Most Affordable Car Insurance Florida

Tuesday, August 8, 2023

Edit

Most Affordable Car Insurance in Florida

Searching for Cheapest Car Insurance Rates in Florida?

If you’re looking for the most affordable car insurance in Florida, then you’re in luck. Florida is a great place to find the best car insurance rates. With the large number of insurance companies competing for your business, you are sure to find an insurance plan that meets your needs and budget.

The most important thing to consider when searching for a car insurance policy in Florida is to compare prices and policies between different companies. Different companies offer different discounts and coverage options. You should compare several different companies in order to find the best deal. It is also important to read the policy carefully to make sure you understand all the terms and conditions.

What Factors Affect Car Insurance Rates in Florida?

Car insurance rates in Florida can be affected by many factors, such as your driving record, your age and gender, the type of car you drive, and where you live. Your driving record is one of the most important factors in determining your car insurance rate. If you have a clean record with no accidents or traffic violations, then you can expect to receive lower rates than someone who has had multiple violations or accidents.

Your age and gender also play a role in determining your car insurance rate. Generally, younger drivers are considered to be a higher risk and therefore pay higher rates. Additionally, males typically pay higher rates than females.

The type of car you drive also affects your car insurance rate. Certain vehicles, such as sports cars, are considered to be more of a risk and are therefore charged higher rates.

Finally, where you live can also affect your car insurance rate. If you live in an area that is considered to be more dangerous, such as a high crime area, then you can expect to pay higher rates than someone who lives in a safer area.

How to Find Affordable Car Insurance in Florida?

When searching for affordable car insurance in Florida, the best way to find the best deal is to compare quotes from different companies. As previously mentioned, different companies offer different discounts and coverage options. It is important to take the time to compare quotes to make sure you’re getting the best deal.

You can also look for discounts offered by different companies. Many companies offer discounts for good drivers, multi-car policies, good students, and other factors. Additionally, many companies offer discounts for bundling your car insurance with other policies, such as homeowners or renters insurance.

What is the Minimum Car Insurance Required in Florida?

The minimum car insurance required by law in Florida is $10,000 in personal injury protection and $10,000 in property damage liability. Personal injury protection covers medical expenses for injuries sustained in an accident, regardless of who is at fault. Property damage liability covers any damage done to another person’s property in an accident.

While the minimum car insurance required by law in Florida is $10,000 for each coverage, it is generally recommended that you have more than the minimum amount. This is because if you are found to be at fault for an accident, the other person’s medical bills and property damages can exceed the $10,000 minimum.

Conclusion

Finding the most affordable car insurance in Florida can be a challenge, but with the right research and comparison shopping, you can find the best deal that meets your needs and budget. Make sure to compare quotes between different companies, look for discounts, and consider having more than the minimum coverage required by law. With the right research, you can find the most affordable car insurance in Florida.

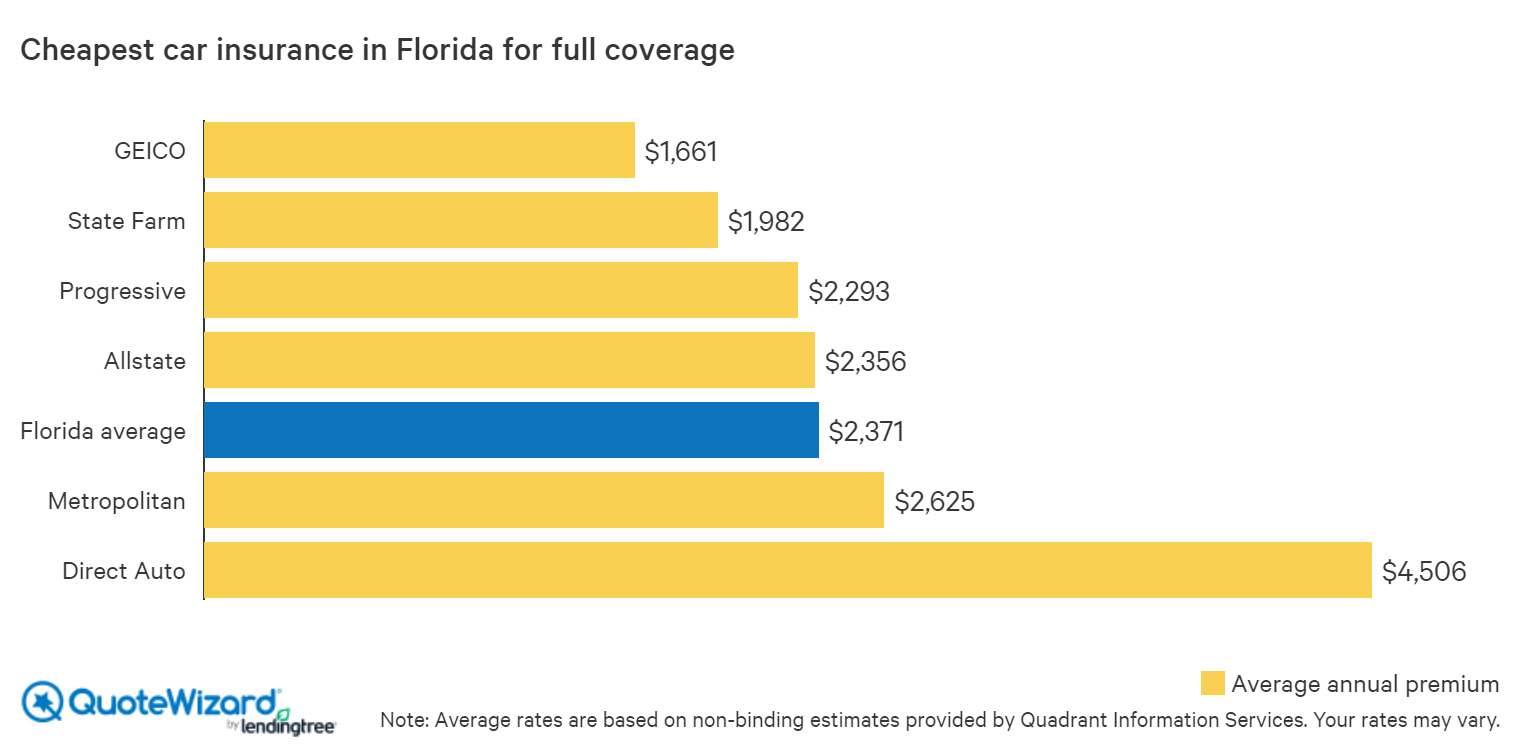

Cheap Car Insurance in Florida (2020) | QuoteWizard

Cheapest Car Insurance in Florida for 2020 | Millennial Money

Who Has the Cheapest Auto Insurance Quotes in Florida?

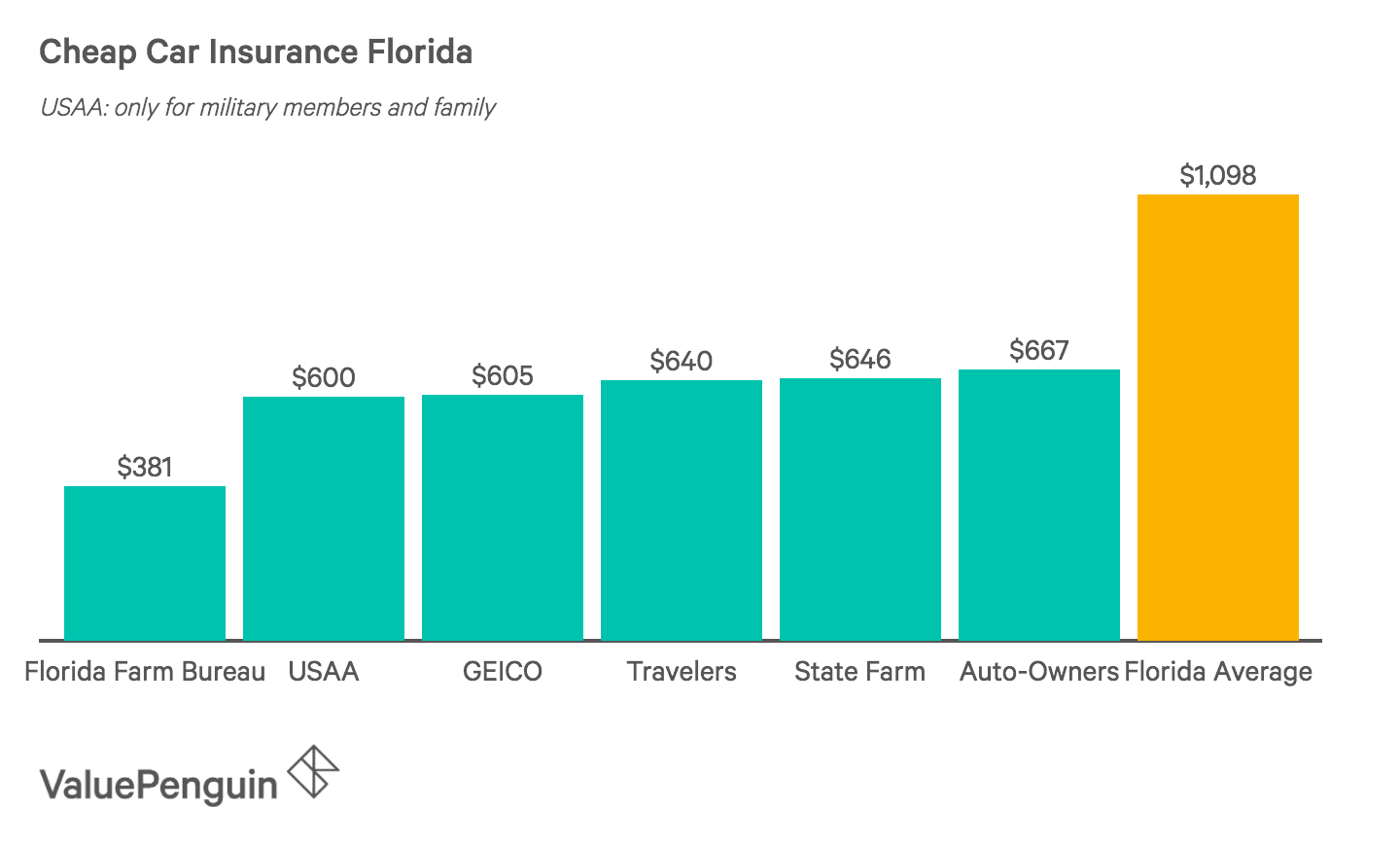

Cheapest Auto Insurance Quotes in Florida (2020) - ValuePenguin

Who Has the Cheapest Auto Insurance Quotes in Florida? (2019