Does Your Car Insurance Cover Turo

Does Your Car Insurance Cover Turo?

What is Turo?

Turo is an online marketplace, which enables car owners to rent out their cars to others. It’s a peer-to-peer car rental service, which means that it’s a direct rental between two private individuals. This service is available in the United States, Canada, the United Kingdom, Germany, and Finland. If you’re a car owner, you can list your car on Turo, and people can rent it for a fee. And if you’re a renter, you can rent a car from a car owner in your area.

Does Car Insurance Cover Turo?

The answer to this question depends on the type of car insurance policy you have. Generally, if you have a standard policy, it won’t cover you for Turo rentals. Most standard policies only cover you for the use of your car for personal purposes. If you’re using your car for business purposes (i.e. renting it out to others), then you won’t be covered by a standard policy. However, if you have a non-standard policy, then you might be covered for Turo rentals.

What’s a Non-Standard Policy?

A non-standard policy is a type of car insurance that offers more comprehensive coverage than a standard policy. Non-standard policies are more expensive than standard policies, but they cover a wider range of activities, including car rentals. Depending on the policy, a non-standard policy may provide coverage for Turo rentals.

What Does Turo Insurance Cover?

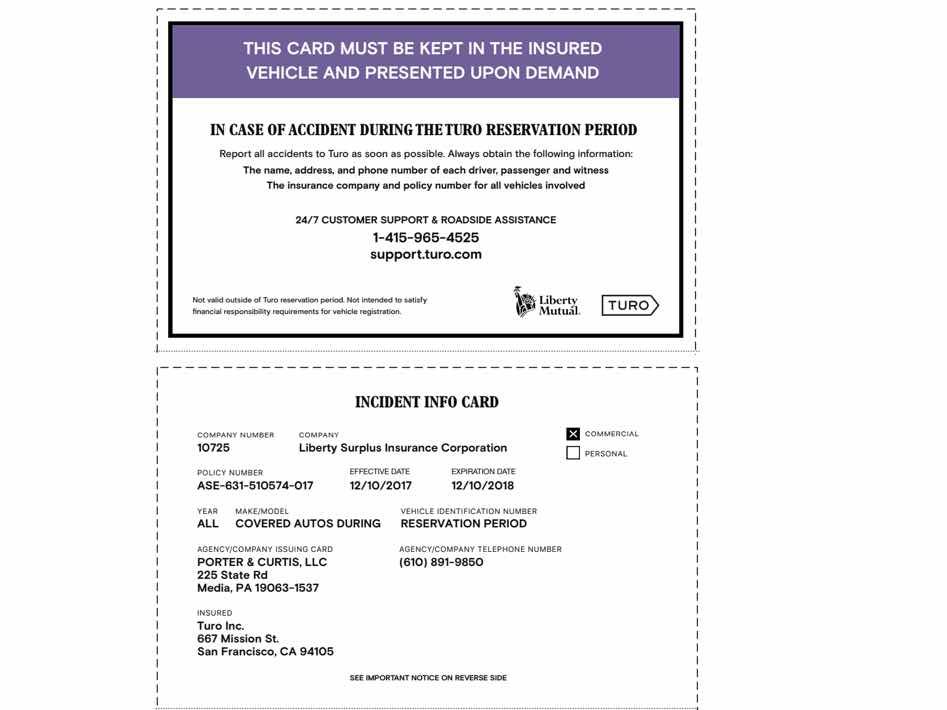

Turo has its own insurance policy, which covers you in the event of an accident or other damage to the vehicle. This insurance policy is separate from your own car insurance policy. The Turo insurance policy covers damage to the vehicle, as well as liability in the event of an accident or injury. The Turo insurance policy also provides coverage for roadside assistance, in the event of a breakdown or flat tire.

What is the Best Option?

If you’re considering renting out your car on Turo, it’s important to understand your own insurance coverage and the coverage offered by Turo. If you have a non-standard policy, it may provide coverage for Turo rentals, so it’s worth checking with your insurer to see if you’re covered. If you’re not covered by your own policy, then the Turo insurance policy is the best option.

Conclusion

Renting out your car on Turo can be a great way to make some extra money. But it’s important to make sure that you’re properly insured, in case of an accident or other damage. If you have a non-standard policy, it may provide coverage for Turo rentals. If not, then the Turo insurance policy is the best option. It’s always a good idea to check with your insurer before renting out your car on Turo, to make sure you’re properly covered.

Turo Review: How Renting Out Our Cars on Turo Turned Into a Free Tesla

Turo Third-Party Automobile Liability Insurance - KAASS LAW

Pros and Cons of Turo Car Rental for Travellers – Sling Adventures

How to Rent Your Car on TURO | FV058 - YouTube

How Does Turo Insurance Work : Host Tips How Insurance Works On Turo