Insurance For 21 Year Olds

Insurance For 21 Year Olds

What is Insurance?

Insurance is a form of risk management. It is a contract between two parties, the insurer and the insured, in which the insurer agrees to pay for the losses that the insured may incur in the future. Insurance is designed to protect the insured from losses due to accidents, natural disasters, and other occurrences. Insurance is also used to pay for medical expenses, and to provide financial protection in the event of death or disability.

Types of Insurance for 21 Year Olds

Insurance for 21 year olds can be divided into two main categories: life insurance and non-life insurance. Life insurance is designed to provide financial protection to the insured's family in the event of death or disability. Non-life insurance, also known as general insurance, provides financial protection for losses due to accidents, natural disasters, and other occurrences.

Life Insurance

Life insurance is a type of insurance that provides financial protection to the insured's family in the event of death or disability. It pays out a lump sum or a series of payments to the family in the event of death or disability, and can be used to cover funeral expenses, medical bills, and other expenses. Life insurance can also be used to provide financial security in the event of death or disability.

Non-Life Insurance

Non-life insurance, also known as general insurance, provides financial protection for losses due to accidents, natural disasters, and other occurrences. Examples of non-life insurance include auto insurance, homeowners insurance, renters insurance, and liability insurance. Non-life insurance can also be used to provide financial protection for medical expenses, and to help cover the costs of legal fees in the event of a lawsuit.

Benefits of Insurance for 21 Year Olds

Insurance for 21 year olds can provide peace of mind and financial security. It can help to protect the insured's family in the event of death or disability, and can help to cover the costs of medical bills, funeral expenses, and other expenses. Insurance can also help to cover the costs of legal fees in the event of a lawsuit. Additionally, insurance can help to provide financial security in the event of death or disability.

Conclusion

Insurance for 21 year olds is an important form of risk management. It can provide peace of mind and financial security for the insured and their family in the event of death or disability, and can help to cover the costs of medical bills, funeral expenses, and other expenses. Insurance can also help to provide financial protection in the event of death or disability, and to help cover the costs of legal fees in the event of a lawsuit.

Create a news blog article about Insurance For 21 Year Olds, in relaxed English. The article consists of at least 6 paragraphs. Every paragraphs must have a minimum 200 words. Create in html file form without html and body tag. first title using tag. sub title using and tags. Paragraphs must use

tags. Paragraphs must use

tags.

Insurance For 21 Year Olds: An Overview

What is Insurance?

Insurance is a form of risk management. It is a contract between two parties, the insurer and the insured, in which the insurer agrees to pay for the losses that the insured may incur in the future. Insurance is designed to protect the insured from losses due to accidents, natural disasters, and other occurrences. Insurance is also used to pay for medical expenses, and to provide financial protection in the event of death or disability. Insurance can be divided into two main categories: life insurance and non-life insurance.

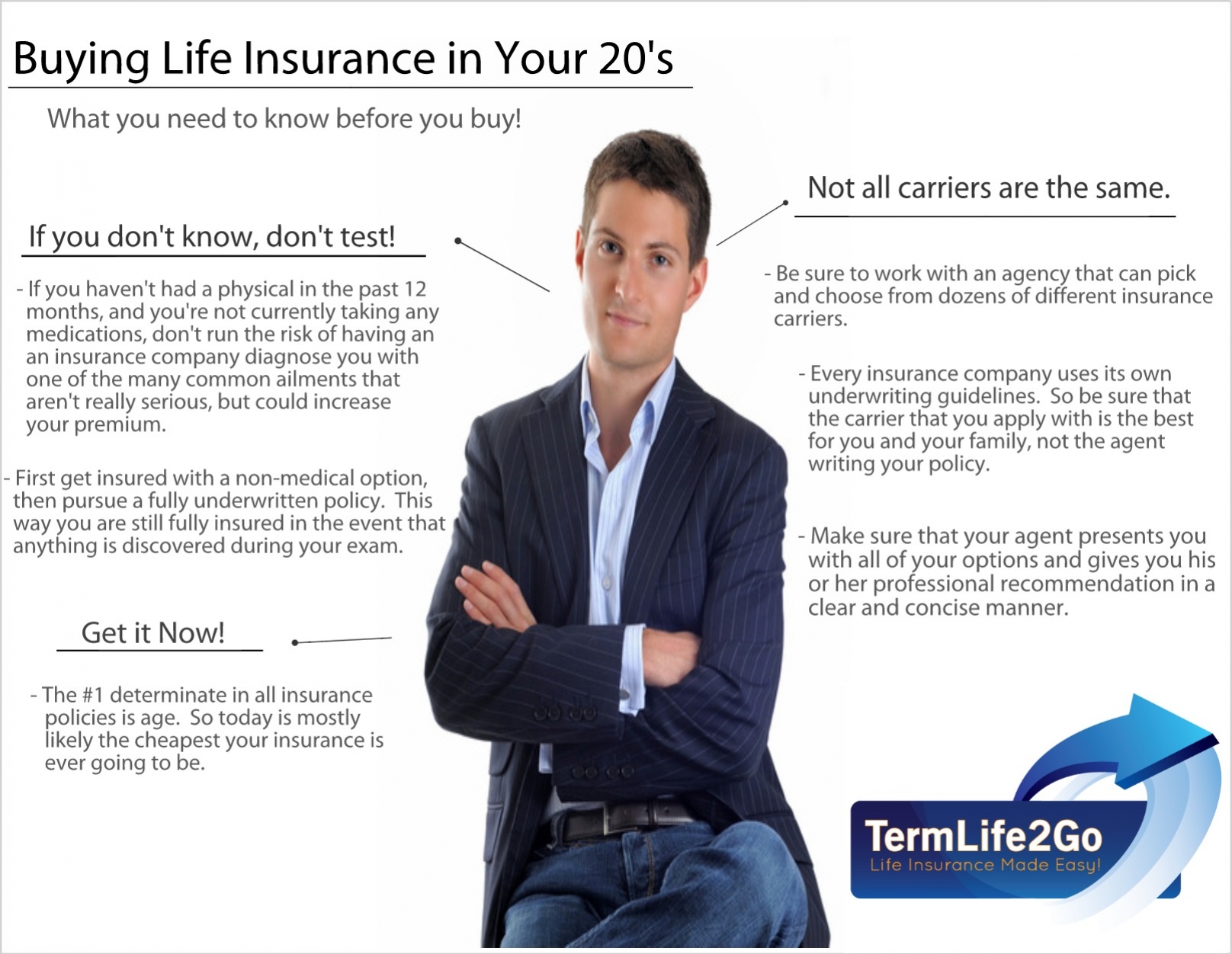

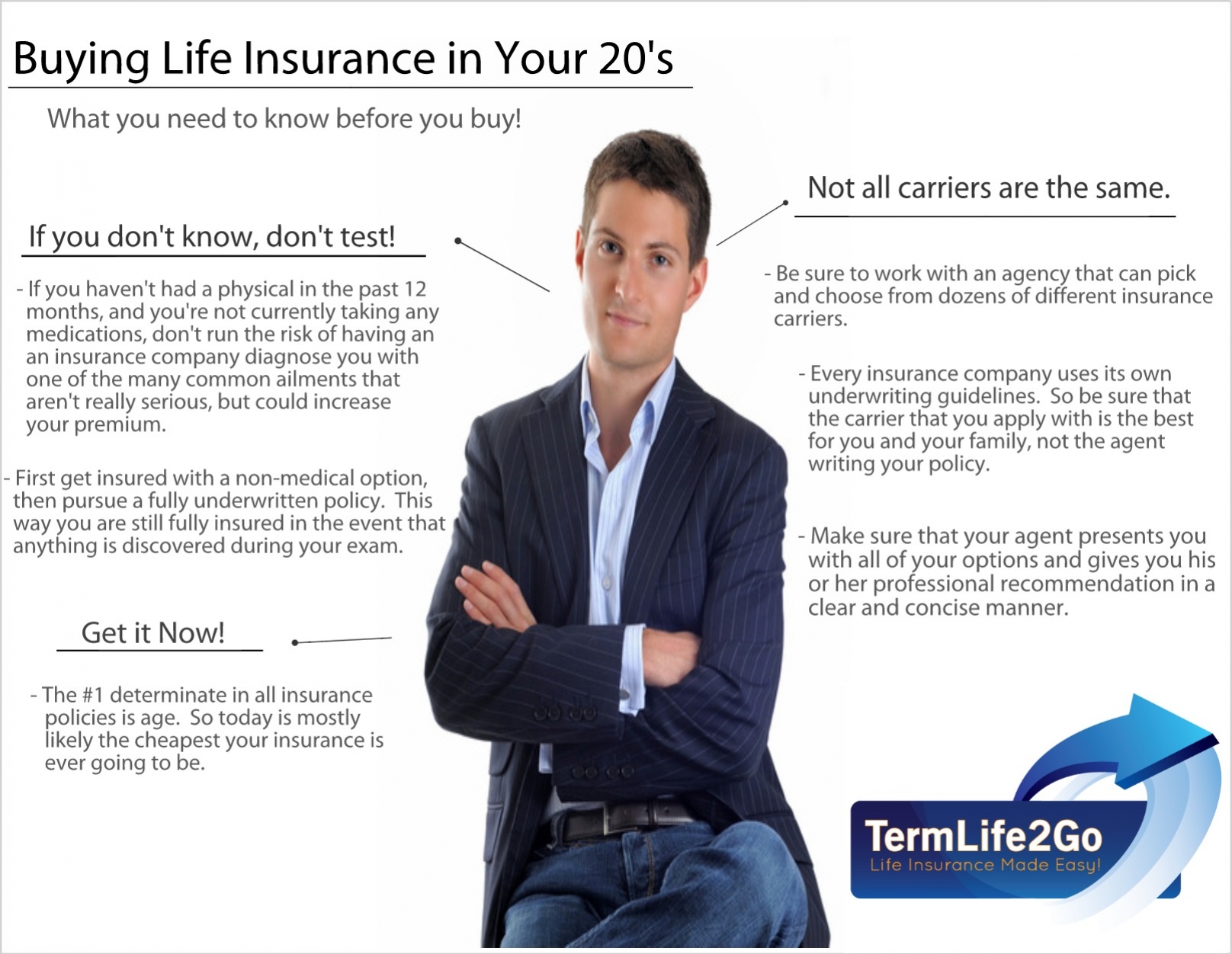

Life Insurance for 21 Year Olds

Life insurance is designed to provide financial protection to the insured's family in the event of death or disability. It pays out a lump sum or a series of payments to the family in the event of death or disability, and can be used to cover funeral expenses, medical bills, and other expenses. Life insurance can also be used to provide financial security in the event of death or disability. There are several types of life insurance available, including term life insurance, whole life insurance, and universal life insurance.

Term Life Insurance

Term life insurance is a type of insurance that provides coverage for a set period of time, usually between one and 30 years. It pays out a lump sum if the insured dies during the term of the policy. Term life insurance is typically more affordable than other types of life insurance, but it does not build cash value.

Whole Life Insurance

Whole life insurance is a type of insurance that provides coverage for the insured's entire life. It pays out a lump sum when the insured dies, and also builds cash value over time. The cash value can be used to pay premiums, borrow against, or use as an investment. Whole life insurance is typically more expensive than term life insurance, but it provides more long-term financial security.

Universal Life Insurance

Universal life insurance is a type of insurance that combines the features of term life and whole life insurance. It pays out a lump sum when the insured dies, and also builds cash value over time. The cash value can be used to pay premiums, borrow against, or use as an investment. Universal life insurance is typically more expensive than other types of life insurance, but it provides more long-term financial security.

Non-Life Insurance for 21 Year Olds

Non-life insurance, also known as general insurance, provides financial protection for losses due to accidents, natural disasters, and other occurrences. Examples of non-life insurance include auto insurance, homeowners insurance, renters insurance, and liability insurance. Non-life insurance can also be used to provide financial protection for medical expenses, and to help cover the costs of legal fees in the event of a lawsuit.

Benefits of Insurance for 21 Year Olds

Insurance for 21 year olds can provide peace of mind and financial security. It can help to protect the insured's family in the event of death or disability, and can help to cover the costs of medical bills, funeral expenses, and other expenses. Insurance can also help to provide financial protection for medical expenses, and to help cover the costs of legal fees in the event of a lawsuit. Additionally, insurance can help to provide financial security in the event of death or disability.

Conclusion

Insurance for 21 year olds is an important form of risk management. It can provide peace of mind and financial security for the insured and their family in the event of death or disability, and can help to cover the costs of medical bills, funeral expenses, and other expenses. Insurance can also help to provide financial protection in the event of death or disability, and to help cover the costs of legal fees in the event of a lawsuit. For these reasons, it is important to consider purchasing insurance for 21 year olds.

Best Life Insurance for a 21 year old.

Car Insurance for 21-Year-Olds - Policygenius

Car Insurance For 21 Year Old – 21 Year Old Auto Insurance With No

What Is 5 Digit Insurance Company Code - TRAVELVOS

Car Insurance Estimate For 21 Year Old Female