What Does No Fault Insurance Mean

What Does No Fault Insurance Mean?

What is No Fault Insurance?

No Fault Insurance is a type of insurance system that protects people from financial loss due to the actions of another party. It is a system of insurance coverage that does not require an individual to prove that the other party was at fault for their losses. Instead, the individual simply has to show that they have suffered some kind of financial loss as a result of the actions of the other party. This type of insurance provides protection for individuals in the event of an accident or other type of incident. No Fault Insurance can be offered in both personal and commercial insurance policies.

How Does No Fault Insurance Work?

No Fault Insurance works by providing protection to individuals in the event of an accident or other type of incident. The individual simply has to show that they have suffered some kind of financial loss as a result of the actions of the other party. In most cases, the individual does not have to prove that the other party was at fault for their losses. Instead, the individual simply has to show that they have suffered some kind of financial loss as a result of the actions of the other party. This type of insurance is typically offered in both personal and commercial insurance policies.

Who Is Eligible for No Fault Insurance?

No Fault Insurance is typically available to individuals who are involved in an accident or other type of incident. The individual simply has to show that they have suffered some kind of financial loss as a result of the actions of the other party. This type of insurance is typically offered in both personal and commercial insurance policies. In most cases, the individual does not have to prove that the other party was at fault for their losses. Instead, the individual simply has to show that they have suffered some kind of financial loss as a result of the actions of the other party.

What Are the Benefits of No Fault Insurance?

No Fault Insurance provides numerous benefits to individuals who are involved in an accident or other type of incident. This type of insurance provides financial protection for individuals in the event of an accident or other type of incident. The individual does not have to prove that the other party was at fault for their losses. Instead, the individual simply has to show that they have suffered some kind of financial loss as a result of the actions of the other party. Additionally, this type of insurance may provide coverage for medical expenses, lost wages, and other costs associated with an accident or incident.

Are There Any Drawbacks to No Fault Insurance?

Although No Fault Insurance can provide financial protection for individuals in the event of an accident or other type of incident, there are a few drawbacks to this type of insurance. For example, No Fault Insurance does not provide coverage for any damage to property, liability, or legal fees. Additionally, the individual may be responsible for some of the costs associated with an accident or incident. As a result, it is important to carefully consider the pros and cons of this type of insurance before committing to a policy.

Conclusion

No Fault Insurance provides numerous benefits to individuals who are involved in an accident or other type of incident. This type of insurance provides financial protection for individuals in the event of an accident or other type of incident. Additionally, No Fault Insurance does not require an individual to prove that the other party was at fault for their losses. However, it is important to consider the pros and cons of this type of insurance before committing to a policy. No Fault Insurance can be a great way to protect yourself financially in the event of an accident or other type of incident.

No Fault Insurance | Best rates in Your State | Ogletree Financial

PPT - Property and Liability Insurance PowerPoint Presentation - ID:6591819

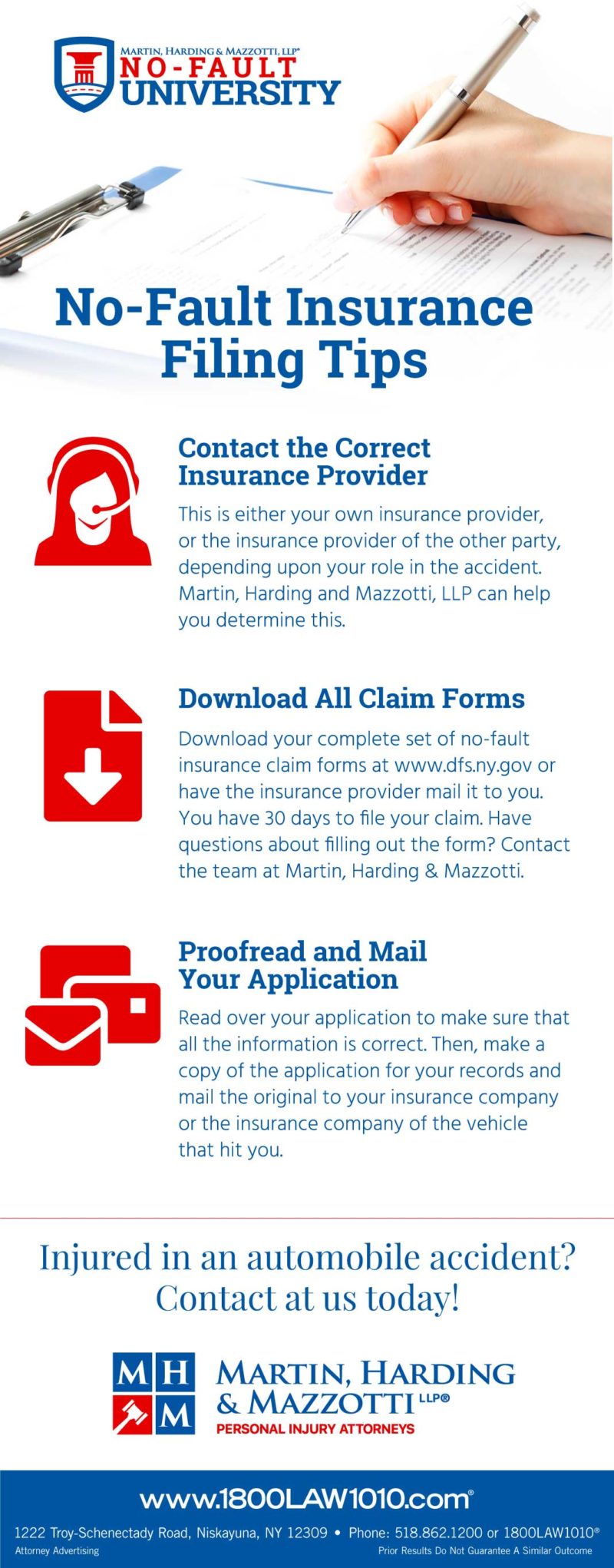

Infographic: Filing Tips for No Fault Insurance | Martin, Harding

What does No Fault Insurance Mean? (Ontario) - Ask Ayr Farmers - YouTube

Infographic: Filing Tips for No Fault Insurance | The Car Crash Pros