Average Annual Car Insurance Woolworths

Average Annual Car Insurance Woolworths: What You Need to Know

Understanding Car Insurance

Car insurance is a type of insurance that is designed to protect you financially if you are involved in an accident or your car is stolen or damaged. In most places, car insurance is mandatory by law. It is important to understand the different types of car insurance policies and coverage so you can choose the best one for you.

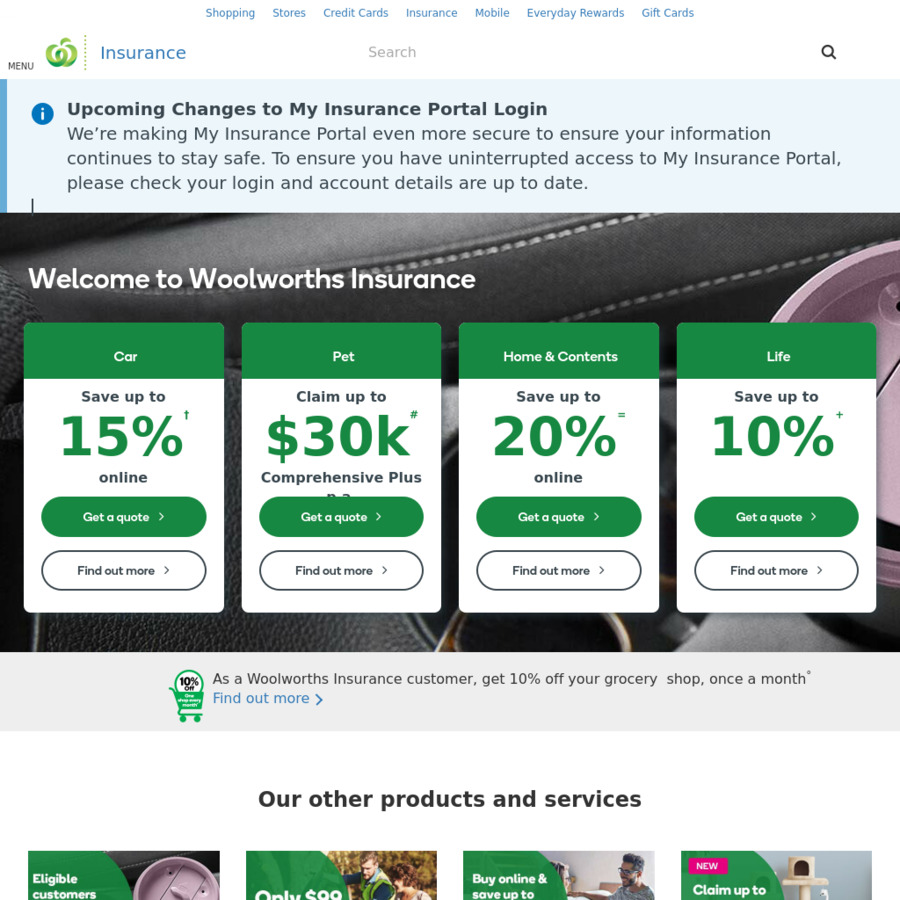

Average Annual Car Insurance Woolworths

At Woolworths, they offer a variety of car insurance plans to suit your needs. Whether you are looking for a basic plan or something more comprehensive, they have you covered. Their average annual car insurance rates are competitive and they offer a range of discounts and special offers to help you save even more.

Types of Car Insurance Coverage

Woolworths offers three types of car insurance coverage: Comprehensive, Third Party Fire and Theft, and Third Party Property Damage. Comprehensive insurance covers damage to your car and to other people's property. It also covers medical expenses for you and any passengers in your car. Third Party Fire and Theft provides cover for damage caused to other people's property, and for loss or damage to your car due to fire or theft. Third Party Property Damage covers damage to other people's property caused by your car.

Discounts and Special Offers

Woolworths offers a range of discounts and special offers to help you save on your car insurance. Some of these include no-claims bonus discounts, multi-policy discounts, and discounts for paying your premium in full. They also offer discounts for having an approved anti-theft device installed in your car, or for having a safe driving record.

Comparing Car Insurance Rates

When shopping for car insurance, it is important to compare rates from different companies. This will help you get the best deal. Woolworths offers a comparison service that allows you to compare their car insurance rates with other companies. This makes it easy to find the best policy for you at the best price.

Getting the Most Out of Your Car Insurance

When choosing a car insurance policy, it is important to understand your coverage and make sure you get the most out of your policy. Make sure you understand the limits of your coverage and any deductibles or other fees that may be associated with your policy. Also, make sure you are aware of any discounts or special offers available to you. By taking the time to understand your policy and shop around, you can ensure you get the best car insurance for your needs.

Woolworths Car Insurance | ProductReview.com.au

Car insurance - Woolworths $100 price beat - OzBargain Forums

Woolworths Car Insurance Reviews - ProductReview.com.au

Allstate vs. State Farm: Rates and Coverages (2023)

Get Quotes on the Average Price of Car Insurance in Your State | The