What Is Full Coverage Insurance State Farm

What is Full Coverage Insurance State Farm?

Full coverage insurance from State Farm is an insurance plan that covers a wide range of eventualities, from theft and damage to lawsuits, medical expenses, and more. It is the highest level of coverage available from the popular insurance provider, and can help protect drivers and their families from a range of risks. State Farm's full coverage insurance includes liability coverage, which helps to cover expenses if you are found at fault in an accident; collision coverage, which helps pay for repairs to your car if it is damaged in an accident; and comprehensive coverage, which helps cover costs if your car is damaged by something other than an accident, such as theft or a natural disaster.

Why Should I Have Full Coverage Insurance?

Full coverage insurance from State Farm is a great way to protect yourself and your family from a range of risks. It provides a great deal of protection against both accidents and other risks, such as theft and damage caused by weather. It can also help pay for medical expenses if you are injured in an accident, as well as legal costs if you are sued. In addition, full coverage insurance can help you save money on your monthly insurance premium, because it is more comprehensive than other types of coverage.

What Does Full Coverage Insurance State Farm Cover?

Full coverage insurance from State Farm covers a wide range of risks. In addition to liability coverage, which helps to cover expenses if you are found at fault in an accident, it also includes collision coverage, which helps pay for repairs to your car if it is damaged in an accident; and comprehensive coverage, which helps cover costs if your car is damaged by something other than an accident, such as theft or a natural disaster. State Farm’s full coverage insurance also includes uninsured motorist coverage, which helps to pay for medical expenses and other costs if you are in an accident with a driver who does not have insurance.

How Much Does Full Coverage Insurance Cost?

The cost of full coverage insurance from State Farm depends on a variety of factors, such as the type of vehicle you drive, the age and driving record of the drivers in your household, and the area you live in. The best way to get an accurate estimate of the cost of full coverage insurance is to contact State Farm directly and request a quote. Additionally, it is important to remember that the cost of full coverage insurance may be higher than other types of coverage, but the added protection is well worth the additional cost.

What Are the Benefits of Full Coverage Insurance?

Full coverage insurance from State Farm provides a great deal of protection against a range of risks. It helps to cover expenses if you are found at fault in an accident, and also helps pay for repairs to your car if it is damaged in an accident. It can also help pay for medical expenses if you are injured in an accident, as well as legal costs if you are sued. In addition, full coverage insurance can help you save money on your monthly insurance premium, because it is more comprehensive than other types of coverage.

In Conclusion

Full coverage insurance from State Farm is an excellent way to protect yourself and your family from a range of risks. It provides a great deal of protection against both accidents and other risks, such as theft and damage caused by weather. It can also help pay for medical expenses if you are injured in an accident, as well as legal costs if you are sued. Additionally, full coverage insurance can help you save money on your monthly insurance premium, because it is more comprehensive than other types of coverage. For more information on full coverage insurance from State Farm, contact your local State Farm agent.

80+ Car Insurance Full Coverage Quotes - Hutomo Sungkar

How Does State Farm Rideshare Insurance Work?

State Farm Stays Profitable Despite Higher Losses, Lower Premiums | WGLT

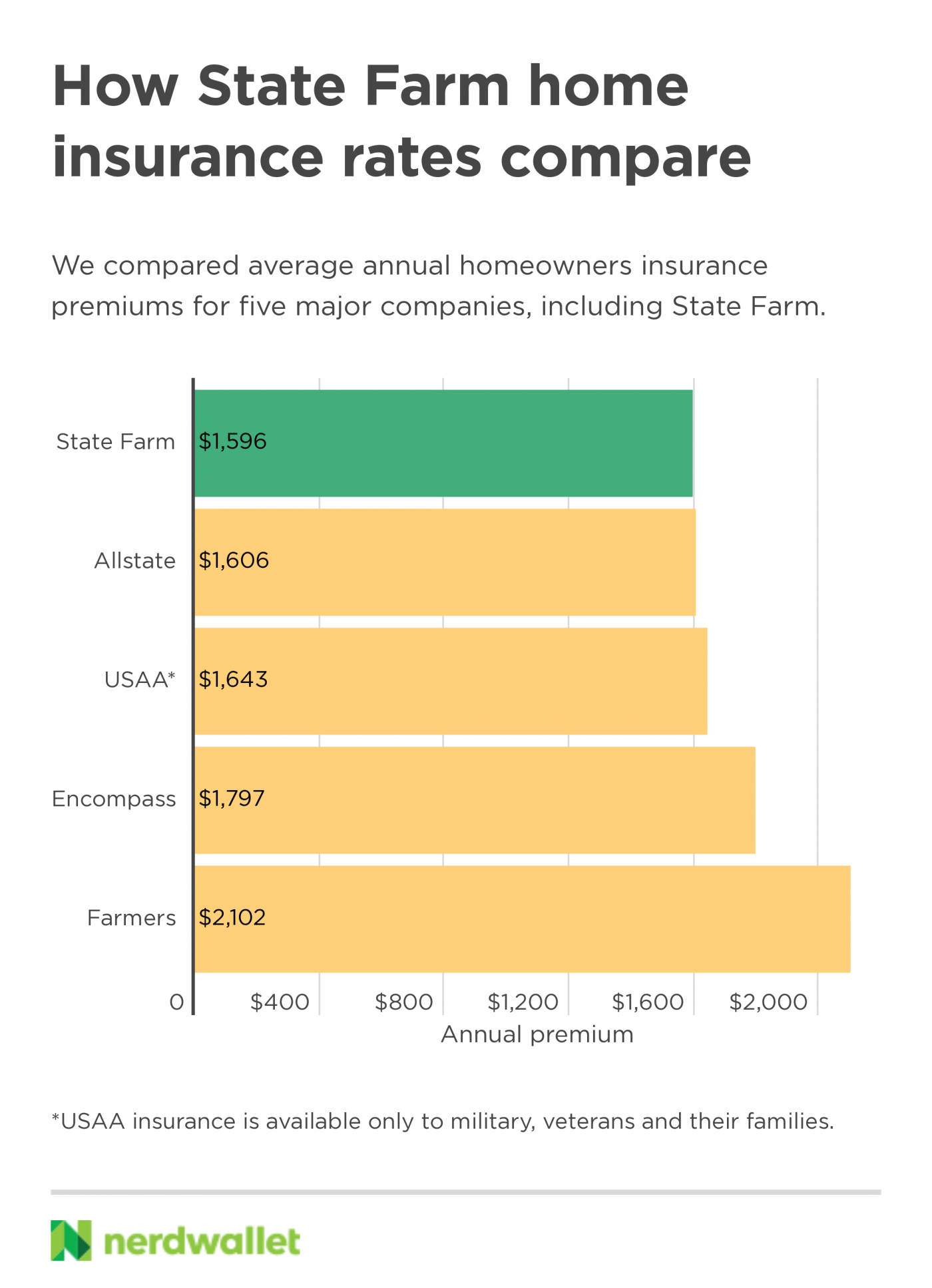

State Farm Home Insurance Review 2021 - NerdWallet