Shriram Car Insurance Claim Settlement Ratio

Understanding Shriram Car Insurance Claim Settlement Ratio

What is Shriram Car Insurance Claim Settlement Ratio?

Shriram Car Insurance Claim Settlement Ratio is an important indicator of how efficiently an insurance company is able to settle the claims. This ratio is calculated by dividing the total number of claims settled by the total number of claims reported. A higher ratio means that the insurance company has done a better job in settling its claims. In other words, a higher claim settlement ratio indicates that the insurance company has been able to resolve more claims than expected.

Why is Shriram Car Insurance Claim Settlement Ratio significant?

The Claim Settlement Ratio of an insurance company is an important factor to consider when choosing an insurance policy. It gives an insight into how well the company is able to manage and settle claims. A higher claim settlement ratio indicates that the company is able to resolve claims in a timely manner and with relatively fewer disputes. This is why it is important to consider the claim settlement ratio of an insurance company before making a decision.

What is the current Shriram Car Insurance Claim Settlement Ratio?

The current claim settlement ratio of Shriram Car Insurance is quite impressive. It stands at an impressive 97.57%, which is significantly higher than the industry average of around 95%. This indicates that the company is doing an excellent job in settling the claims of its clients. Moreover, the company has been able to maintain its high claim settlement ratio for several years now, which is a testament to its efficiency.

How does Shriram Car Insurance fare in comparison to other insurers?

When compared to other insurers, Shriram Car Insurance fares very well in terms of its claim settlement ratio. The company has consistently been able to maintain a higher claim settlement ratio compared to its peers. This indicates that the company is able to manage and settle claims in an efficient manner. Furthermore, the company is backed by a strong customer support team that is able to quickly resolve any disputes that may arise.

What are the benefits of a high Shriram Car Insurance Claim Settlement Ratio?

A high claim settlement ratio is beneficial for both the insurance company and its customers. For the company, a high claim settlement ratio indicates that it is able to efficiently manage and settle claims. This results in higher customer satisfaction and better customer retention rates. For customers, a high claim settlement ratio indicates that the company is able to efficiently resolve disputes and settle claims in a timely manner.

Conclusion

Shriram Car Insurance is an excellent option for those looking for an efficient and reliable insurance company. The company has consistently been able to maintain a high claim settlement ratio of 97.57%, which is significantly higher than the industry average. This indicates that the company is able to manage and settle claims efficiently and in a timely manner. Furthermore, the company is backed by a strong customer support team that is able to quickly resolve any disputes that may arise.

Car Insurance Renewal - Check Claim Settlement Ratios

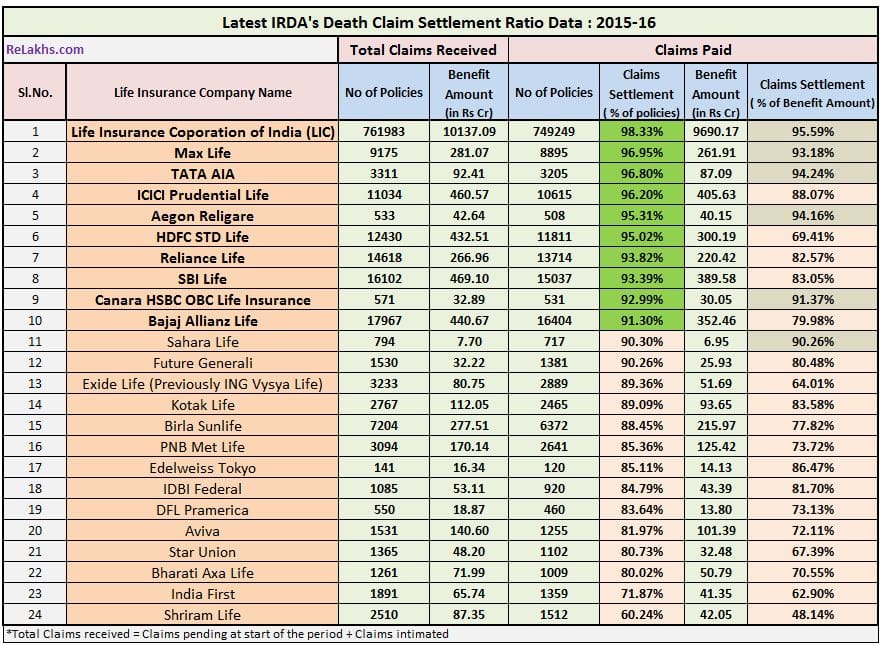

Latest IRDA Claim Settlement Ratio 2015-16 | Top Life Insurance Cos

Term Insurance Claim Ratio

What is the claim settlement ratio? - Magma HDI

Best online Term Insurance Plans in India for 2015-A comparative list