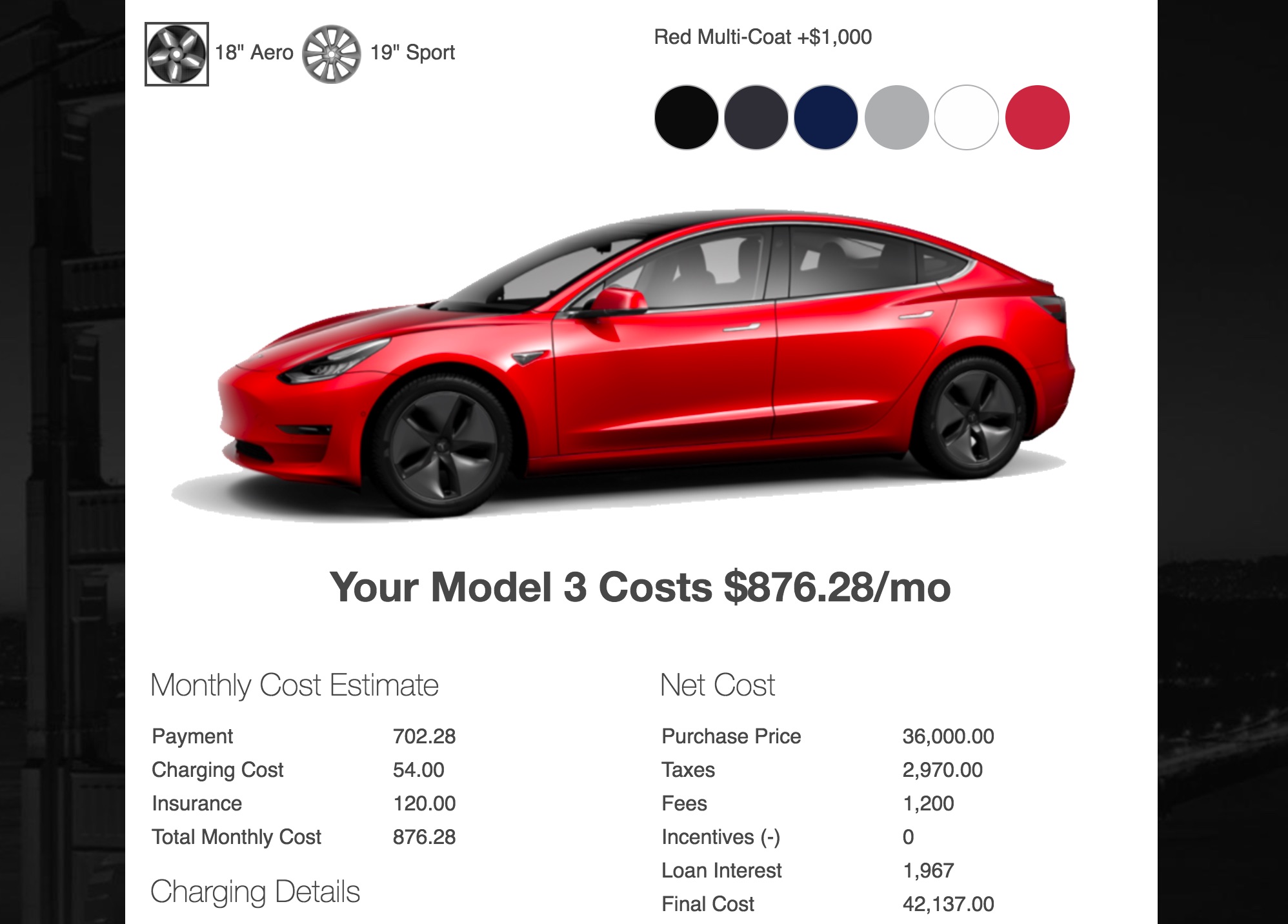

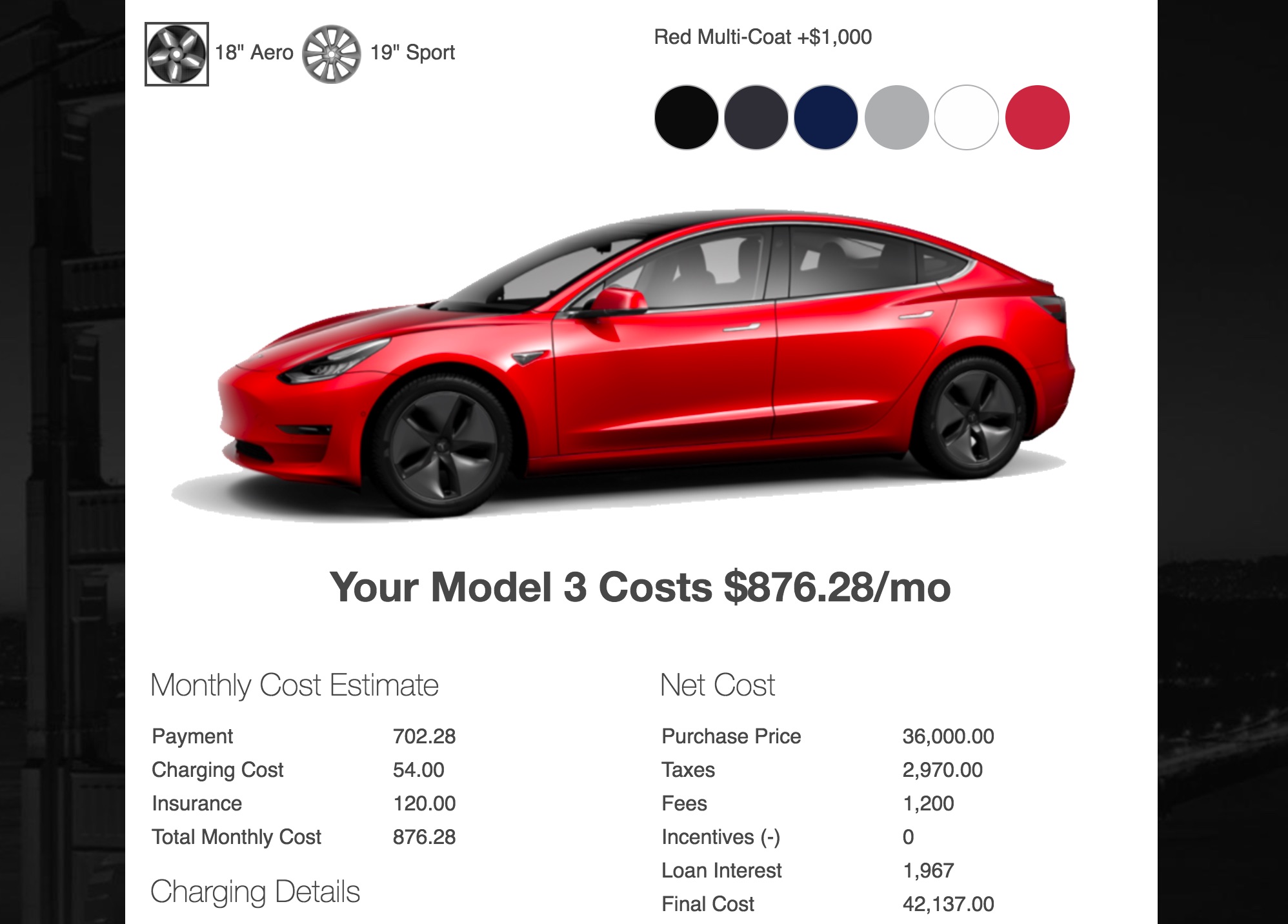

Want a Tesla Model 3? This price calculator will tell you how much it

Tesla Model 3 Insurance Cost 2022 | FRugally

How Much Does Tesla Insurance Cost / How Much Does A Tesla Model 3 Cost

Tesla Model 3 Insurance Cost : Tesla Model 3 Insurance Cost Usa / A