Certificate Of Currency Car Insurance Raa

What Is Certificate Of Currency Car Insurance Raa?

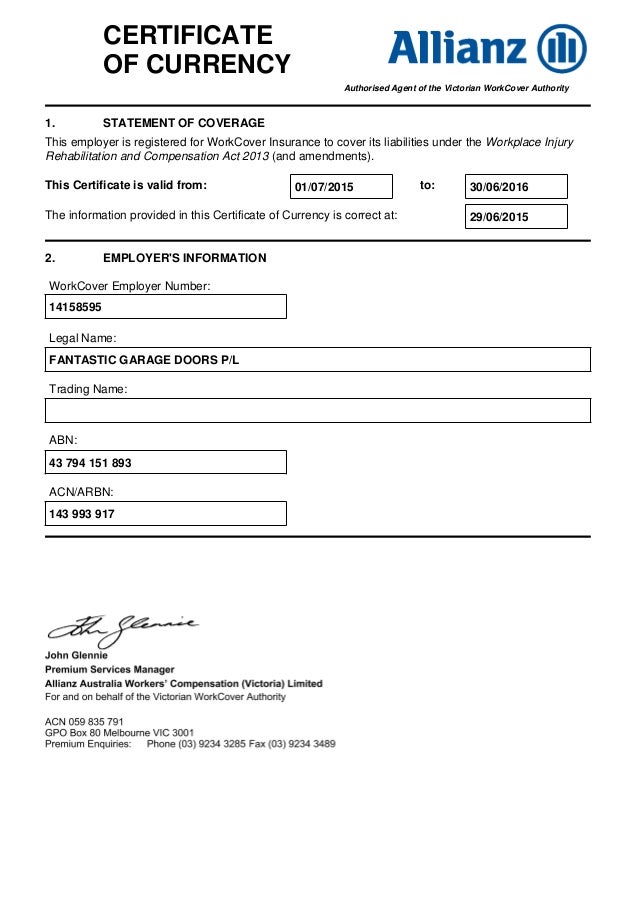

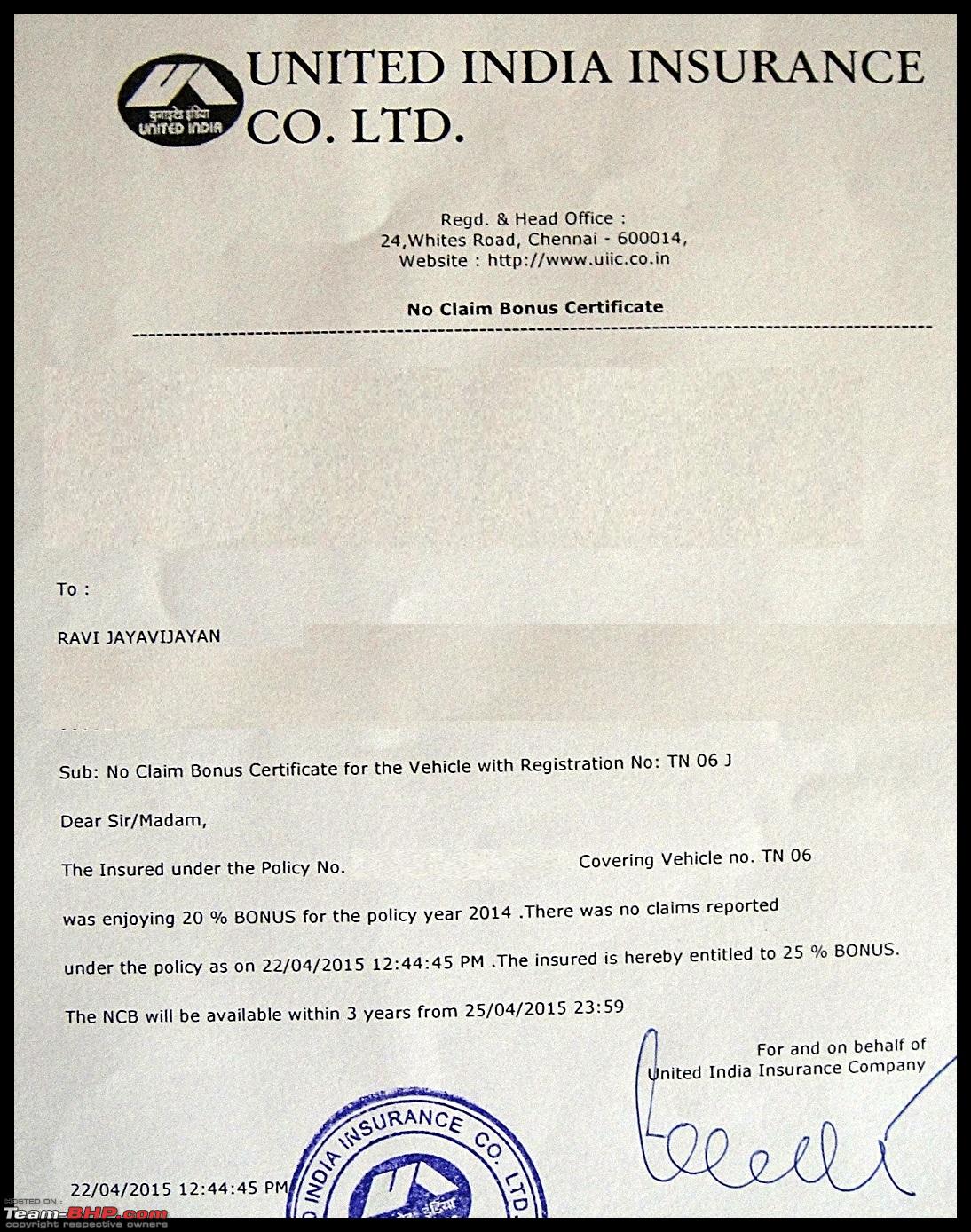

Certificate of Currency car insurance RAA is a document which is issued by an insurance company that indicates the current state of a policyholder’s insurance coverage. It provides proof that the policyholder has valid insurance in place, and it is often required when opening a bank account or applying for a loan. It is also used to prove to third parties that an individual has the necessary coverage in place.

The Certificate of Currency car insurance RAA is typically issued by an insurance company upon request. The request can be made by the policyholder, the policyholder’s representative, or by a third party that requires proof of insurance. The document contains all the necessary details to prove that the policyholder has valid insurance coverage in place, including the policy number, the policyholder’s name, the type of insurance coverage, the policy effective date and the policy expiration date.

The Certificate of Currency car insurance RAA is a very important document for policyholders, as it helps to ensure that they have the necessary coverage in place. It also provides assurance to third parties that the policyholder has the necessary coverage in place, thus enabling them to make informed decisions about the policyholder. For example, when a bank or lender needs to know that an individual has the necessary coverage in place, a Certificate of Currency car insurance RAA can provide this assurance.

When Do I Need a Certificate Of Currency Car Insurance Raa?

A Certificate of Currency car insurance RAA is typically required when a policyholder applies for a loan or opens a bank account. It is also necessary when a third party needs to verify that the policyholder has valid insurance in place. Additionally, it may be required when a policyholder wants to make a claim on their insurance or when an insurance company needs to verify that a policyholder’s coverage is up to date.

The Certificate of Currency car insurance RAA is an important document that helps to ensure that a policyholder has the necessary coverage in place. It also provides assurance to third parties that the policyholder has the necessary coverage in place, thus enabling them to make informed decisions about the policyholder. For example, when a bank or lender needs to know that an individual has the necessary coverage in place, a Certificate of Currency car insurance RAA can provide this assurance.

How Do I Get a Certificate Of Currency Car Insurance Raa?

A Certificate of Currency car insurance RAA can be requested from the insurance company that provides the policyholder’s coverage. The request can be made by the policyholder, the policyholder’s representative, or by a third party that requires proof of insurance. Once the request has been made, the insurance company will issue the document, which usually takes a few days.

It is important for policyholders to request a Certificate of Currency car insurance RAA when needed, as it helps to ensure that they have the necessary coverage in place. It also provides assurance to third parties that the policyholder has the necessary coverage in place, thus enabling them to make informed decisions about the policyholder. For example, when a bank or lender needs to know that an individual has the necessary coverage in place, a Certificate of Currency car insurance RAA can provide this assurance.

What Should I Do If I Don’t Have a Certificate Of Currency Car Insurance Raa?

If a policyholder does not have a Certificate of Currency car insurance RAA, they should contact the insurance company and request one. The request can be made by the policyholder, the policyholder’s representative, or by a third party that requires proof of insurance. Once the request has been made, the insurance company will issue the document, which usually takes a few days.

It is important for policyholders to request a Certificate of Currency car insurance RAA when needed, as it helps to ensure that they have the necessary coverage in place. It also provides assurance to third parties that the policyholder has the necessary coverage in place, thus enabling them to make informed decisions about the policyholder. For example, when a bank or lender needs to know that an individual has the necessary coverage in place, a Certificate of Currency car insurance RAA can provide this assurance.

Car Insurance Certificate Template Unique Auto Insurance Certificate

Download Vehicle Insurance Certificate Pdf Template for Free - FormTemplate

INSURANCE FORMS

Insurance Certificate Of Vehicle : Auto Insurance Cards Templates To

14158595 WorkCover Insurance Certificate of Currency 30-06-16