Third Party Car Insurance Youi

What is Third Party Car Insurance Youi?

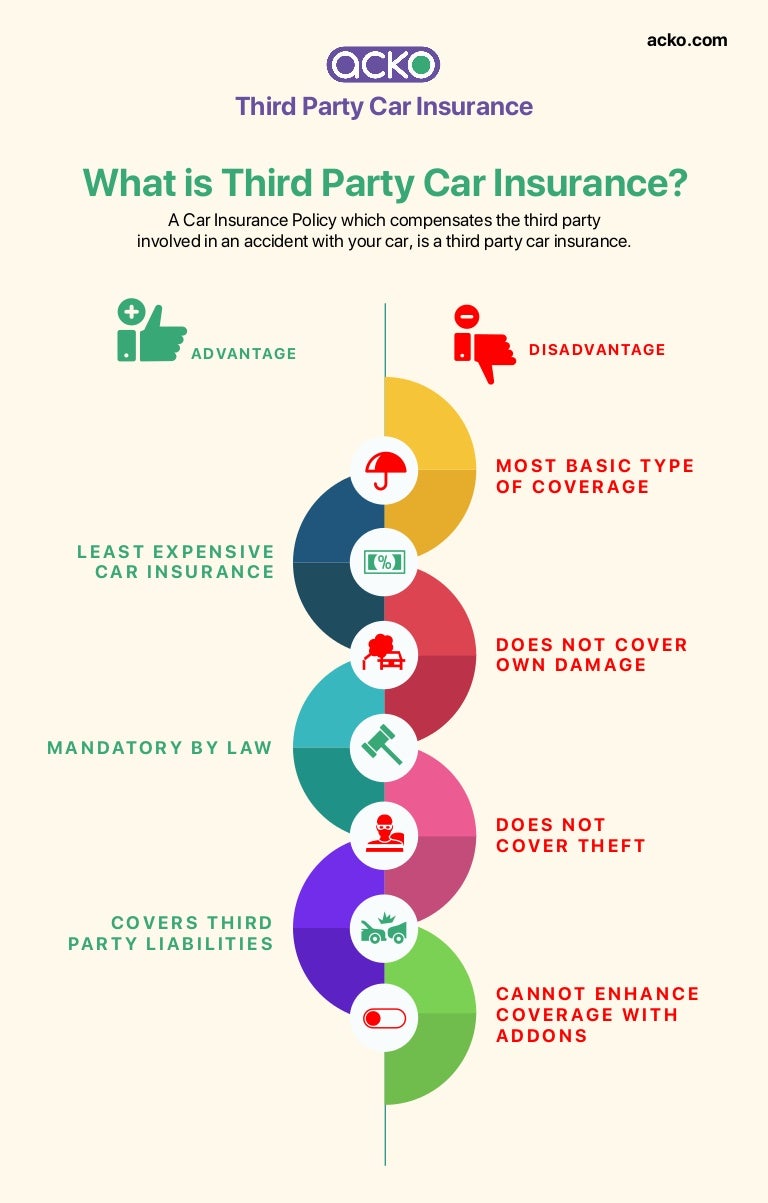

Third Party Car Insurance Youi is a plan that provides cover for damage that you cause to other people, their vehicles, or their property. It is the most basic car insurance policy and is commonly the minimum level of cover required by law. It is also the type of policy that insures you against the risk of being liable for damage caused to another person in a car accident, regardless of who was at fault. Third Party Car Insurance Youi offers cover for up to $20 million in legal liability and includes personal injury cover if you cause injury or death to another person.

Youi's Third Party Car Insurance offers a range of benefits, including a choice of excess levels, no claims bonus protection, and an optional hire car for up to 14 days after an accident. Youi also offers a range of optional extras, such as windscreen, fire and theft, and loss of use cover, so you can tailor the policy to meet your specific needs.

What does Third Party Car Insurance Youi cover?

Third Party Car Insurance Youi provides cover for damage that you cause to other people, their vehicles, or their property. This includes damage caused by a collision, accidental fire, or theft. It also includes cover for any legal liability you may have for death or injury to other people, or damage to their property. Youi also provides up to $20 million in legal liability cover, so you are protected in the event of a larger claim.

Youi's Third Party Car Insurance also includes personal injury cover, so you can seek compensation if you or a passenger are injured in a car accident. This cover includes medical expenses, legal costs, and loss of income. Youi also offers a choice of excess levels, so you can choose the level of cover that best suits your needs and budget.

What are the optional extras for Third Party Car Insurance Youi?

Youi offers a range of optional extras for Third Party Car Insurance to provide additional cover. These include windscreen cover, fire and theft cover, and loss of use cover. Windscreen cover provides cover for repairs or replacement of the windscreen, windows, and sunroof. Fire and theft cover provides cover for the insured vehicle if it is stolen or damaged by fire or malicious damage. Loss of use cover provides cover for a hire car for up to 14 days after an accident.

How much does Third Party Car Insurance Youi cost?

The cost of Third Party Car Insurance Youi will vary depending on a range of factors, such as the age and type of vehicle, the level of cover chosen, and the excess level. Youi also offers discounts for customers who have a good driving record and no claims bonus protection. You can get a quote online or speak to a Youi representative for an accurate quote.

Third Party Car Insurance Youi is a great option for drivers who are looking for basic cover at an affordable price. It provides cover for damage that you cause to other people, their vehicles, or their property, and includes personal injury cover and up to $20 million in legal liability cover. Youi also offers a range of optional extras and discounts, so you can tailor the policy to meet your specific needs.

Third party motor insurance demystified, all you need to know

third party car insurance online - YouTube

What is third party insurance in vehicle - YouTube

2017 Car Insurance Quotes | Opt For 3rd Party Cover To Reduce Costs

Third Party Car Insurance