Kotak Car Insurance Claim Settlement Ratio

Kotak Car Insurance Claim Settlement Ratio is Impressive

Kotak has become one of the leading insurers in India and its car insurance policy has become popular with customers. One of the reasons behind this popularity is the impressive claim settlement ratio of Kotak car insurance. The claim settlement ratio of Kotak car insurance is one of the highest in the industry. It is a measure of how efficiently and quickly the company settles the claims of its customers. It is also a measure of the customer satisfaction of the company.

When it comes to car insurance, Kotak offers a comprehensive cover that includes a wide range of features such as personal accident cover, third-party liability cover, 24x7 roadside assistance, and more. The company also offers a range of add-on covers that can be availed to enhance the coverage of the policy. The claim process of Kotak car insurance is also quite easy and hassle-free, making it easier for customers to file their claims.

Kotak Claim Settlement Ratio

The claim settlement ratio of Kotak car insurance is one of the highest in the industry. In the financial year 2019-20, the claim settlement ratio of Kotak stood at 96.84%, which is significantly higher than the industry average of 89.02%. This indicates that the company is able to settle the claims of its customers very quickly and efficiently. The company also has a track record of settling the claims of its customers without any hassles.

Claim Intimation

In case of an accident, it is important to intimate the claim as soon as possible. Kotak car insurance policyholders can intimate their claim either by calling the toll-free number of the company or by logging in to the website. The company has a dedicated team of professionals who are available 24x7 to help its customers with their claims. It is important to note that the claim intimation should be made within seven days of the incident.

Documents Required for Claim Settlement

After intimating the claim, the policyholder needs to submit the required documents to the company. Some of the documents that are required for the settlement of the claim are the duly filled claim form, FIR copy, driving license, medical bills, repair bills, and surveyor report (if required). It is important to submit all the documents in order to ensure that the claim is settled quickly and efficiently.

Conclusion

Kotak car insurance is one of the most popular policies in the market due to its comprehensive cover and impressive claim settlement ratio. The claim settlement ratio of the company is one of the highest in the industry and the company is able to settle the claims of its customers quickly and efficiently. Kotak car insurance policyholders can intimate their claim either by calling the toll-free number of the company or by logging in to the website.

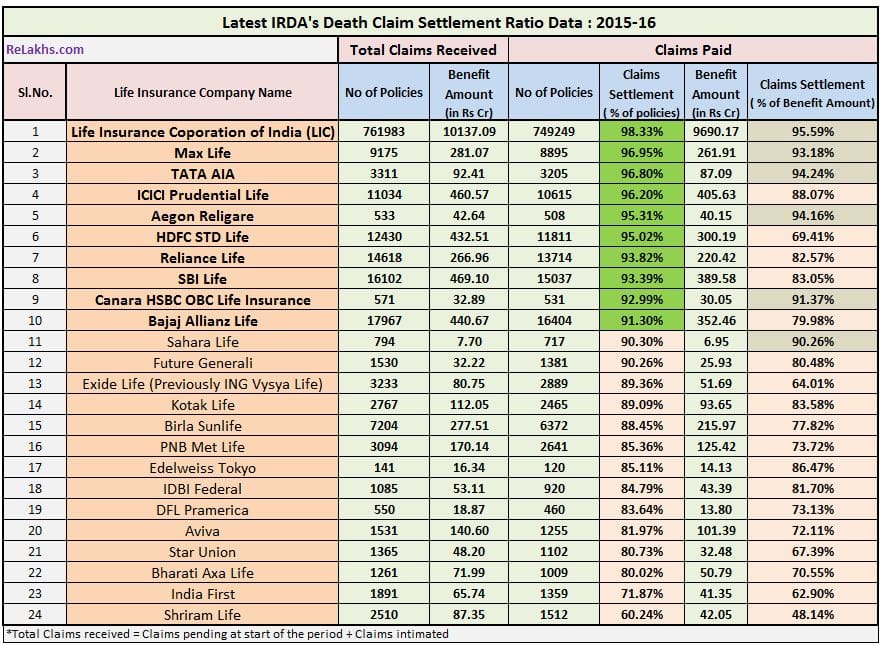

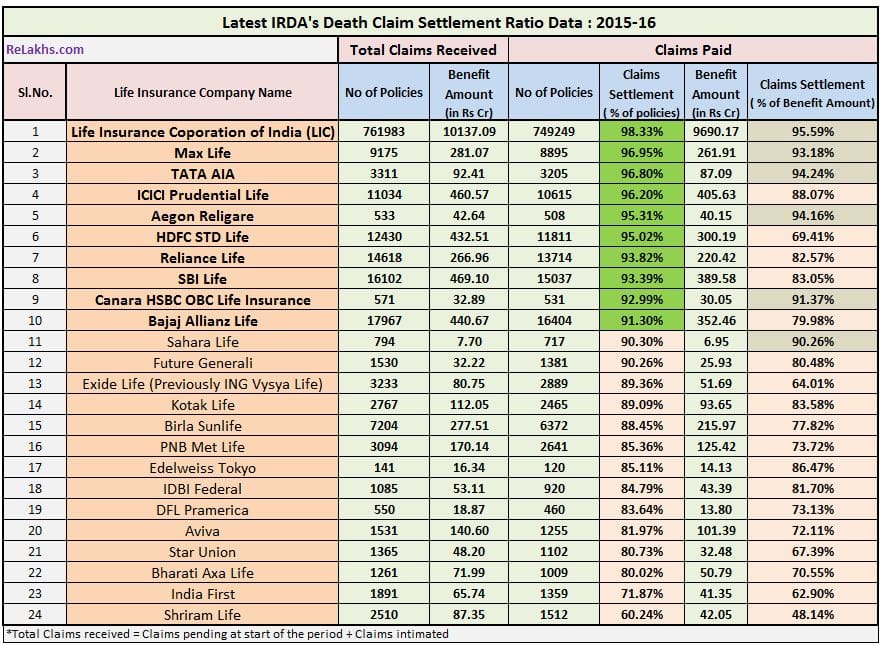

Latest IRDA Claim Settlement Ratio 2015-16 | Top Life Insurance Cos

Online Term Policy Claim Settlement Ratio

Car Insurance Renewal - Check Claim Settlement Ratios

Irda Claim Settlement Ratio 2017 18 Car Insurance - Classic Car Walls

Top 10 Best Claim Settlement Ratio Life Insurers