Cheapest Car Insurance For Over 50s

Cheapest Car Insurance for Over 50s

Finding the Right Insurance

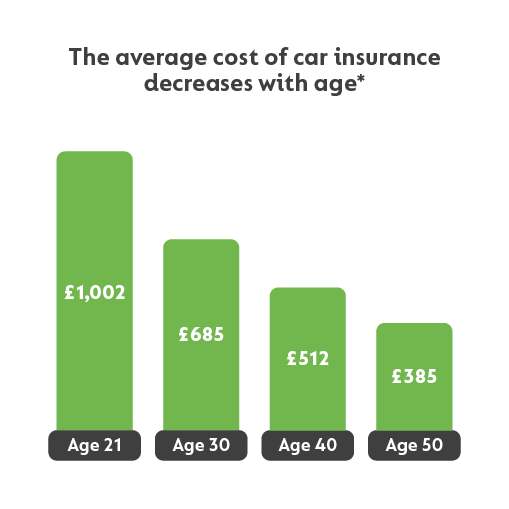

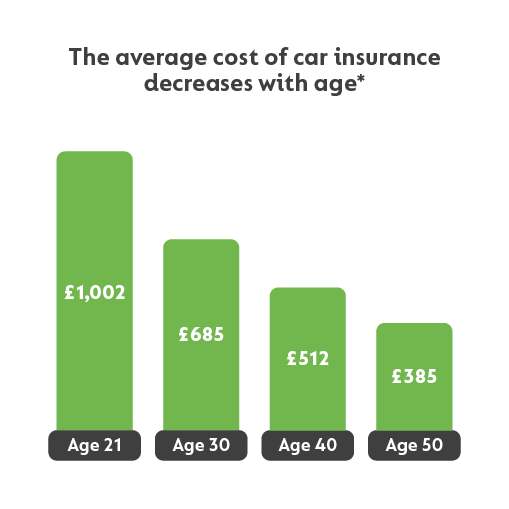

If you are over the age of 50 and are in the market for car insurance, you may be wondering what is the cheapest car insurance for over 50s? With the increasing cost of insurance, finding the right policy can be difficult. Fortunately, there are several steps that you can take to ensure that you get the best car insurance for your age and driving experience.

Before you start looking for car insurance, it is important to understand the different types of coverage available. Most car insurance policies will cover liability, collision, and comprehensive coverage. Liability coverage covers any property damage or bodily injury that you may cause to another driver or passenger. Collision coverage covers damage to your own car caused by another driver. Comprehensive coverage covers damage caused by weather, theft, and other events.

Shop Around for the Best Rates

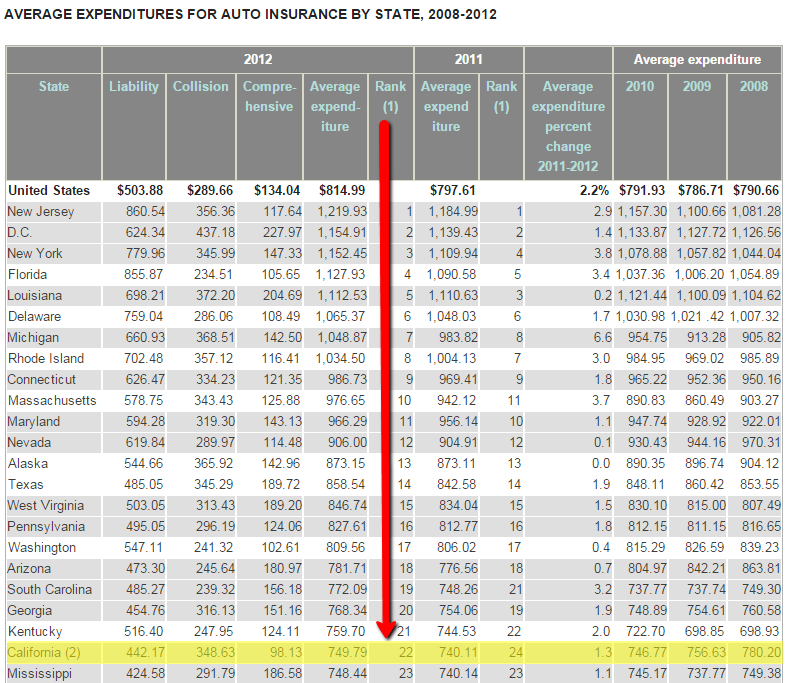

Once you understand the different types of coverage, you can start shopping around for the best rates. It is important to compare quotes from multiple companies to ensure that you get the best deal. Be sure to compare the same coverage levels, deductibles, and other factors to get an accurate comparison. You may also want to consider discounts such as multi-car or multi-policy discounts.

When comparing quotes, it is important to consider the customer service ratings of the companies. Look for companies with positive customer reviews and ratings to ensure that you are getting the best customer service. You may also want to consider the financial stability of the insurer. This can help you determine whether the company is likely to be able to pay out on a claim.

Look for Special Discounts

When shopping for car insurance, it is also important to look for special discounts. Many insurers offer discounts to drivers over the age of 50. In some cases, you may be able to get a lower rate simply by being over the age of 50. Insurance companies may also offer discounts for drivers who have taken a driver safety course or have a clean driving record.

It is also important to look for discounts based on your vehicle. Some insurers offer discounts for certain makes and models of cars. You may also be able to get lower rates if you have certain features on your car such as anti-theft devices or airbags. Finally, you may be able to get a discount if you have a high safety rating for your car.

Choose the Right Plan for You

Once you have compared quotes and looked for discounts, it is time to choose the right plan for you. Be sure to read the fine print of the policy before you make your decision. Make sure that the coverage is adequate for your needs and that the deductibles and other terms are reasonable.

Finding the cheapest car insurance for over 50s can be a daunting task. However, by taking the time to compare quotes and look for discounts, you can be sure that you are getting the best coverage for your needs. Be sure to shop around and read the fine print to ensure that you are getting the best deal.

Compare Over 50s Car Insurance Quotes at GoCompare

Cheap Car Insurance Over 50S Uk - Car Insurance Get A Quote From 195

What Is The Cheapest Car Insurance For Seniors - Auto Insurance For

Cheapest auto insurances in california by Promax Insurance Agency Inc