Bajaj Allianz Motor Insurance Claim Procedure

Tuesday, January 10, 2023

Edit

Bajaj Allianz Motor Insurance Claim Procedure

Understanding the Claim Procedure

The process of filing a motor insurance claim with Bajaj Allianz is quite simple and straightforward. However, it is important to understand the various steps involved in the process. A motor insurance claim can be divided into two sections- pre-authorization and post-authorization. The pre-authorization process includes filing the claim and getting it approved by the insurance company. Post-authorization involves getting the claims amount disbursed and the repair work done.

Filing a Motor Insurance Claim

Filing a motor insurance claim with Bajaj Allianz is an easy process. You can either call their customer care number or approach your nearest branch to register a claim. You need to provide the following information to register the claim:

- Insurance policy details

- Name and contact details of the insured

- Vehicle registration number

- Description of the incident

- Estimated cost of repairs

Once you provide the above-mentioned information, Bajaj Allianz will register the claim and provide you with a claim reference number. You can use this number to track the status of your claim.

Documents Required for Claim Settlement

In order to settle your motor insurance claim, Bajaj Allianz requires you to submit certain documents. These documents include the following:

- Copy of your vehicle’s registration certificate

- Copy of the driving license of the driver at the time of the incident

- Copy of the FIR lodged in case of theft or third-party liability

- Copy of the repair estimates from an authorized garage

- Copy of the medical bills in case of personal injury

It is advisable to keep all these documents handy before you approach Bajaj Allianz for a motor insurance claim.

Claim Authorization

Once you submit all the required documents, Bajaj Allianz will evaluate the documents and verify the authenticity of the information provided. Depending on the type of claim you have filed, the company may send an authorized surveyor to inspect your vehicle and assess the damage. Once the surveyor has completed the inspection, the claims team will review the report and approve or reject the claim.

Claim Disbursement and Repair Work

If your claim has been approved, the company will disburse the claim amount within a few days. You can use the disbursed amount to get the repair work done from an authorized garage. Bajaj Allianz also offers cashless facility at select authorized garages across the country. Under this facility, you do not have to pay for the repair work as the expenses are settled directly between the garage and the insurance company.

Conclusion

Filing a motor insurance claim with Bajaj Allianz is a simple and hassle-free process. However, it is important to understand the various steps involved in the process and have all the required documents ready before filing the claim. The company has a network of authorized garages across the country and offers cashless facility at select garages. This makes it easy for the policyholders to get their vehicles repaired without any hassles.

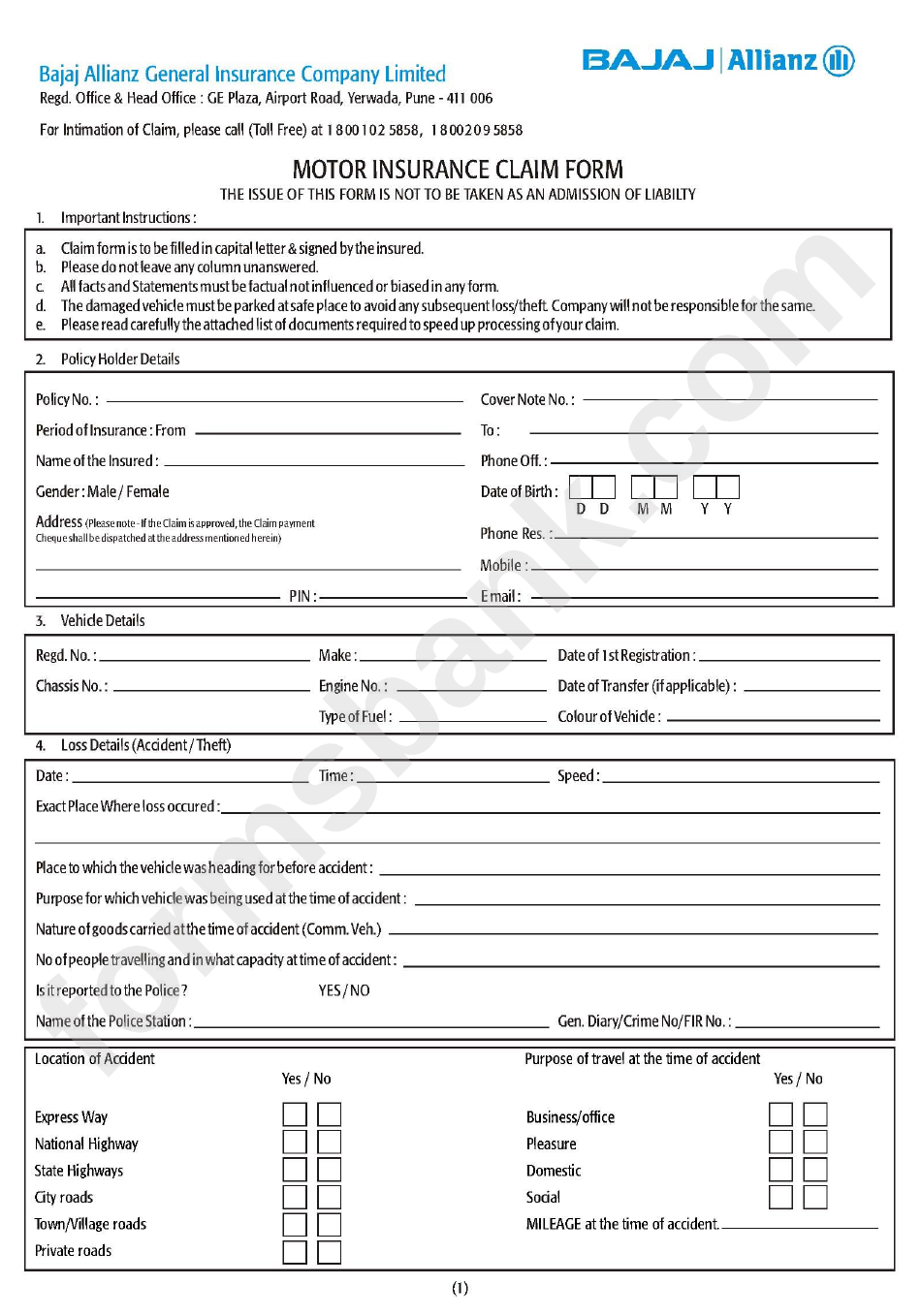

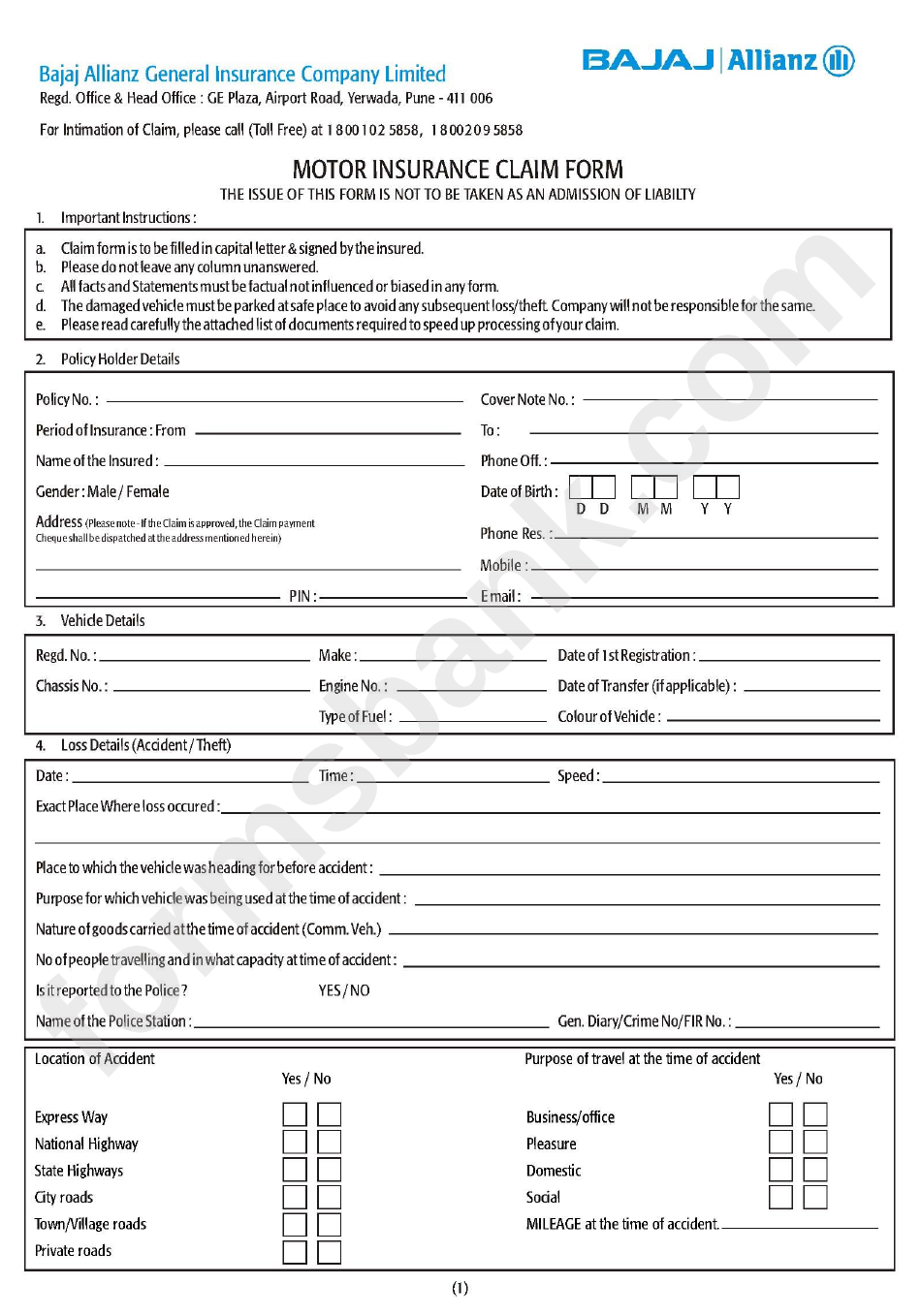

Motor Claim Form - Bajaj Allianz printable pdf download

BAJAJ ALLIANZ TWO WHEELER INSURANCE DUPLICATE COPY PDF

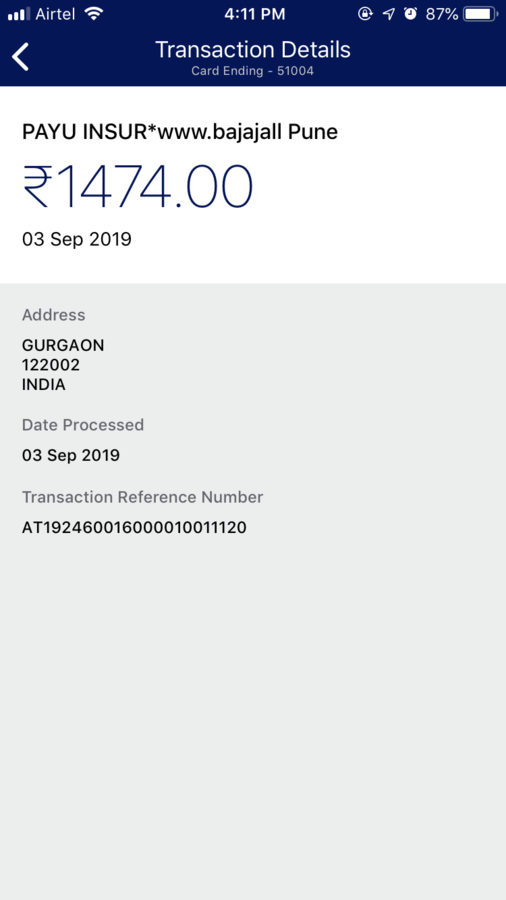

Bajaj Allianz — insurance claim swift dl9car9079

PPT - Bajaj Allianz Life Insurance Policy PowerPoint Presentation, free

Bajaj Allianz Mediclaim Policy Download