How Much Is Gap Insurance On A New Vehicle

Gap Insurance on a New Vehicle - What You Need to Know

When thinking about buying a new vehicle, there are a lot of things to consider. One of them is gap insurance. Gap insurance is an optional type of insurance that ensures you are fully covered in the event of a gap between the amount your insurance company pays and the amount you owe on your loan or lease. It is important to understand what gap insurance is, how it works, and the various coverage options available.

What is Gap Insurance?

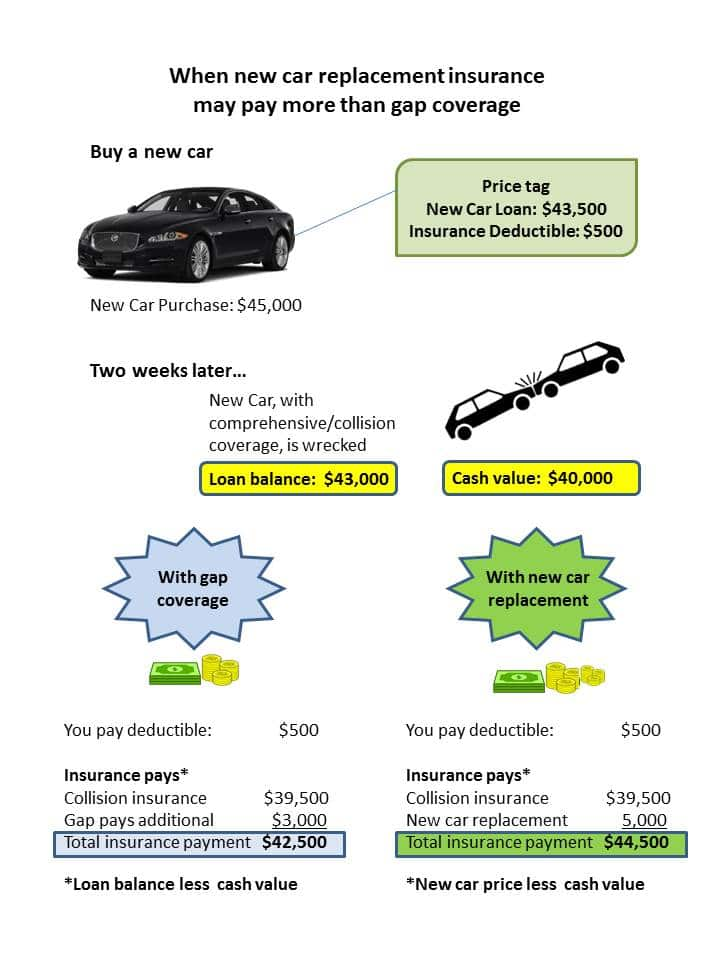

Gap insurance is an optional type of insurance that covers the difference between what you owe on your loan or lease and what your insurance company pays out in the event of an accident. This coverage can be helpful in ensuring that you are not stuck with a loan balance that is higher than the value of your vehicle. Gap insurance can also help you avoid late fees and other charges that can occur if you are unable to pay off your loan or lease.

How Does Gap Insurance Work?

Gap insurance works by covering the difference between the amount you owe on your loan or lease and the amount your insurance company pays out in the event of an accident. It is important to note that gap insurance will not cover the entire loan balance. Instead, it will only cover the difference between what you owe and what your insurance company pays out. This means that it is important to have a good understanding of the value of your vehicle and what the insurance company will pay out in the event of an accident.

What Types of Gap Insurance are Available?

There are several types of gap insurance available, including new car gap insurance, used car gap insurance, and lease-end gap insurance. New car gap insurance is designed to cover the difference between the amount you owe on your loan or lease and the amount your insurance company pays out in the event of an accident. Used car gap insurance is similar, but it is designed to cover the difference between the amount you owe on your loan or lease and the amount your insurance company pays out in the event of a total loss. Lease-end gap insurance is designed to cover the difference between the amount you owe on your lease and the amount your insurance company pays out in the event of an accident.

How Much Does Gap Insurance Cost?

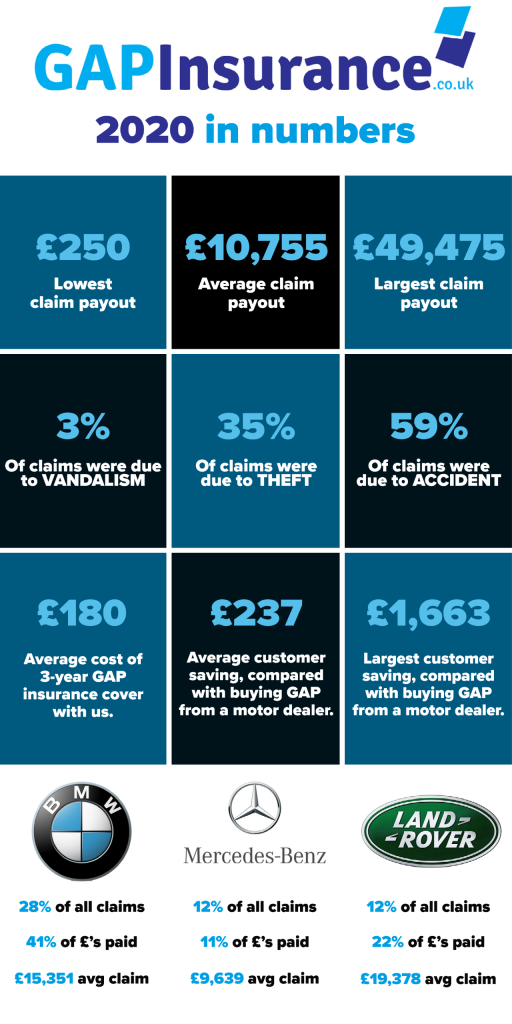

The cost of gap insurance can vary depending on the type of coverage you choose and the value of your vehicle. Generally speaking, gap insurance can cost anywhere from a few hundred dollars to a few thousand dollars. It is important to shop around and compare different policies to ensure that you are getting the best coverage at the best price.

Conclusion

Gap insurance can be a great way to ensure that you are fully covered in the event of an accident or total loss. It is important to understand what gap insurance is, how it works, and the various coverage options available. It is also important to shop around and compare different policies to ensure that you are getting the best coverage at the best price.

How Does Gap Insurance Work? | RamseySolutions.com

Gap Insurance for your New or Leased Cars

Is GAP insurance worthwhile? - babybmw.net

Return to Invoice GAP Insurance| Trowbridge | Platinum Dacia

Gap Car Insurance Tips - Can I Buy Gaping Coverage Without Paying More