Third Party Car Insurance Price In Saudi Arabia

Friday, March 1, 2024

Edit

Third Party Car Insurance Price In Saudi Arabia

Types of Insurance Coverage

When it comes to car insurance in Saudi Arabia, there are two types of coverage available: third party and comprehensive. Third party insurance is the most basic and is mandatory for all cars in the country. It covers any damages or injuries you may cause to another person or their property in an accident. Comprehensive coverage, on the other hand, covers damage or loss to your car in addition to third party coverage. It also covers theft, fire damage, and natural disasters. The cost of comprehensive coverage depends on the type of car and its value.

Third Party Insurance Rates

The cost of third party car insurance in Saudi Arabia is largely dictated by the type of car and its value. For example, a small, low-value car may cost less to insure than a large, expensive car. The average cost of third party car insurance in Saudi Arabia is between 600 and 1000 SAR ($160 to $267). There are also additional fees such as registration costs, inspection fees, and more, that you must pay when purchasing third party insurance.

Factors Affecting Insurance Cost

There are several factors that can affect the cost of third party car insurance in Saudi Arabia. The age of the driver, the type of car, and its value are all taken into consideration when calculating the cost of insurance. Other factors include the driver's experience, the driver's driving record, and the driver's credit score. All of these factors can have a significant impact on the cost of insurance.

Comparing Insurance Rates

It is important to compare insurance rates before purchasing third party car insurance in Saudi Arabia. Different insurance companies offer different rates, so it is important to shop around to find the best deal. The internet is a great resource for comparing insurance rates, as there are many websites that allow you to compare rates from different companies. Additionally, you can speak to your local insurance provider to get an idea of the cost of insurance in your area.

Discounts and Incentives

Insurance companies in Saudi Arabia often offer discounts and incentives to attract customers. These discounts can include lower premiums for drivers with a good driving record, discounts for drivers who have taken a defensive driving course, and discounts for drivers who have installed safety features in their cars. Additionally, many insurance companies offer loyalty rewards for customers who have been with them for a long time.

Conclusion

Third party car insurance in Saudi Arabia is a necessity for all drivers. The cost of insurance can vary greatly depending on the type of car and its value, as well as the driver's experience and driving record. It is important to compare insurance rates before purchasing, and to look out for discounts and incentives offered by insurance companies. With a little research, you can find the right insurance policy to suit your needs and budget.

Third Party Insurance Price Uae - akuapprovesing

How to Get Vehicle Insurance in Saudi Arabia | Times of KSA

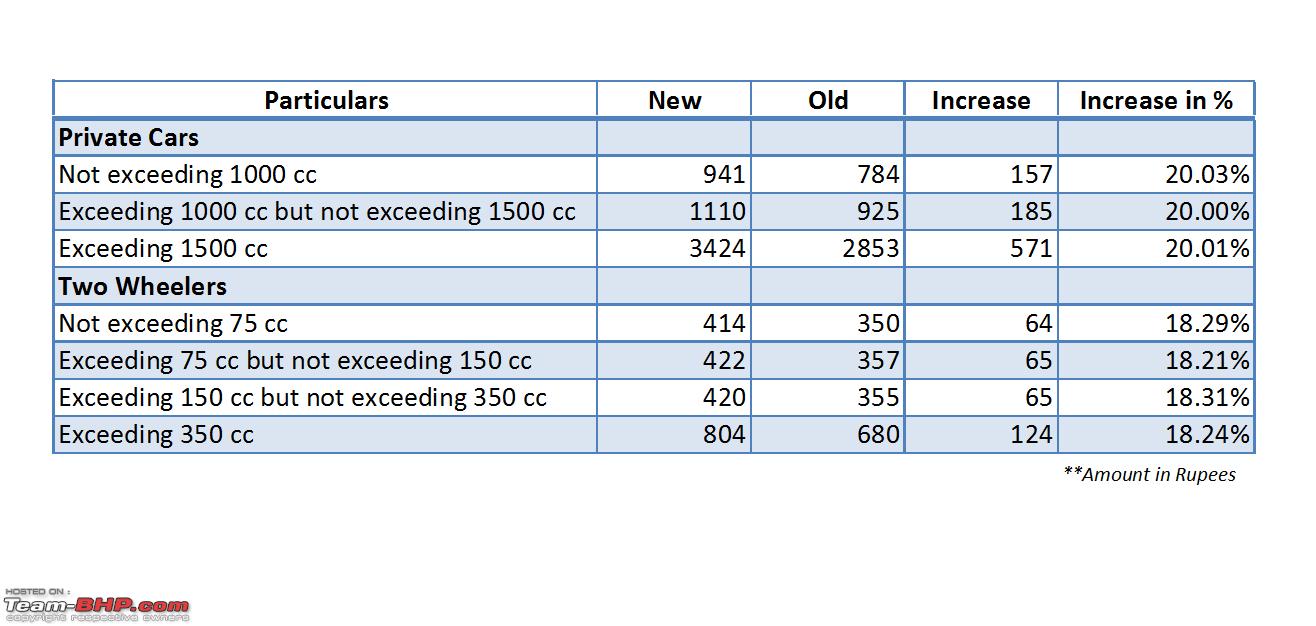

Third Party Insurance Premium to go up W.e.f 1st April 2013 - Team-BHP

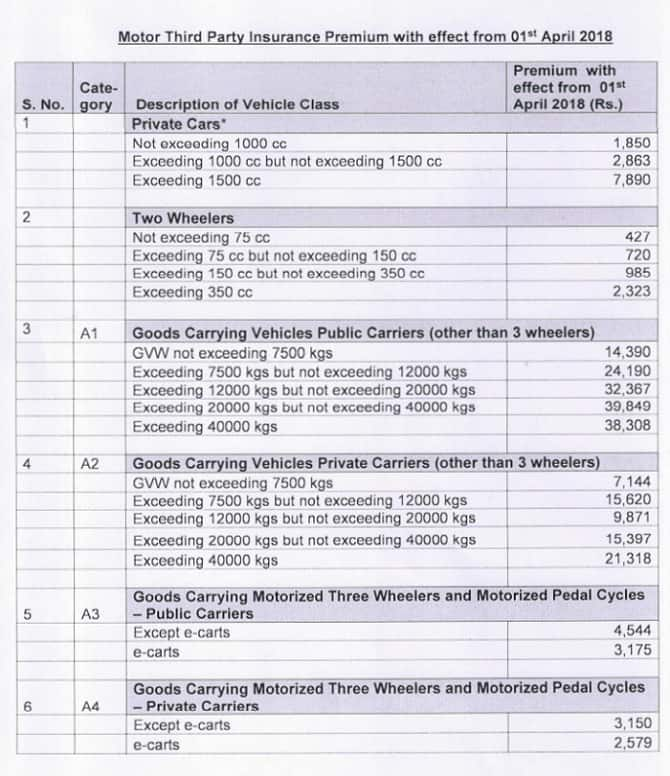

Exclusive | Third party insurance premium on commercial vehicle could

Third Party Car Insurance: What You Need To Know