Car Insurance That Covers All Drivers

Car Insurance That Covers All Drivers

What is Car Insurance?

Car insurance is an agreement between a driver and an insurance company. This agreement states that the insurance company will provide financial coverage for the insured driver in the event of an accident, theft, or other damages to the vehicle. The insurance company will pay for any repairs, medical costs, and other expenses that the driver may incur due to the accident. The driver usually pays a monthly or annual premium to the insurance company in exchange for this coverage. The amount of premium depends on factors such as the driver’s age, driving record, type of vehicle, and location of the vehicle.

What is All-Driver Car Insurance?

All-driver car insurance is a type of insurance that covers all drivers in a particular area. This type of insurance is often offered by large insurance companies. It is designed to provide protection to all drivers in a particular area regardless of their driving record or financial status. All-driver car insurance is typically cheaper than individual policies since the risk of an accident is spread across the entire pool of drivers in the area. This type of policy also eliminates the need for individual drivers to purchase multiple policies for each vehicle they own.

What are the Benefits of All-Driver Car Insurance?

The main benefit of all-driver car insurance is that it provides financial protection to a large number of drivers. This type of policy can cover drivers regardless of their driving records or financial status. It also eliminates the need for drivers to purchase multiple policies in order to cover multiple vehicles. All-driver car insurance can also be more cost-effective than individual policies since the risk of an accident is spread across the entire pool of drivers in the area.

What are the Disadvantages of All-Driver Car Insurance?

One of the main disadvantages of all-driver car insurance is that it may not provide the same level of protection as individual policies. This type of policy may not cover certain types of accidents or damages that are not covered by the policy. Additionally, all-driver car insurance may not provide the same level of customer service and support as individual policies. Finally, some insurance companies may not offer all-driver car insurance in certain areas, which may limit the number of drivers who can benefit from this type of policy.

Who Should Consider All-Driver Car Insurance?

All-driver car insurance is best suited for drivers who own multiple vehicles and live in the same area. This type of policy can provide financial protection to a large number of drivers without the need for them to purchase multiple policies. It can also be more cost-effective than individual policies since the risk of an accident is spread across the entire pool of drivers in the area. All-driver car insurance is also ideal for drivers who are considered high-risk due to their driving record or financial status.

Conclusion

All-driver car insurance is a type of insurance that covers all drivers in a particular area. This type of policy can provide financial protection to a large number of drivers without the need for them to purchase multiple policies. It can also be more cost-effective than individual policies since the risk of an accident is spread across the entire pool of drivers in the area. All-driver car insurance is best suited for drivers who own multiple vehicles and live in the same area, as well as drivers who are considered high-risk due to their driving record or financial status.

Find out which types of car insurance you should be looking into for

Get The Best Car Insurance Quote For New Driver With The Affordable

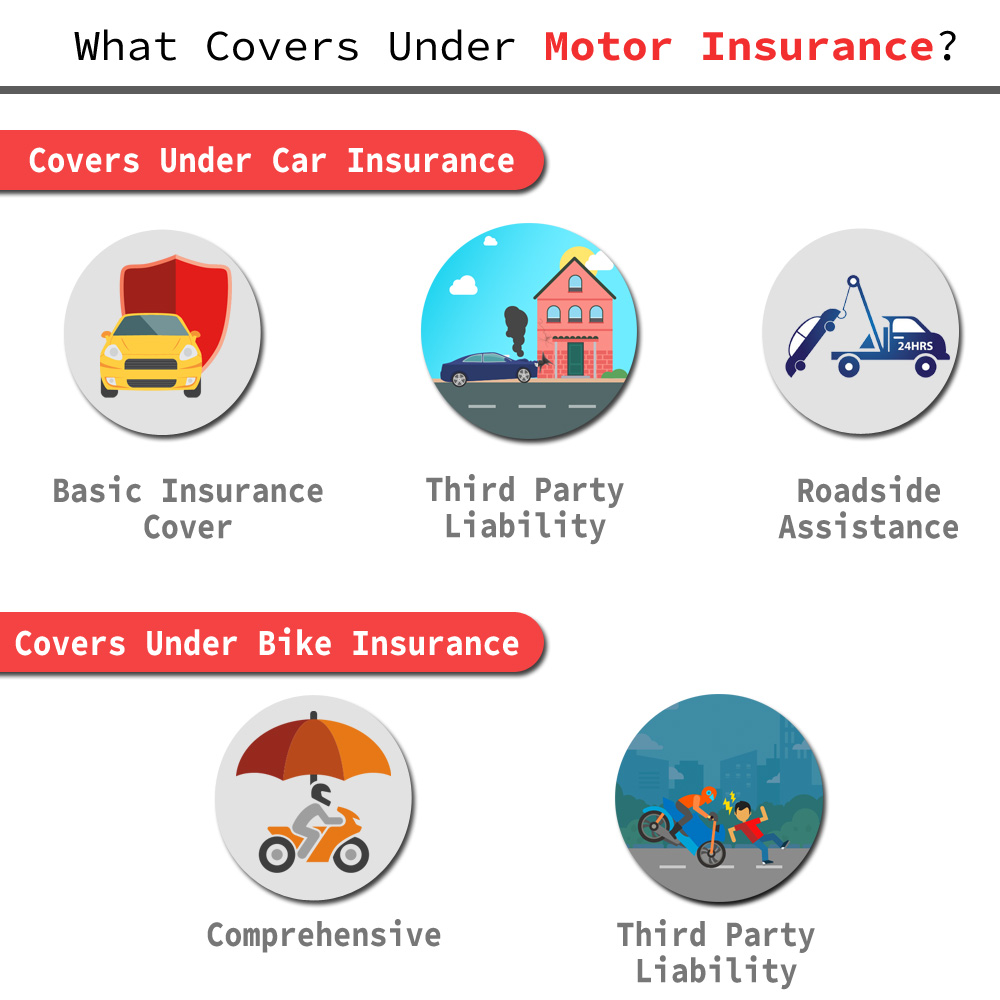

Motor Insurance | Car Insurance | Two Wheeler Insurance Plans

Best Car Insurance For New Drivers Under 25 (In 2020)

Does My Car Insurance Cover Me out of State? – MoneyMink.com | Car