Full Coverage Cheap Car Insurance

Tuesday, February 18, 2025

Edit

Full Coverage Cheap Car Insurance

The Benefits of Having Full Coverage

Car owners know how important it is to have full coverage car insurance. It provides protection against a variety of risks, including liability, collision and comprehensive coverage. But, what exactly does full coverage mean and what are the benefits of having it?

Full coverage is an umbrella term that includes liability, collision, and comprehensive coverage. Liability coverage protects you from financial losses if you cause an accident that damages another person’s property or injures them. Collision coverage pays for repairs to your car if you are involved in an accident. Comprehensive coverage pays for repairs to your car if it is damaged by theft, vandalism, fire, or other covered events.

Having full coverage means that your car is protected from a variety of risks. In the event of an accident, you’ll be protected from financial losses due to the other driver’s fault. Plus, you’ll be able to repair your car without having to pay out of pocket.

Finding Cheap Full Coverage Car Insurance

Finding full coverage cheap car insurance doesn’t have to be difficult. The first step is to shop around and compare rates from different companies. You can do this online or by calling different insurers and getting quotes. When you compare rates, make sure that you’re comparing the same coverage levels and deductibles.

Another way to save money on full coverage car insurance is to take advantage of discounts. Many insurance companies offer discounts for good drivers, multi-car policies, and even for having safety features on your car. Ask your insurance agent about any discounts that you may be eligible for.

Finally, you can save money on full coverage car insurance by raising your deductibles. This means that you’ll be responsible for a larger portion of the repair costs if you’re involved in an accident. However, it can also mean a lower monthly premium.

Tips for Lowering Your Insurance Costs

If you’re looking for ways to lower your insurance costs, there are several things you can do. First, make sure that you’re maintaining a good driving record. This means driving safely and obeying all traffic laws. You may also want to consider taking a defensive driving course, as this can help to lower your insurance costs.

You can also save money on your insurance by driving a car that is less expensive to insure. For example, cars with higher safety ratings tend to be cheaper to insure. Additionally, you may want to consider buying a car with anti-theft devices, such as a car alarm or immobilizer.

Finally, make sure that you’re getting the best deal on your insurance. Shop around and compare rates from different companies. You may also want to consider switching to a different insurance company if you’re not getting the best deal.

Conclusion

Full coverage cheap car insurance is an important investment for any car owner. It provides protection against a variety of risks, including liability, collision and comprehensive coverage. To get the best deal, it’s important to shop around and compare rates from different companies. Additionally, you may want to take advantage of discounts, raise your deductibles, and maintain a good driving record. By following these tips, you can save money on your car insurance and have the peace of mind that comes with knowing you’re protected.

PPT - Cheap Full Coverage Car Insurance For All People PowerPoint

How to Get Cheap Full Coverage Auto Insurance Plan by Helvin Hills - Issuu

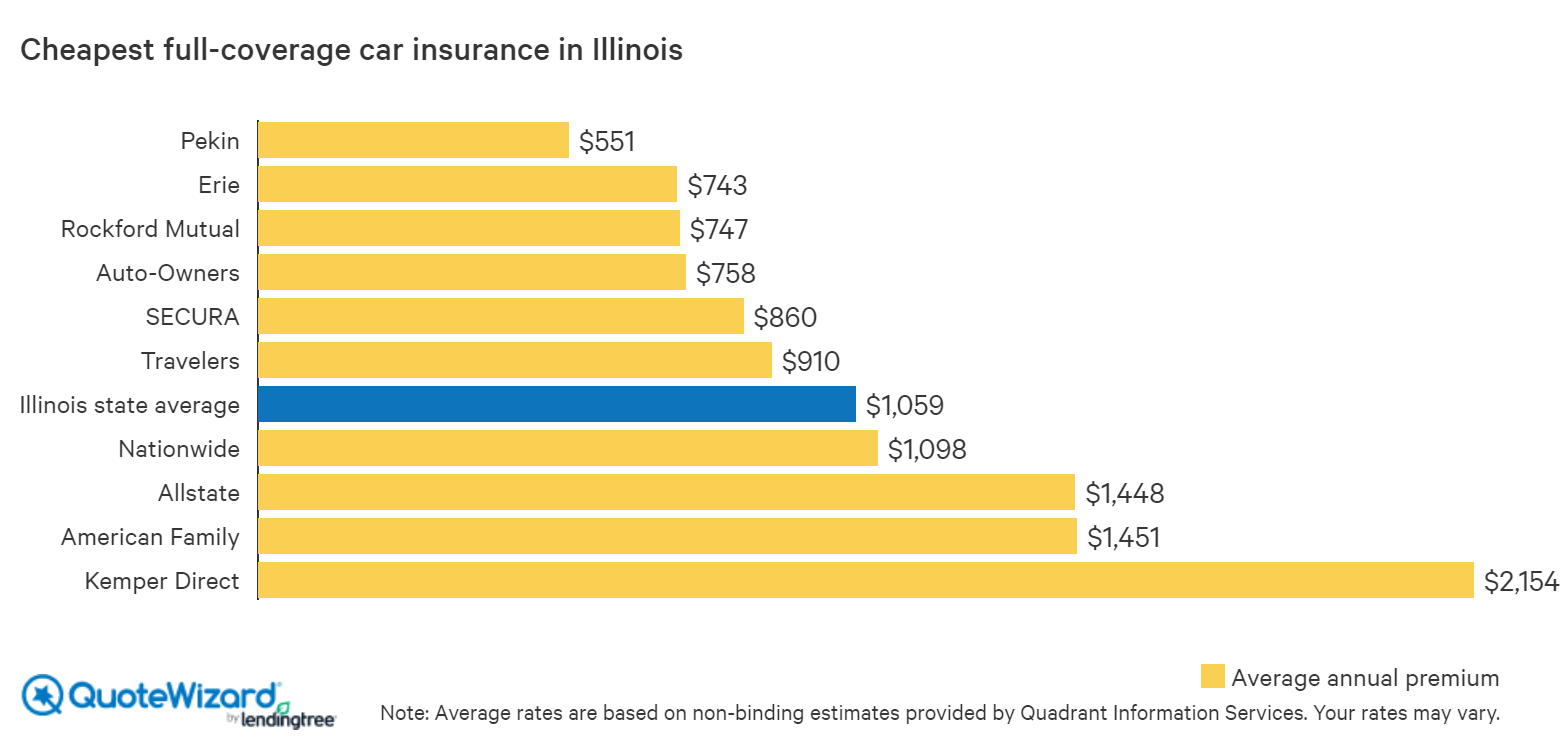

Find Cheap Car Insurance in Illinois | QuoteWizard

Cheap Full Coverage Auto Insurance With No Down Payment - YouTube

Cheap Full Coverage Auto Insurance with No Down Payment