General Liability Insurance Policy Cost

How Much Does General Liability Insurance Cost?

General liability insurance is one of the most important investments a business can make. It provides protection against a variety of claims related to bodily injury, property damage, libel, slander, and copyright infringement. Additionally, it can provide protection against claims of negligence and/or malpractice. The cost of general liability insurance varies depending on the type of business, the size of the company, and the amount of coverage needed.

Factors That Affect General Liability Insurance Cost

The cost of general liability insurance is based on several factors, including the type of business, its size, the amount of coverage needed, and the location of the business. For example, a small business in a rural area may pay less for general liability insurance than a larger business in an urban area. Additionally, businesses with more employees may pay more for coverage than those with fewer employees.

Types of General Liability Insurance

The most common type of general liability insurance is called a “per occurrence” policy. This type of policy covers claims that arise out of a single incident or event. For example, if a customer slips and falls in a store and makes a claim against the business, the per occurrence policy would cover the claim. Other types of general liability insurance include “products and completed operations” policies, which cover claims related to a product or service that is sold or provided by a business, and “premises and operations” policies, which cover claims related to the premises of a business.

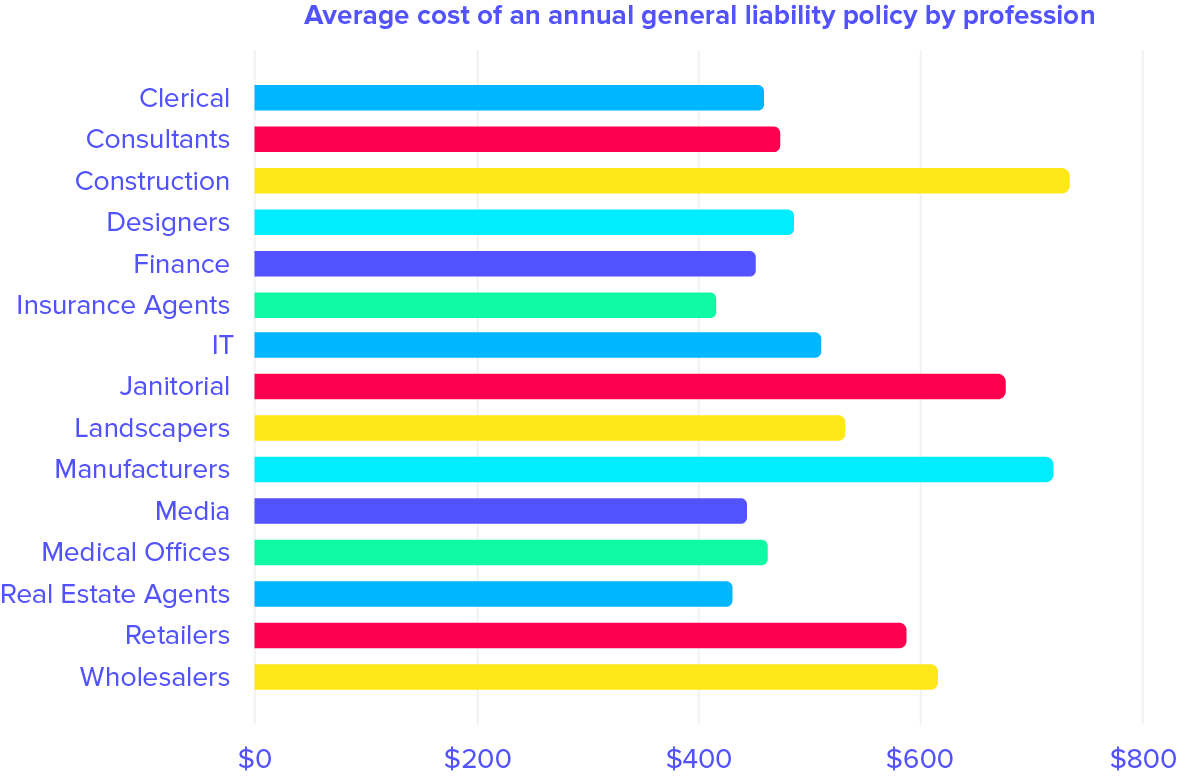

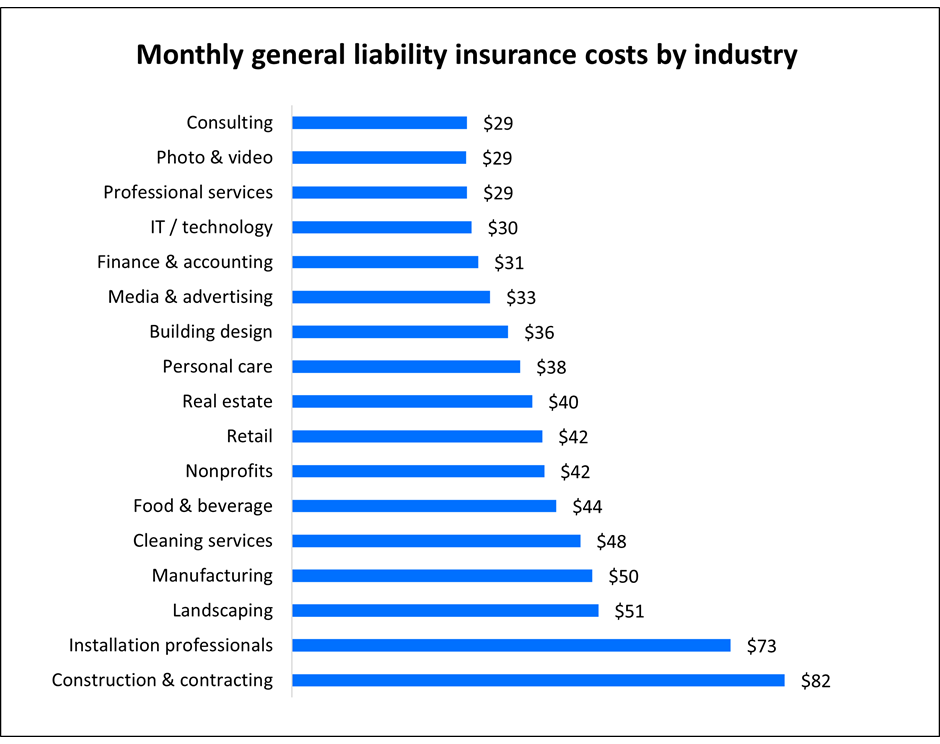

Average Cost of General Liability Insurance

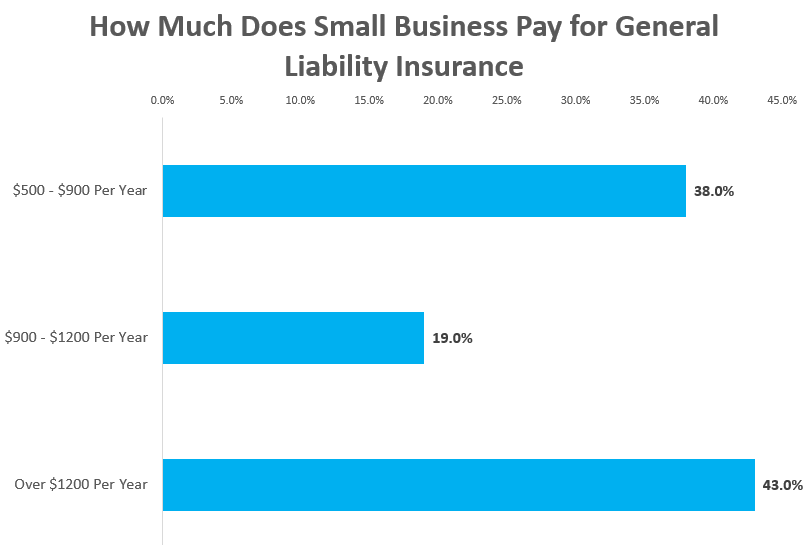

The average cost of general liability insurance for small businesses is around $500 per year for a $1 million policy. However, this cost can vary widely depending on the type of business, the amount of coverage needed, and the location of the business. Additionally, some businesses may be eligible for discounts on their general liability insurance. Finally, businesses that purchase other types of insurance, such as workers' compensation or commercial auto insurance, may be able to obtain a reduced rate on their general liability insurance.

How to Find the Best Price on General Liability Insurance

To find the best price on general liability insurance, it is important to shop around and compare quotes from multiple insurers. Additionally, businesses should consider working with an insurance broker who can help them find the best coverage for their needs at the lowest possible cost. Finally, businesses should consider their risk tolerance and make sure that their policy includes the coverage they need to protect their business in the event of a claim.

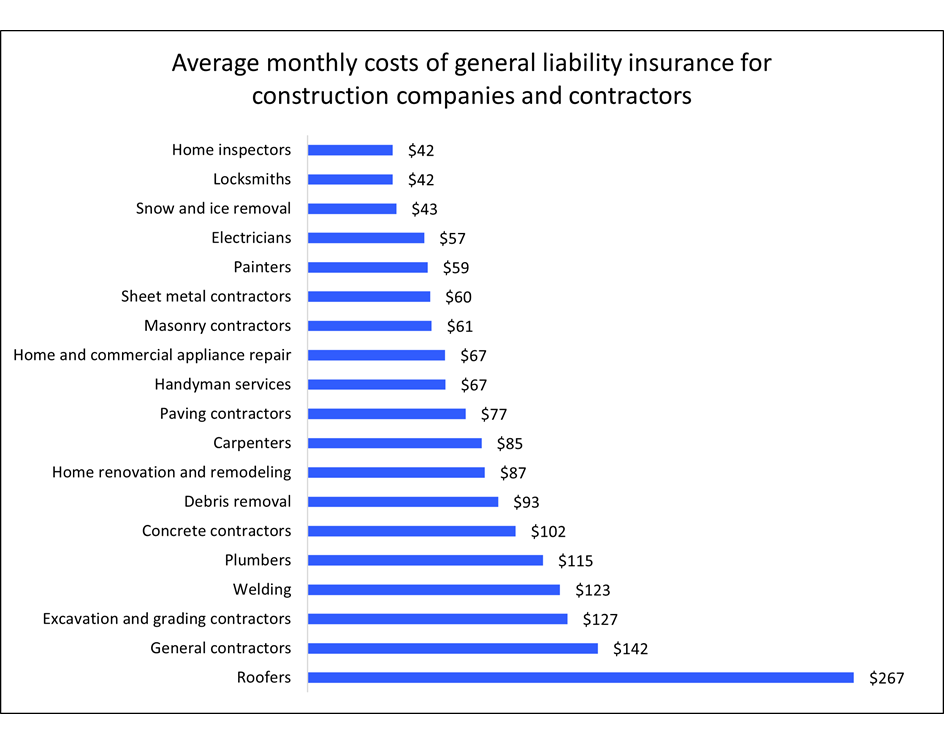

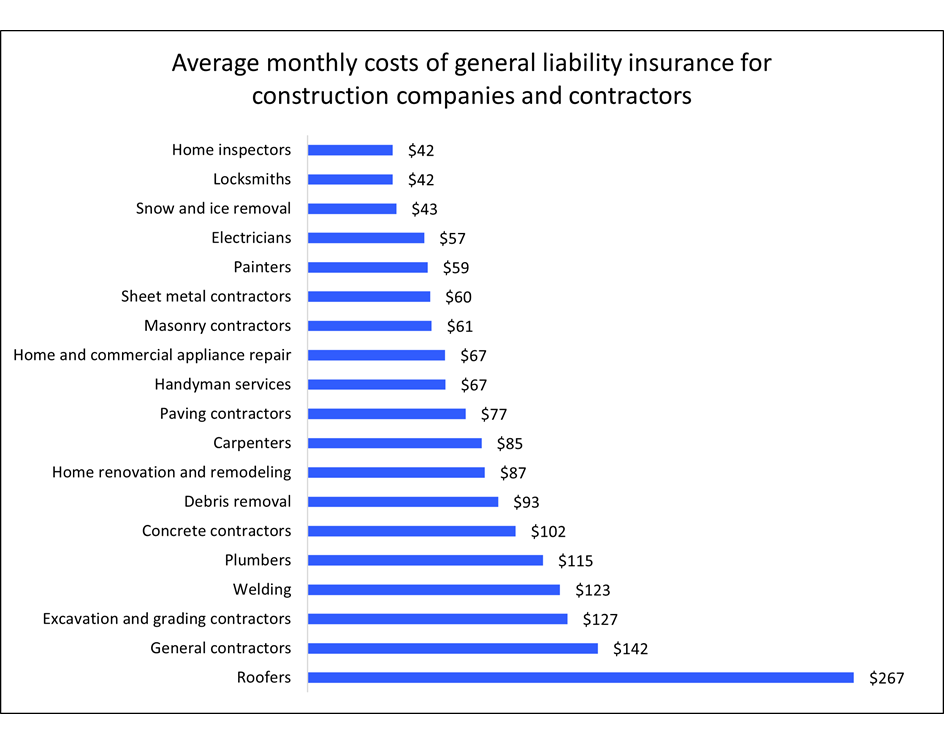

Business Insurance Cost for Contractors and Construction Companies

Commercial general liability insurance cost - insurance

How Much Does Insurance Cost For A Carpet Cleaning Business - Carpet

How Much Does General Liability Insurance Cost? | IronPoint Insurance

General Liability Insurance Cost Guide | Pogo Insurance