Medicare Part D 2023 Coverage Gap

Everything You Need to Know About Medicare Part D 2023 Coverage Gap

What is Medicare Part D?

Medicare Part D is prescription drug coverage for individuals with Medicare. It helps cover the cost of medications, and can be added to existing Medicare plans. Part D plans are offered by private insurance companies, and vary in price and coverage. There are “stand-alone” plans that are just for prescription drug coverage, and there are plans that combine prescription drug coverage with other types of coverage, such as health and hospital insurance.

What is the Coverage Gap?

The coverage gap, also known as the “donut hole,” is a period of time when Medicare Part D beneficiaries are responsible for paying a greater portion of their prescription drug costs. It begins when the total cost of your medications reaches a certain amount, and ends when your out-of-pocket costs reach another amount. During the coverage gap, you may be responsible for paying up to 40% of the cost of your medications. The coverage gap is scheduled to end in 2023.

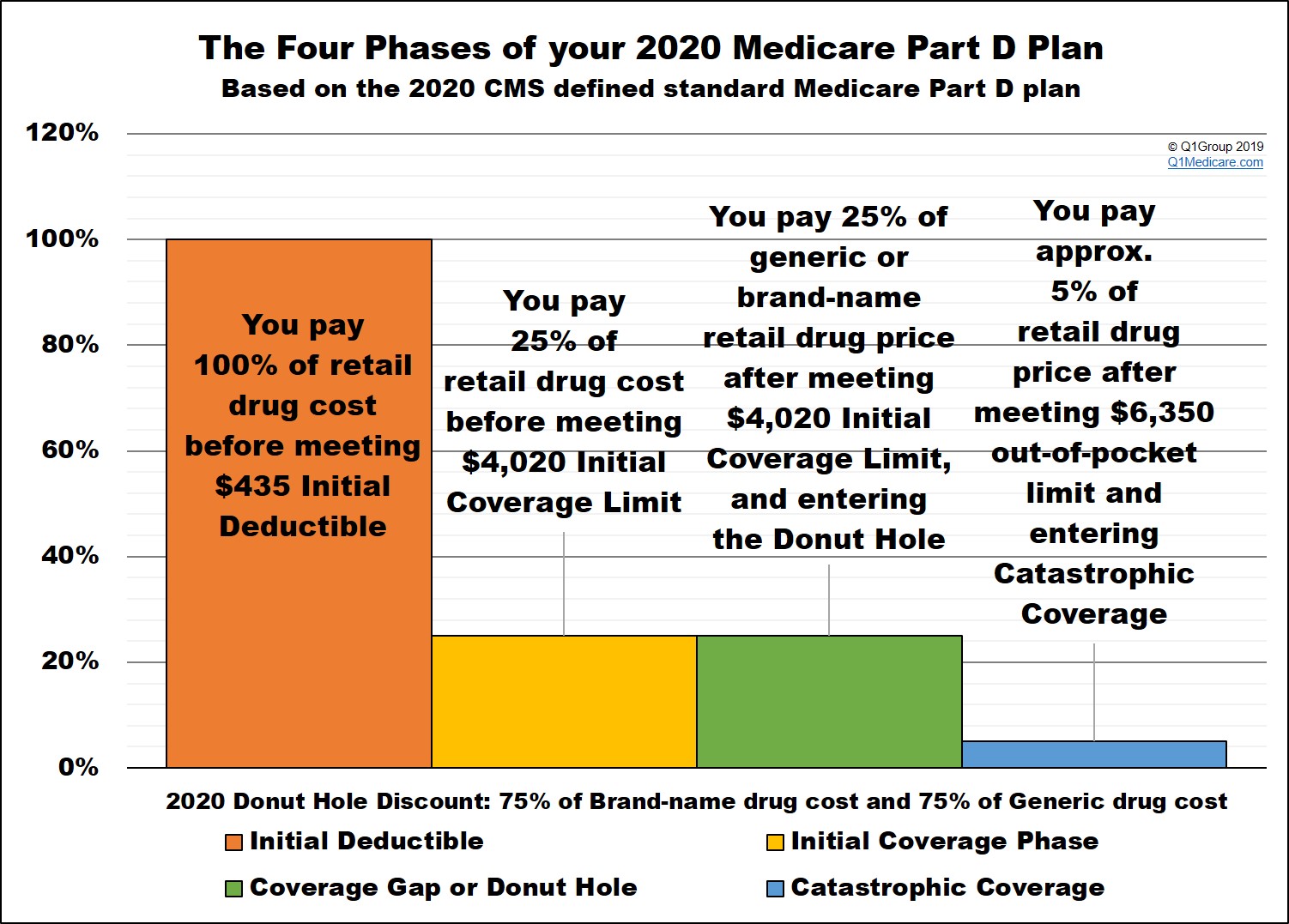

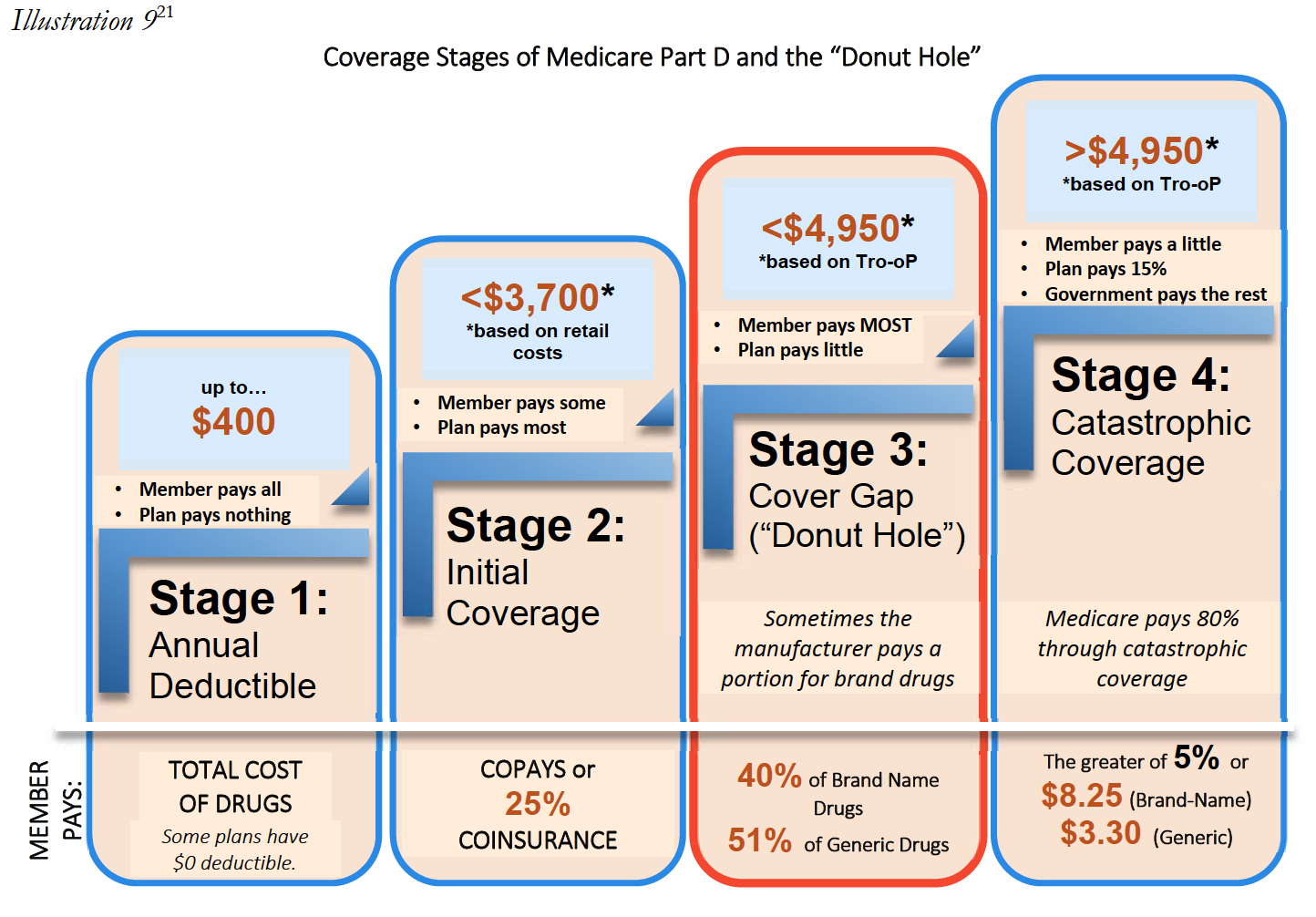

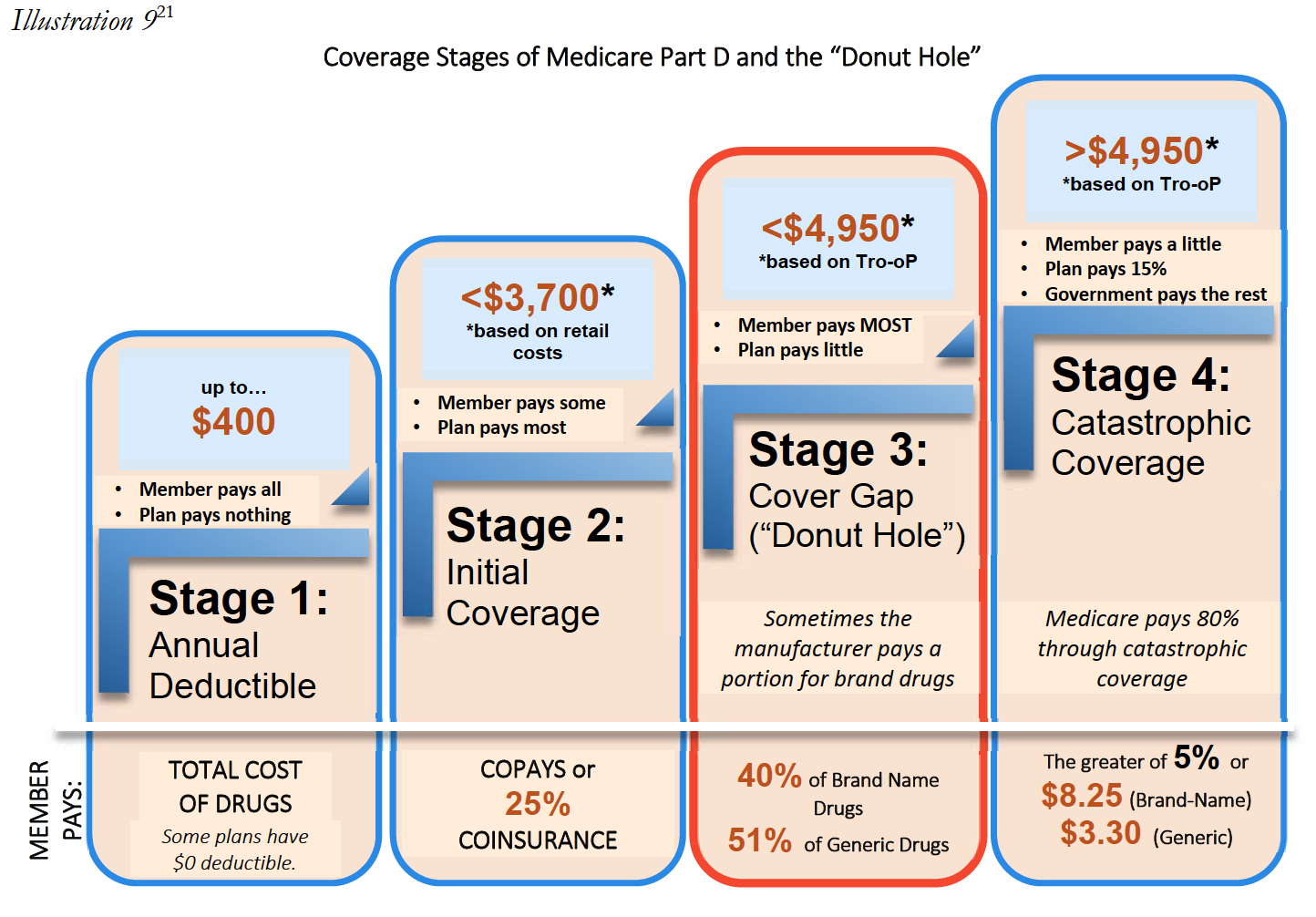

How Does the Coverage Gap Work?

The coverage gap works like this: when you sign up for a Part D plan, you pay a deductible, which is a fixed cost that you must pay before your insurance coverage kicks in. After your deductible has been paid, you are responsible for a percentage of your medication costs. This percentage is called coinsurance. Once your out-of-pocket costs reach a certain amount, the coverage gap begins. During this period, you are responsible for a greater portion of your medication costs, up to 40%. Once your out-of-pocket costs reach a certain amount, the coverage gap ends and your insurance coverage begins again.

How Does the Coverage Gap Work?

The coverage gap will end in 2023, when Medicare Part D beneficiaries will no longer be responsible for paying a greater portion of their medication costs during the coverage gap. This means that after the coverage gap ends, you will only be responsible for paying the same coinsurance amount that you pay before the coverage gap begins. This change will help make prescription drug coverage more affordable for Medicare Part D beneficiaries.

What Are the Benefits of the Coverage Gap Ending?

The biggest benefit of the coverage gap ending is that it will make prescription drug coverage more affordable for Medicare Part D beneficiaries. Currently, many beneficiaries are responsible for paying a large portion of their medication costs during the coverage gap, which can be very expensive. When the coverage gap ends, however, beneficiaries will only be responsible for the same coinsurance amount that they pay before the coverage gap begins, which will make prescription drug coverage much more affordable.

What Should I Do Now?

If you are a Medicare Part D beneficiary, you should start preparing for the coverage gap to end in 2023. This means that you should start looking into Part D plans that offer the best coverage and prices now. You should also start planning for how you will pay for your medications once the coverage gap ends. You may want to start saving money now so that you can pay for your medications without relying on your insurance coverage. By planning ahead, you can make sure that you are prepared when the coverage gap ends.

CY 2023 Medicare Advantage And Part D Proposed Rule (CMS-4192-P) | COPA

Preparing For The Medicare Part D Coverage Gap | Humana Pharmacy®

Understanding Medicare and your coverage options | Principal

2023 Medicare Premiums and Open Enrollment

What is the 2020 standard Initial Coverage Limit and how does the ICL work?