Reliance Car Insurance Claim Settlement Ratio

Reliance Car Insurance Claim Settlement Ratio

Reliance Car Insurance Overview

Reliance Car Insurance is one of the most reliable car insurance policies available in the market. It is offered by Reliance General Insurance, a part of the Reliance Anil Dhirubhai Ambani group. This insurance policy covers damage to your vehicle due to natural disasters, man-made calamities and third-party liabilities. Reliance car insurance also provides a host of additional benefits such as cashless repairs, free roadside assistance, free towing of the vehicle, etc. This insurance policy comes with various features and options that you can select according to your needs.

Reliance Car Insurance Claim Settlement Ratio

Reliance Car Insurance claim settlement ratio is one of the most important factors to consider before buying a car insurance policy. Reliance car insurance has a proven track record of providing satisfactory claim settlement services. As per the latest data from the Insurance Regulatory and Development Authority of India (IRDAI), Reliance Car Insurance has a claim settlement ratio of 95.21%, which is the highest among all the major car insurance companies. This proves that Reliance Car Insurance provides an excellent service in terms of claim settlement.

Benefits of Reliance Car Insurance Claim Settlement Ratio

A high claim settlement ratio is an indication of the reliability of the insurance company. The higher the claim settlement ratio, the more reliable the insurance company is. Thus, a high claim settlement ratio is beneficial for the insured as it ensures that the insurance company will settle their claims in a timely and efficient manner. Moreover, a high claim settlement ratio also ensures that the insured will get the full benefit of their insurance policy in case of any mishap.

Tips to Increase the Claim Settlement Ratio

There are certain steps that you can take to increase the claim settlement ratio of your car insurance policy. Firstly, make sure you read the policy document carefully and understand the clauses and conditions. Secondly, always provide accurate and updated information to the insurance company. This will help the company to process your claim faster and more efficiently. Lastly, always make timely premium payments, as this will ensure that your policy does not lapse and your claim is settled promptly.

Conclusion

Reliance Car Insurance has a high claim settlement ratio that ensures that the insured will get the full benefit of their policy in case of any mishap. The insured can also take certain steps to increase their claim settlement ratio such as providing accurate information to the insurance company and making timely premium payments. Therefore, Reliance Car Insurance is one of the best car insurance policies available in the market.

Car Insurance Renewal - Check Claim Settlement Ratios

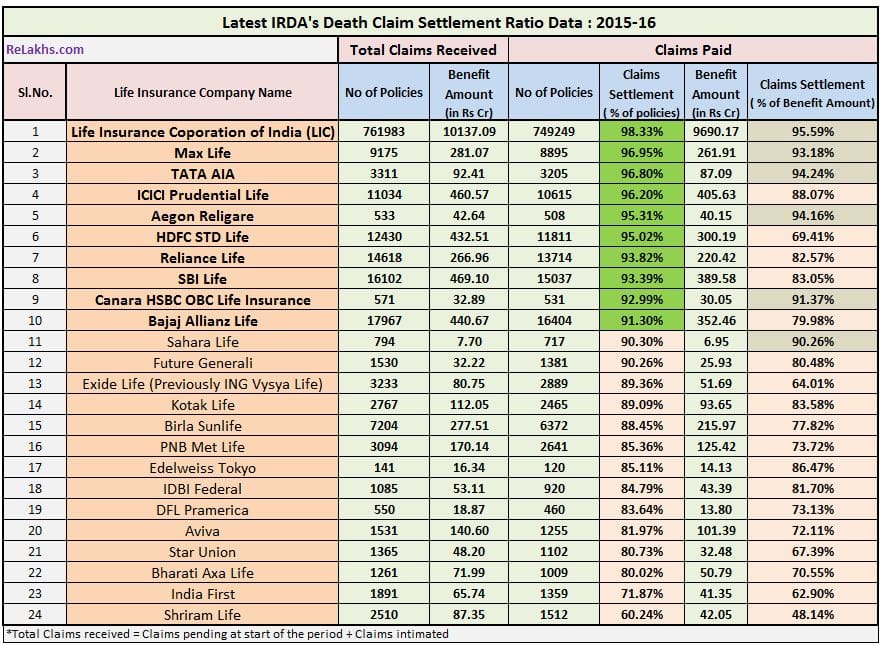

Latest IRDA Claim Settlement Ratio 2015-16 | Top Life Insurance Cos

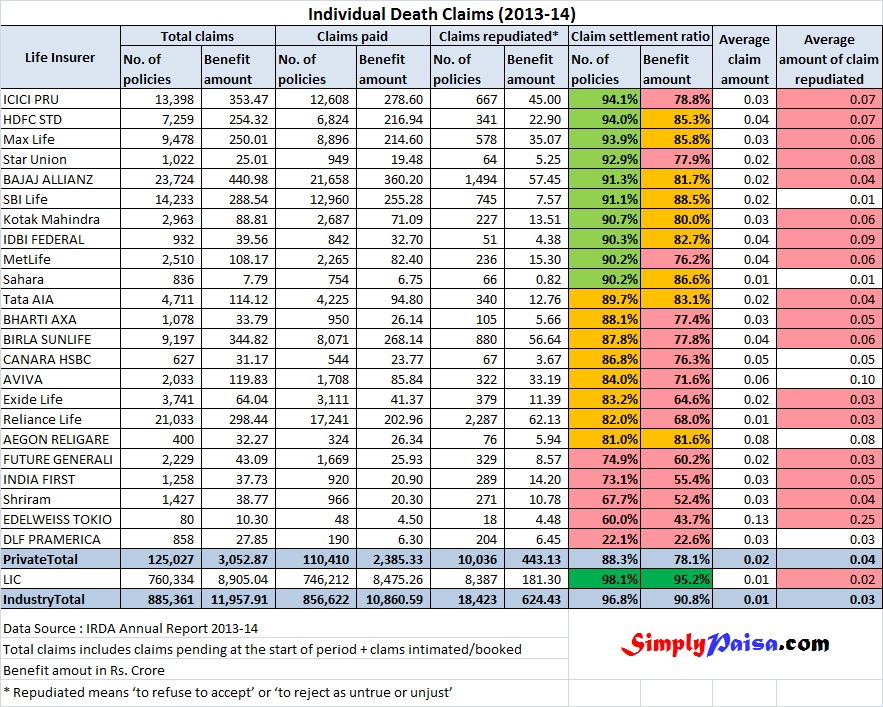

Claim Settlement Ratio 2013-2014 to buy Health Insurance

Now check IRDA Claim Settlement ratio 2013-14 before buying Insurance