Health Care Coverage Offered By Is Called Group Health Insurance

Group Health Insurance: What You Need to Know

What is Group Health Insurance?

Group health insurance is a type of health care coverage that is offered to businesses, organizations, and associations to provide their employees with access to health plans. The health plan is provided by an insurance provider that is chosen by the employer, and the employer is usually responsible for the majority of the cost of the policy. This type of health coverage is an attractive option for many employers because it allows them to provide their employees with access to quality health care without having to pay the full cost of health insurance.

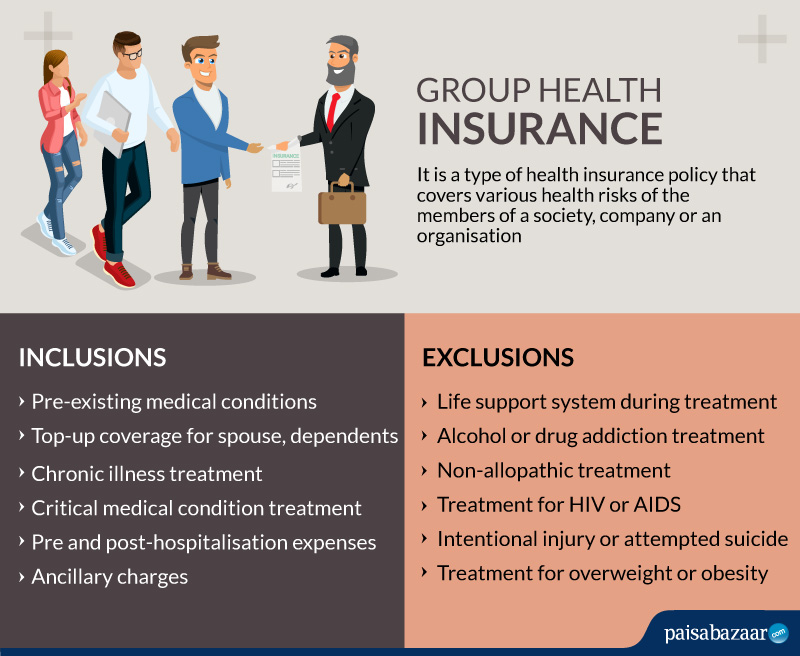

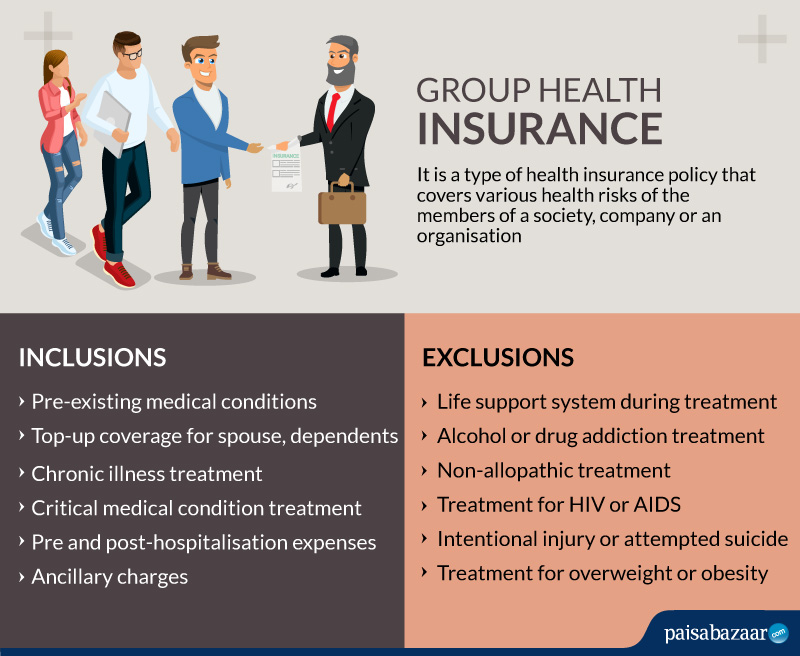

What Does Group Health Insurance Cover?

Group health insurance typically covers a wide range of health care costs, including doctor's visits, hospitalization, prescription drugs, and preventative care. Some policies may also cover vision and dental services, as well as mental health care. It is important to note that coverage will vary depending on the policy and the provider, so it is important for employers to understand what is and is not covered under the health plan.

Who Can Receive Group Health Insurance?

Group health insurance can be provided to any group of people that meet certain criteria, such as employees of a business, members of an organization, or members of an association. Generally, the group must have at least two people in order to qualify for group health insurance. In some cases, the employer may require that all employees be enrolled in the health plan in order to receive the lower group rate.

Are There Any Restrictions?

Some insurance providers may have restrictions on who can receive coverage under a group health plan, such as pre-existing medical conditions or age restrictions. It is important to understand any restrictions that may be in place before enrolling in a group health plan. In addition, some providers may require that the group meet certain requirements in order to qualify for the group rate, such as having a certain number of employees or maintaining a certain level of health coverage.

What Are the Benefits of Group Health Insurance?

Group health insurance offers many benefits for employers and employees alike. For employers, group health insurance is typically more cost effective than providing individual health plans for their employees. Additionally, group health insurance can help employers attract and retain quality employees, as it provides them with access to quality health care. For employees, group health insurance can offer peace of mind knowing that they have access to quality health care.

How Can I Learn More?

If you are interested in learning more about group health insurance, it is important to speak with an insurance provider or an independent insurance agent. They can provide you with the information you need to make an informed decision and ensure that you are getting the coverage you need. Additionally, it is important to understand the specifics of any health plan before enrolling in order to ensure that it meets your needs.

Group Health Insurance: Coverage & Claim

10 Important Medicare Dates to Remember (Timeline) - RetireGuide

Women’s Health Insurance Coverage | The Henry J. Kaiser Family Foundation

Group Health Coverage | Phoenix Health Insurance - YouTube

Our Health Policy Matters: February 2012