Cheap Affordable Full Coverage Car Insurance

Thursday, March 9, 2023

Edit

Finding Cheap Affordable Full Coverage Car Insurance

Why You Need Full Coverage Car Insurance

Having full coverage car insurance is important for many reasons, particularly if you have a loan on your vehicle. If you have a loan, then your lender requires you to have full coverage insurance. This protects them in the event of an accident. Also, if you have a newer model vehicle, you may want to consider full coverage insurance. Even if you don’t have a loan on the car, it is important to protect your vehicle from theft, vandalism, and other unforeseen events. Full coverage car insurance will cover these types of events and provide you with peace of mind.

What is Full Coverage Car Insurance?

Full coverage car insurance is a type of insurance that includes liability coverage for bodily injury and property damage as well as comprehensive and collision insurance. Liability coverage protects you from any damage that you cause to another person or their property. Comprehensive and collision insurance will cover damage to your own vehicle caused by fire, theft, vandalism, and other perils. This type of insurance is usually more expensive than liability only insurance, but it can provide you with more protections in the event of an accident.

How to Find Cheap Affordable Full Coverage Car Insurance

Finding cheap affordable full coverage car insurance can be a challenge. The key is to shop around and compare rates from several different insurance companies. You can use an online comparison tool to quickly compare rates from multiple companies. This can be a great way to find the best deal.

It is also important to look for discounts. Many insurance companies offer discounts for things such as having multiple vehicles, having a good driving record, or being a safe driver. Make sure to ask your insurance agent about any discounts that you may qualify for.

What Factors Can Affect Your Full Coverage Car Insurance Rates?

There are several factors that can affect your full coverage car insurance rates. These include your age, driving record, where you live, the type of car you drive, and the amount of coverage you choose. Your age and driving record can have a big impact on your rates. Your location also matters as insurance companies charge different rates depending on where you live. The type of car you drive can also affect your rates. Luxury vehicles, for example, typically cost more to insure than economy vehicles. Finally, the amount of coverage you choose will affect your rates.

How to Save Money on Your Full Coverage Car Insurance

There are several ways to save money on your full coverage car insurance. One way is to raise your deductible. This can lower your monthly premiums, but it also means you will have to pay more out of pocket if you need to file a claim. You should also look into discounts. Many insurance companies offer discounts for things such as being a safe driver, having a good driving record, or having multiple vehicles. You can also save money by bundling other types of insurance, such as homeowners or renters insurance, with your car insurance.

Conclusion

Full coverage car insurance is an important type of insurance that can provide you with more protection in the event of an accident. It is important to shop around and compare rates from multiple insurance companies to find the best deal. You should also look into discounts and consider raising your deductible to save money. By following these tips, you can find cheap affordable full coverage car insurance.

PPT - Cheap Full Coverage Car Insurance For All People PowerPoint

How to Get Cheap Full Coverage Auto Insurance Plan by Helvin Hills - Issuu

What Is The Cheapest Insurance - KALIMANTAN INFO

cheap full coverage car insurance for new drivers | Insurance for

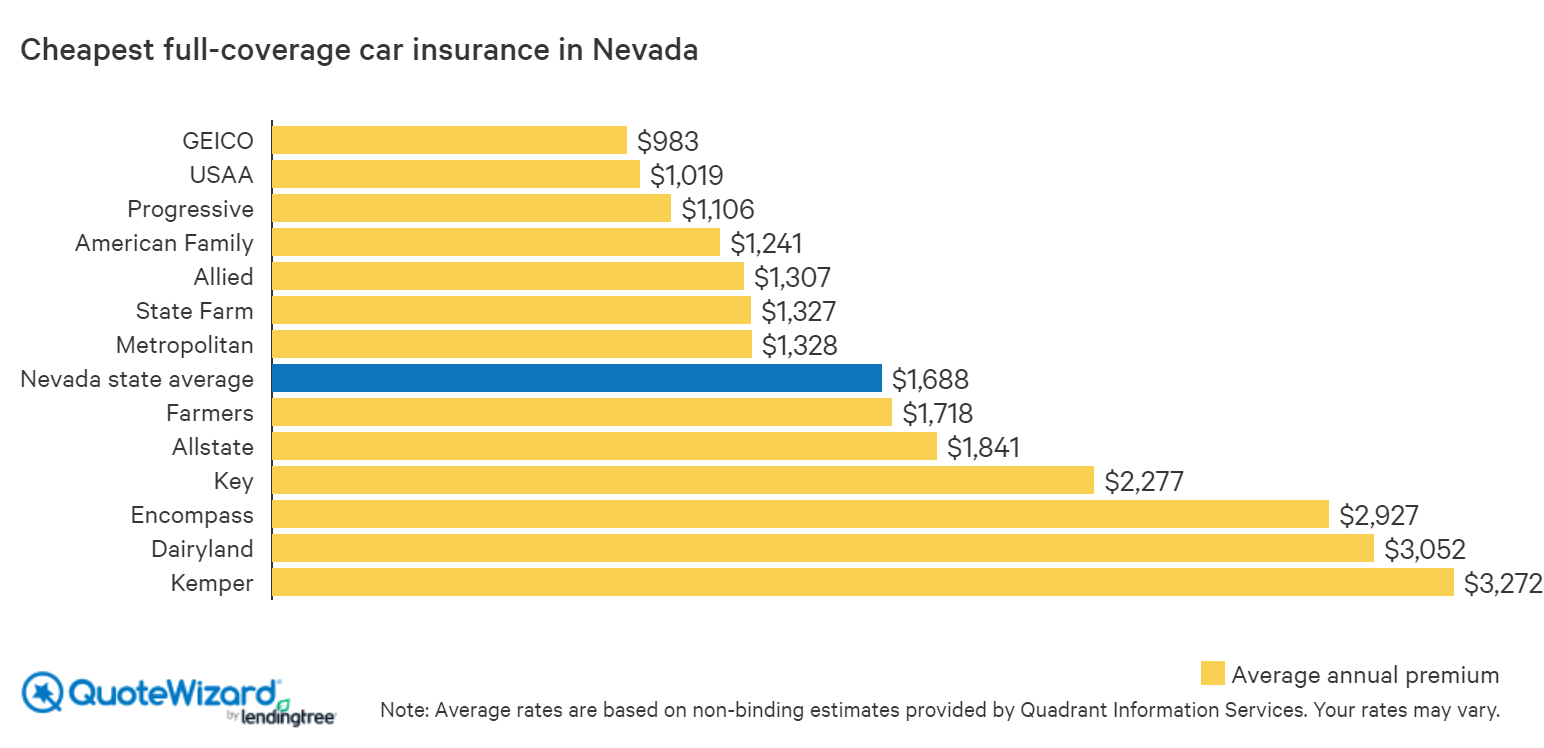

Where to Buy Cheap Nevada Car Insurance | QuoteWizard