Home And Car Insurance For 100 Disabled Veterans

Monday, March 27, 2023

Edit

Home and Car Insurance for 100 Disabled Veterans

Introduction to the Home and Car Insurance for 100 Disabled Veterans

The Department of Veterans Affairs (VA) has been providing home and car insurance for veterans for many years. This insurance is designed to help veterans pay for their homes and cars, as well as providing financial security to their families. The VA has recently announced a new program that will offer home and car insurance to 100 disabled veterans. This program is designed to help disabled veterans get the financial assistance they need to purchase and maintain a home and a car.

Who is Eligible for the Home and Car Insurance for 100 Disabled Veterans?

The VA’s Home and Car Insurance for 100 Disabled Veterans program is open to any veteran who has been rated as 100% disabled by the VA. This includes veterans who have been diagnosed with a permanent physical or mental disability, as well as veterans who have been injured in combat. To be eligible for this program, veterans must have served at least 24 months of continuous active duty, including any time spent in a combat zone.

What Does the Home and Car Insurance for 100 Disabled Veterans Cover?

The Home and Car Insurance for 100 Disabled Veterans program provides a variety of benefits. First, it provides up to $200,000 in home and auto insurance coverage. This coverage can be used to cover the costs of repairs, medical bills, and other expenses related to owning and maintaining a home or car. Additionally, the program provides up to $25,000 in coverage for veterans who are purchasing a home. Finally, the program provides up to $10,000 in coverage for veterans who are purchasing a car.

How Does the Home and Car Insurance for 100 Disabled Veterans Help Veterans?

The Home and Car Insurance for 100 Disabled Veterans program provides a number of benefits to veterans. First, it helps veterans cover the costs of repairs and medical bills related to owning and maintaining a home or car. Additionally, the program provides financial security to veterans’ families. Finally, the program helps veterans purchase a home or car by providing up to $25,000 in coverage for home purchases and $10,000 in coverage for car purchases.

What Other Benefits Does the Home and Car Insurance for 100 Disabled Veterans Provide?

The Home and Car Insurance for 100 Disabled Veterans program also provides other benefits to veterans. For example, it offers free roadside assistance, free towing, free rental car coverage, and free legal assistance. Additionally, the program provides free counseling and financial advice to veterans. Finally, the program provides a variety of discounts on car insurance premiums and home insurance premiums.

Conclusion

The Department of Veterans Affairs’ Home and Car Insurance for 100 Disabled Veterans program is a great way for veterans to get the financial assistance they need to purchase and maintain a home and a car. The program provides up to $200,000 in home and auto insurance coverage, up to $25,000 in coverage for home purchases, and up to $10,000 in coverage for car purchases. Additionally, the program offers free roadside assistance, free towing, free rental car coverage, free legal assistance, free counseling and financial advice, and a variety of discounts on car insurance premiums and home insurance premiums.

DAV Oklahoma 100% Disabled American Veterans pay no property tax (ad

SECRET 100 Percent Disabled Veteran Benefits [NEW in 2021!] - YouTube

![Home And Car Insurance For 100 Disabled Veterans SECRET 100 Percent Disabled Veteran Benefits [NEW in 2021!] - YouTube](https://i.ytimg.com/vi/scU2of9cBfs/maxresdefault.jpg)

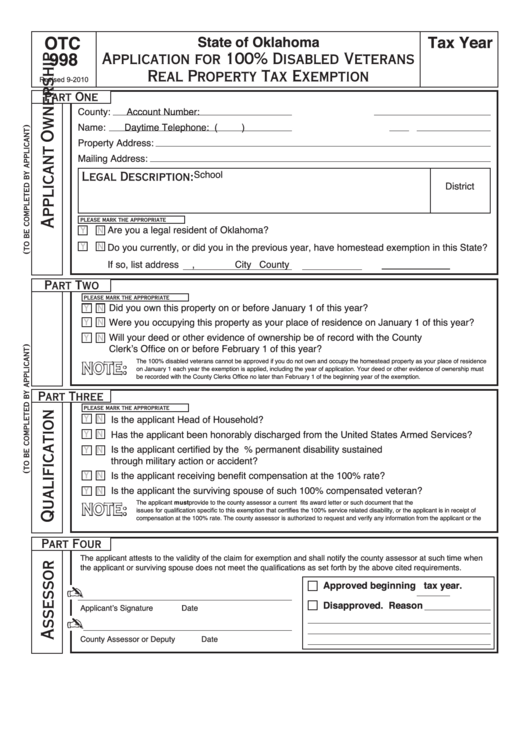

Fillable Form Otc998 - Application For 100% Disabled Veterans Real

How Can Veterans Earn 100% VA Disability Rating? - Hill & Ponton, P.A.

√ Best State To Live In For 100 Disabled Veterans - Navy States