What Does Telematics Mean On Car Insurance

What Does Telematics Mean On Car Insurance?

Car insurance is an essential part of owning a vehicle, and it can be confusing to understand all the terms and conditions. One of the terms you may have heard is “telematics” – but what does this mean? In this article, we will look at what Telematics means on car insurance, and how it can affect your premiums.

What is Telematics?

Telematics is a term used to describe the use of technology to track and monitor a vehicle’s performance and behaviour. This data is then used to provide information about the driver’s driving style, and to calculate premiums for car insurance. Telematics technology can be used to monitor a variety of different factors, such as speed, location, braking, acceleration, and even how often the driver is using their mobile phone while driving.

How Does Telematics Work?

Telematics works by using a small device, called a ‘black box’, which is fitted to the car. This device then monitors a variety of different factors and sends the data to your insurance provider. This data is then used to calculate your premiums, based on your driving style. If you are a careful driver, you may be rewarded with lower premiums. However, if you are a more reckless driver, you may be charged higher premiums.

Advantages of Telematics

The main benefit of Telematics is that it allows insurance providers to have more accurate information about a driver’s habits, which in turn allows them to offer more tailored policies. This means that drivers can get policies which better reflect their individual driving styles, and can save money as a result. Additionally, as the data is collected in real-time, insurers can more easily detect fraudulent claims and can make more informed decisions when it comes to settling claims.

Disadvantages of Telematics

One of the main drawbacks of Telematics is that it can make drivers feel like they are being monitored and judged, which can be off-putting. Additionally, if the device fails or is tampered with, the data may be inaccurate or incomplete, which could lead to incorrect premiums being calculated. Finally, some drivers may feel that the data collected by their insurance provider is being used to discriminate against them, and that their premiums are not being calculated fairly.

Conclusion

Telematics can be a useful tool for calculating car insurance premiums, as it allows insurance providers to have more accurate information about a driver’s habits. However, it can also be seen as an invasion of privacy, and some drivers may feel that their premiums are being unfairly calculated. Ultimately, it is up to each individual driver to decide if Telematics is right for them.

Implementing Automotive Telematics for Insurance - IRDAI

Schematic operational view of telematics insurance, by Progressive

Infographics of Insurance Telematics in the UK | Car insurance online

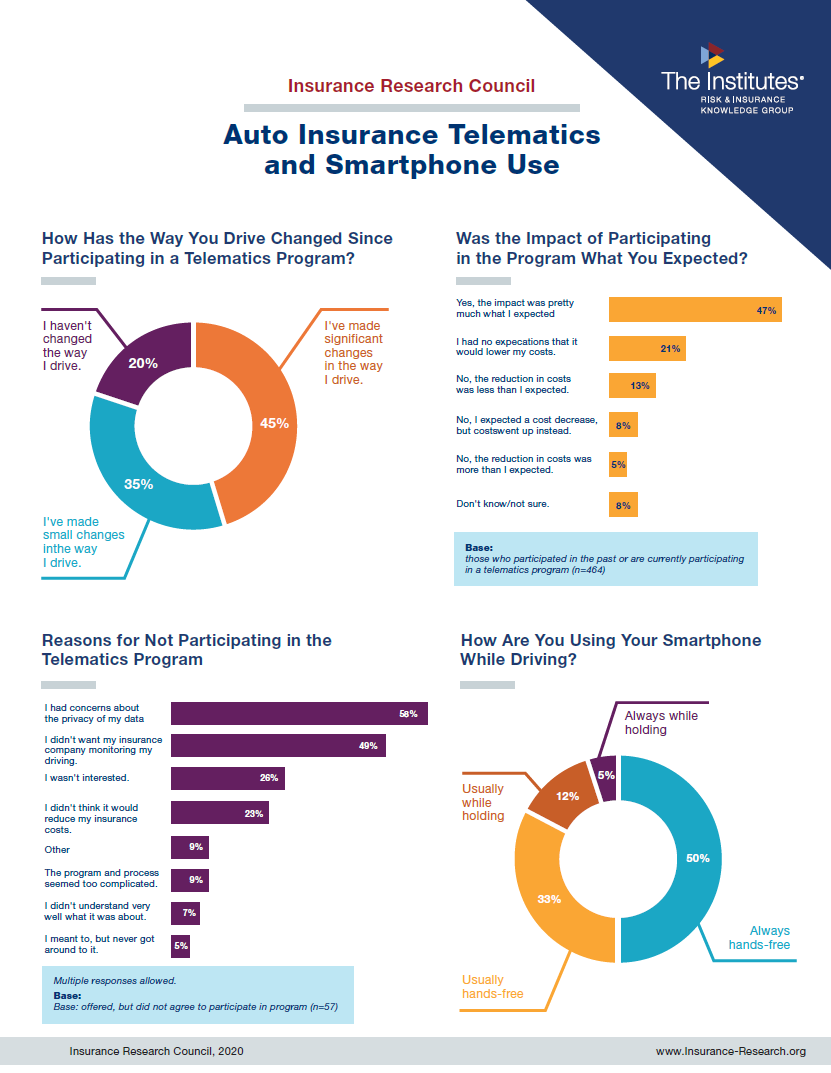

Auto Insurance Telematics & Smartphone Use: Consumer Survey Report

Telematics Testing Solutions for Usage-based Insurance | TestOrigen