Minimum Car Insurance Coverage Texas

Minimum Car Insurance Coverage In Texas

What Is Car Insurance?

Car insurance is a means of protection from financial losses in the event of an accident. It provides protection against losses resulting from a vehicle's damage, the owner's legal liability for damage or injuries caused to other people, and the cost of replacing stolen property. It is an agreement between an insured person and an insurance company, in which the insurer agrees to pay for losses as outlined in the policy for a premium. Car insurance is also referred to as auto insurance, motor insurance, or vehicle insurance.

What Is The Minimum Car Insurance Coverage In Texas?

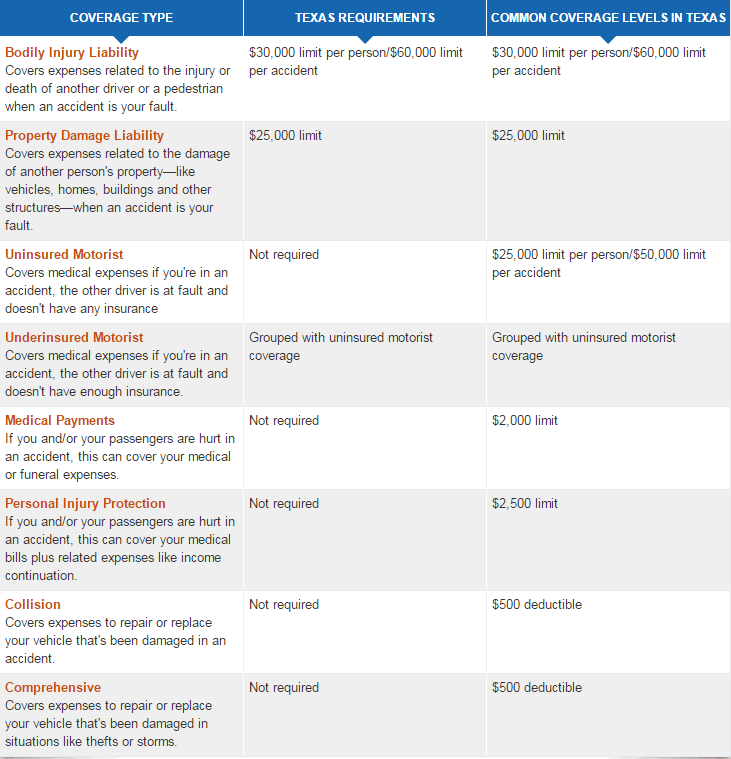

In Texas, the minimum coverage for car insurance is 30/60/25. This means that an insurance company must provide coverage for at least $30,000 per person per accident for bodily injury, $60,000 per accident for bodily injury, and $25,000 for property damage. These are the minimum limits that are required to be covered by an insurance company in Texas.

Do I Need More Coverage Than The Minimum?

Most people will find that the minimum car insurance coverage in Texas is not enough to protect their finances in the event of an accident. It is a good idea to purchase more coverage than the minimum, as it can provide additional protection in the event of an accident or other loss. Additional coverage can include collision and comprehensive coverage, uninsured and underinsured motorist coverage, and medical payments coverage.

What Is Uninsured/Underinsured Motorist Coverage?

Uninsured/underinsured motorist coverage helps to protect you if you are in an accident with someone who does not have enough insurance to cover your losses. This type of coverage will pay for medical bills, lost wages, and other damages that may be incurred if the other driver does not have enough insurance to cover your losses. This type of coverage is not required in Texas, but it is a good idea to purchase it in order to protect yourself financially.

What Is Medical Payments Coverage?

Medical payments coverage is a type of insurance that pays for medical expenses that you may incur in the event of an accident. This type of coverage is not required in Texas, but it is a good idea to purchase it in order to protect yourself financially. Medical payments coverage can help to pay for medical bills, lost wages, and other damages that may be incurred in the event of an accident.

Conclusion

The minimum car insurance coverage in Texas is 30/60/25. This means that an insurance company must provide coverage for at least $30,000 per person per accident for bodily injury, $60,000 per accident for bodily injury, and $25,000 for property damage. It is a good idea to purchase more coverage than the minimum, as it can provide additional protection in the event of an accident or other loss. Uninsured/underinsured motorist coverage and medical payments coverage are two types of coverage that can be purchased to help protect you financially in the event of an accident.

Minimum Coverage Car Insurance Texas / Allstate | Car Insurance in

Texas Auto Insurance Minimum Coverage Requirements

Texas Minimum Car Insurance - Car Insurance For Texas Drivers : Minimum

Texas Minimum Car Insurance Requirements 2019 : Cheapest Car Insurance

texas car insurance