Average Amount For Car Insurance Woolworths

Wednesday, June 7, 2023

Edit

Average Amount For Car Insurance Woolworths

What is Car Insurance Woolworths?

Car insurance Woolworths is a type of insurance policy that provides coverage for drivers who purchase it. It is designed to cover drivers for any damages, injuries, or losses that may occur as a result of an accident or other incident that is deemed to be the fault of the driver. This type of policy is offered by a variety of companies, but Woolworths is one of the most popular and well-known providers. Woolworths offers a range of different policies, depending on the level of coverage that is required.

What Does Car Insurance Woolworths Cover?

Car insurance Woolworths covers a variety of different damages, injuries, and losses that may occur as a result of an incident. This includes the cost of any repairs or replacements that are needed for the vehicle and any legal fees that may arise from the incident. It also covers the medical costs of any passengers who were injured in the incident, as well as any damages that were done to another person’s property. The policy also covers any costs that may be incurred in the event of theft or vandalism.

What Is the Average Amount of Car Insurance Woolworths?

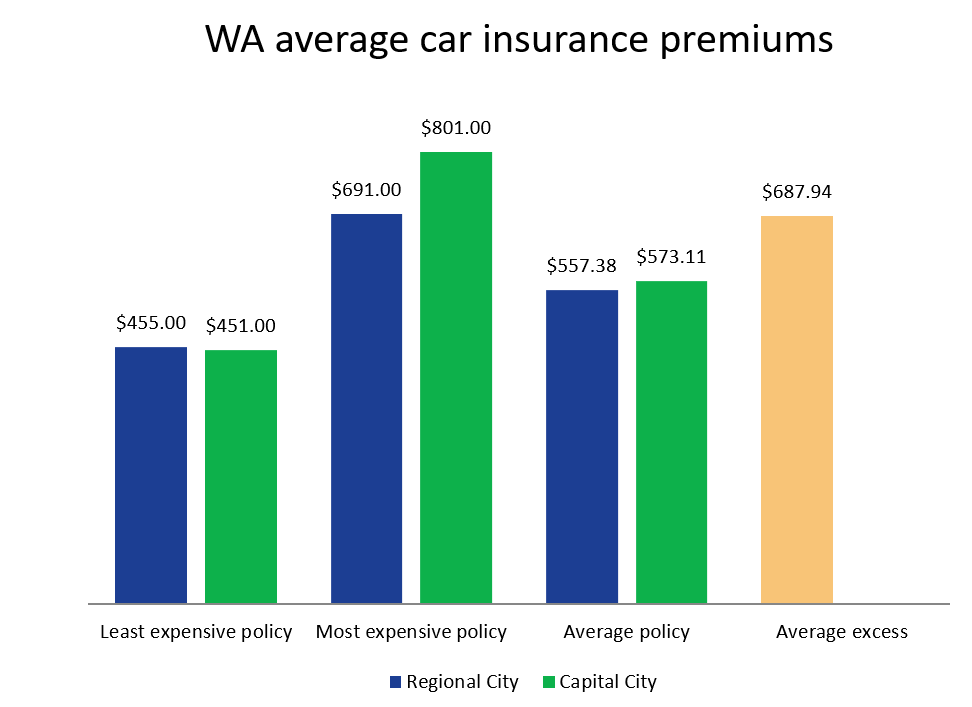

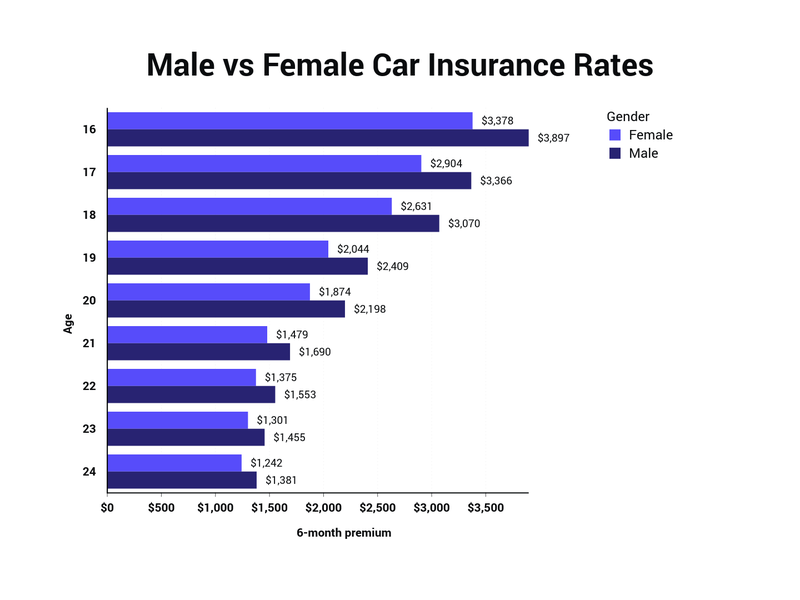

The average amount of car insurance Woolworths is typically determined by the type and level of coverage that is chosen. Generally, the more coverage that is chosen, the more expensive the policy will be. The cost of the policy will also depend on the driver’s age, driving record, and other factors. Generally, drivers who are younger, have a good driving record, and live in a lower-risk area will typically receive a lower premium than those who are older, have a poor driving record, and live in a higher-risk area.

What Factors Affect the Cost of Car Insurance Woolworths?

When determining the cost of car insurance Woolworths, there are a few factors that will affect the cost. These factors include the age of the driver, the driving record, the type and level of coverage, the type of vehicle, and any optional features that are chosen. Additionally, the area that the driver lives in will also play a role in the cost of the policy. For example, drivers who live in a higher-risk area will typically pay more for coverage than those who live in a lower-risk area.

What Are the Benefits of Car Insurance Woolworths?

The main benefit of car insurance Woolworths is that it provides drivers with protection in the event of an accident or other incident. This type of policy is designed to cover the cost of any repairs or replacements that are needed for the vehicle and any legal fees that may arise from the incident. Additionally, it also provides coverage for any medical expenses that may be incurred as a result of the incident, as well as any damages that were done to another person’s property.

How to Get the Best Deal on Car Insurance Woolworths?

The best way to get the best deal on car insurance Woolworths is to shop around and compare different policies. It is important to make sure that the coverage that is chosen is adequate for the driver’s needs and that the cost of the policy is within the budget. Additionally, it is also important to look for discounts and other special offers that may be available. Additionally, drivers should also make sure that they are getting the best rate possible by taking advantage of any discounts or loyalty programs that may be available.

Quick Answer: What Is The Average Car Insurance Rate?? - AutoacService

What's the average cost of car insurance in the US? - Business Insider

Car Insurance Western Australia | WA | Compare The Market

Average Car Insurance Rates by Age and Gender Per Month

Full Coverage Car Insurance Cost / What S The Average Cost Of Car