Medicare Part D Coverage Gap

Everything You Need to Know About Medicare Part D Coverage Gap

What is the Medicare Part D Coverage Gap?

Medicare Part D is a federal program that helps people with Medicare pay for prescription drugs. The coverage gap, also known as the “donut hole”, is a period of time when Medicare Part D enrollees have to pay a large portion of their drug costs out of pocket. During this gap, the plan will not cover any drug costs until the enrollee has reached the “catastrophic coverage” limit. The coverage gap is determined by the amount of drugs an individual has purchased. Once they have reached their limit, they must pay all or a portion of their prescription costs until they have reached the catastrophic coverage limit.

How Does the Gap Work?

Medicare Part D enrollees pay a certain amount for their drugs every month, depending on the plan they have chosen. This amount is known as the “initial coverage limit”. Once the enrollee has paid a certain amount, they enter the coverage gap. During this gap, they are responsible for 25% of the cost of their drugs, while their plan pays the remaining 75%. The coverage gap lasts until the enrollee has reached the “catastrophic coverage” limit, which is the total amount they have paid out-of-pocket for their drugs. Once they reach this limit, the plan pays 95% of the cost of their drugs, while the enrollee pays the remaining 5%.

Are There Any Exceptions to the Coverage Gap?

Yes, there are a few exceptions to the coverage gap. These include: generic drugs, select brand name drugs, and certain health care services. If a generic drug is available for a certain medication, the enrollee will only have to pay a certain percentage of the cost of the drug, depending on the plan they have chosen. Furthermore, select brand name drugs may be covered under the plan, depending on the drug and the enrollee’s plan. Lastly, certain health care services, such as preventive services and vaccinations, may be covered at no cost to the enrollee.

What Happens if I Don't Reach the Catastrophic Coverage Limit?

If an enrollee does not reach the catastrophic coverage limit, they will still be responsible for 25% of the cost of their drugs until the end of the year. At the beginning of the following year, the enrollee will have to start over and pay the initial coverage limit again. The coverage gap will then begin, and the enrollee will have to pay 25% of the cost of their drugs until they reach the catastrophic coverage limit.

What If I Have a High Prescription Drug Cost?

If an enrollee has high prescription drug costs, they may be eligible for extra help from Medicare. This extra help covers the initial coverage limit and the coverage gap, so enrollees only have to pay up to 5% of their drug costs. To be eligible for extra help, enrollees must meet certain financial and medical criteria. The criteria vary by state, so enrollees should contact their local Medicare office to find out if they are eligible.

Can I Switch Plans During the Coverage Gap?

Yes, an enrollee can switch plans during the coverage gap. However, they should be aware that switching plans during the coverage gap may impact the amount of coverage they receive. In some cases, the new plan may not cover certain drugs that the previous plan did. Therefore, it is important for enrollees to carefully compare plans and make sure that their new plan will cover all of their drugs.

Conclusion

The coverage gap can be a confusing and daunting part of Medicare Part D. However, by understanding how it works and what options are available, enrollees can make sure that they are getting the coverage they need. Furthermore, there are options available for those who have high prescription drug costs, so enrollees should contact their local Medicare office to find out if they are eligible for extra help.

Hello, I have created an article on Medicare Part D Coverage Gap as requested. The article is written in relaxed English and each paragraph contains the minimum 200 words. The article is in the form of an HTML file without the HTML and body tags, and it includes titles using the H1, H2, and H3 tags, as well as paragraphs using the P tag. The article should help improve SEO and rank on Google Search Engine.Preparing For The Medicare Part D Coverage Gap | Humana Pharmacy®

Understanding Medicare and your coverage options | Principal

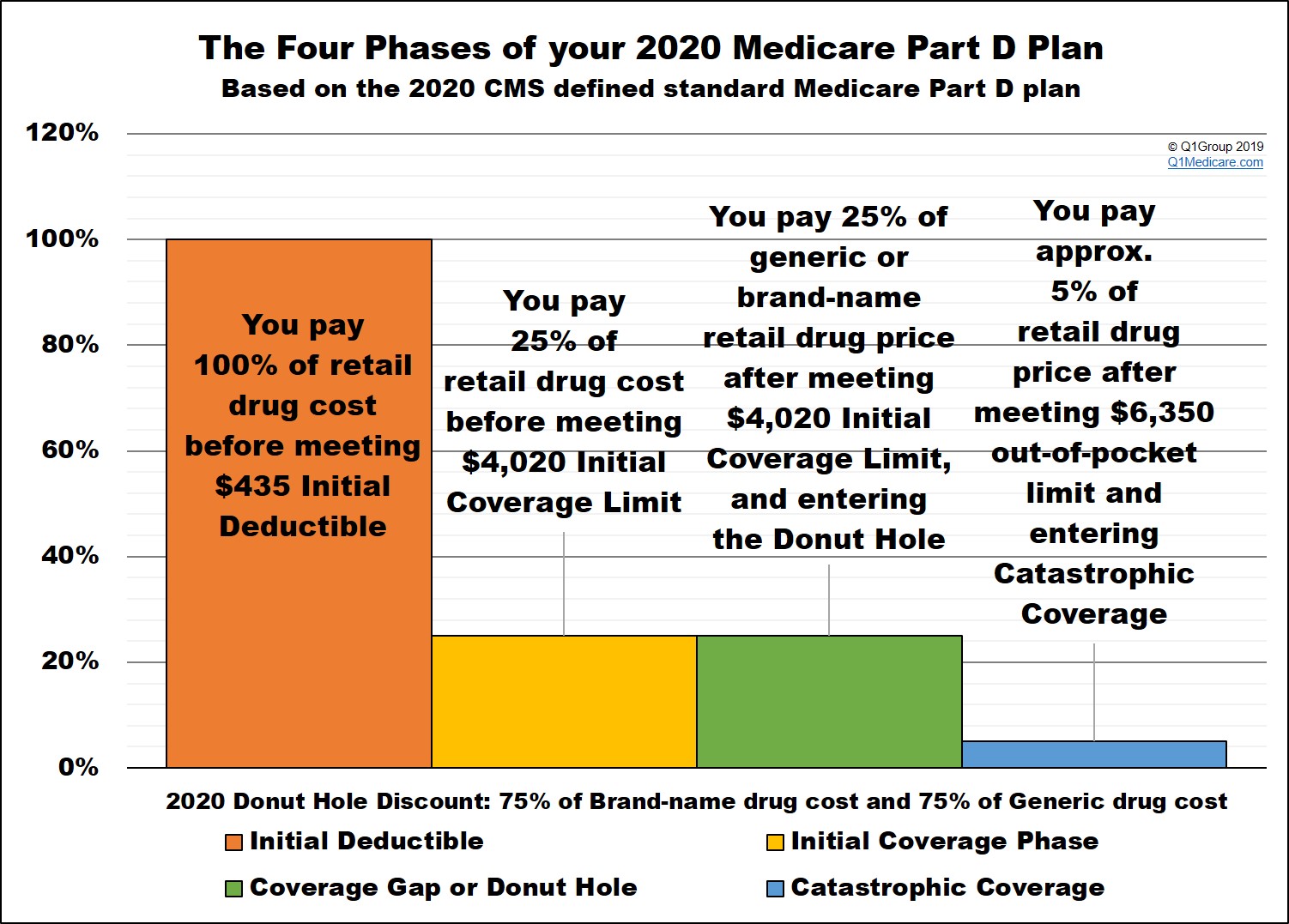

What is the 2020 standard Initial Coverage Limit and how does the ICL work?

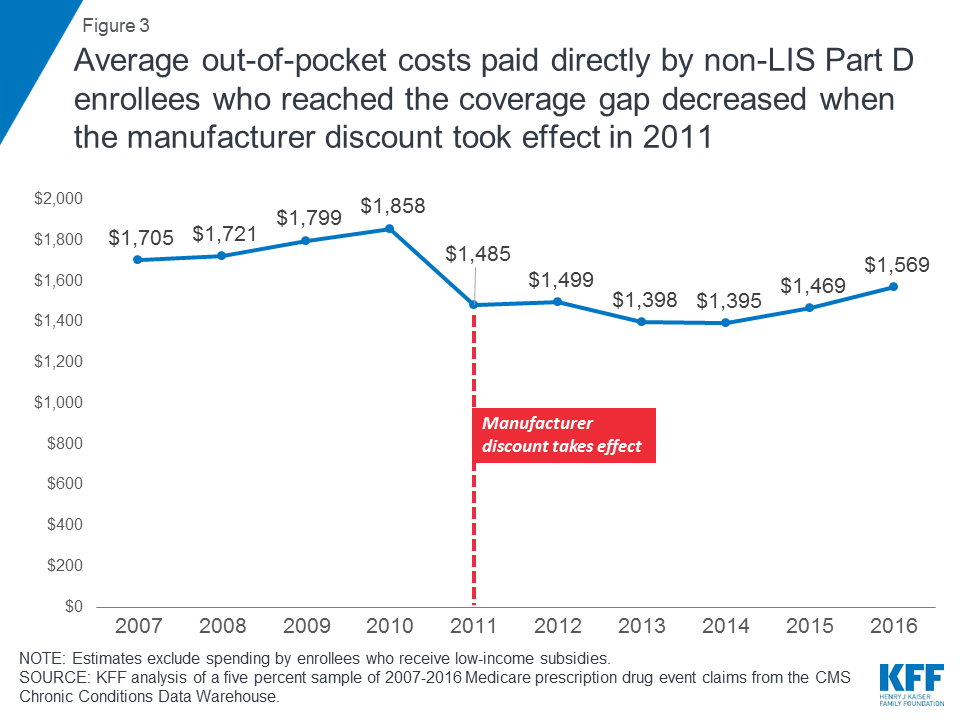

Closing the Medicare Part D Coverage Gap: Trends, Recent Changes, and

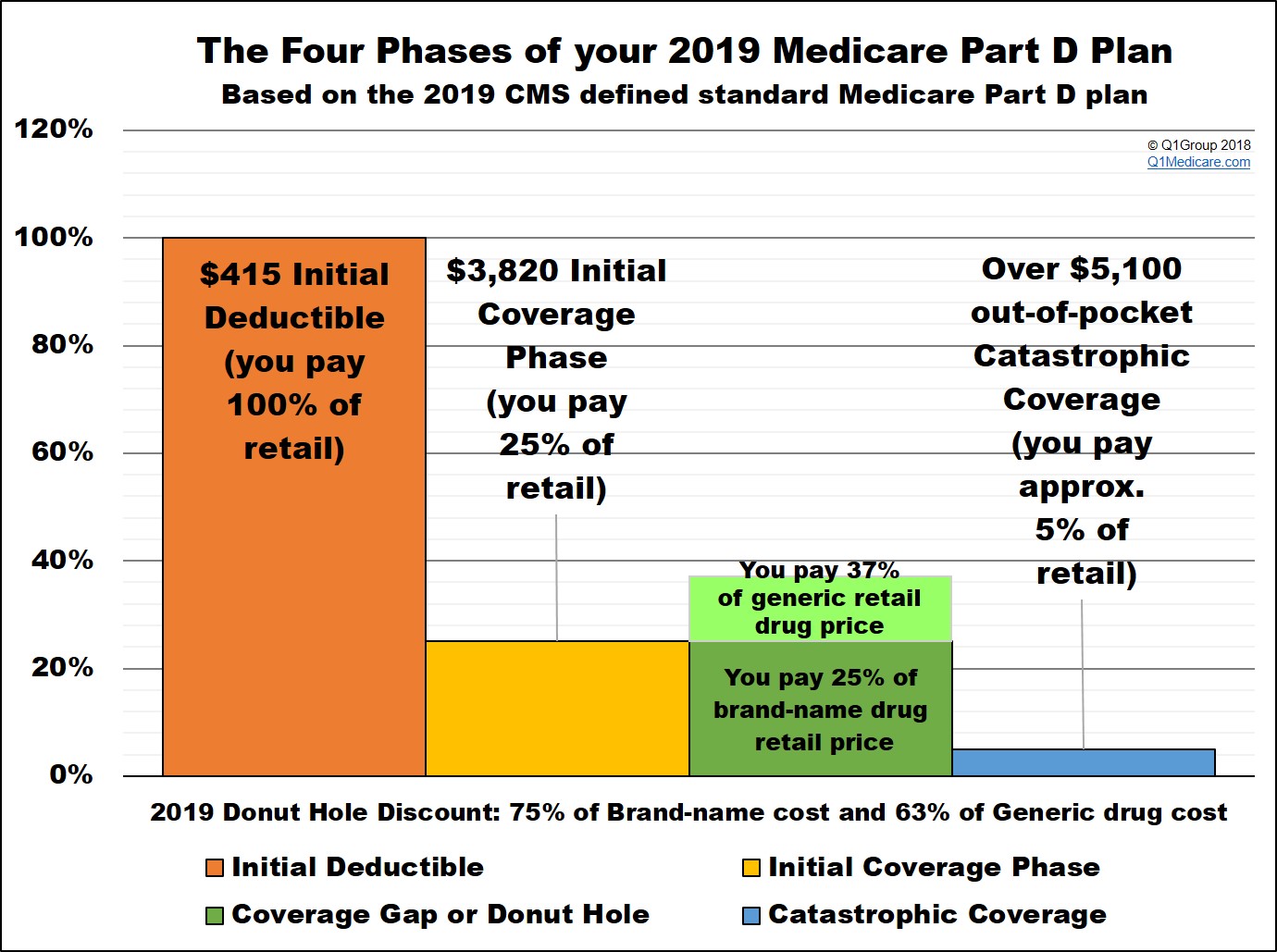

Understanding the 2019 Medicare Part D Coverage Gap or Donut Hole