What Does Third Party Property Insurance Cover

Wednesday, February 26, 2025

Edit

What Does Third Party Property Insurance Cover?

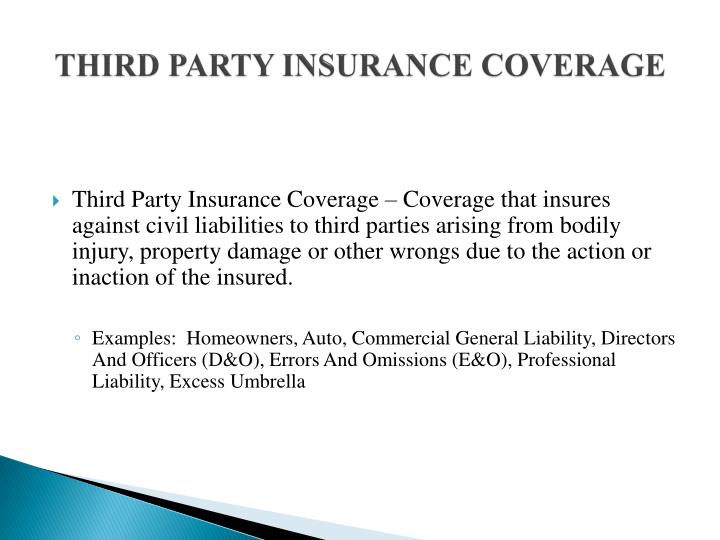

What is Third Party Property Insurance?

Third party property insurance is a type of insurance designed to protect individuals and businesses from any financial losses that may result from damage to another person’s property. It is important to note that this type of insurance does not cover any damage to the insured’s own property. Instead, it provides coverage for any damage that may occur to another person’s property due to the negligence of the insured or their employees.

For example, if a business is found to be negligent in its operation and causes damage to a neighboring business, the insurance company will cover the costs associated with the damages. This type of insurance is also commonly referred to as liability insurance.

What Does Third Party Property Insurance Cover?

Third party property insurance can help protect individuals and businesses from any financial losses that may result from damage to another person’s property. This type of insurance typically covers any liability that results from property damage caused by the insured’s negligence, or from the negligence of the insured’s employees.

It is important to note that this type of insurance does not cover any damage to the insured’s own property. Instead, it provides coverage for any damage that may occur to another person’s property due to the negligence of the insured or their employees.

For example, if a business is found to be negligent in its operation and causes damage to a neighboring business, the insurance company will cover the costs associated with the damages. This coverage may include repair costs, replacement costs, and any costs associated with the disruption of the business caused by the damage.

What is Not Covered by Third Party Property Insurance?

Third party property insurance does not cover any damage to the insured’s own property. Additionally, this type of insurance does not offer coverage for any intentional acts of negligence or intentional damage caused by the insured or their employees.

In addition, this type of insurance does not provide coverage for any losses that may result from natural disasters, such as floods, hurricanes, earthquakes, or tornadoes. Finally, this type of insurance does not provide coverage for any intentional acts of negligence or any intentional damage caused by the insured or their employees.

Who Should Consider Third Party Property Insurance?

Third party property insurance is an important type of insurance for any business or individual who may be held liable for any damages to another person’s property. This type of insurance can provide coverage for any costs associated with repairing or replacing damaged property, as well as any costs associated with the disruption of the business caused by the damage.

Additionally, this type of insurance can provide peace of mind by knowing that any potential damages to another person’s property will be taken care of by the insurance company. For this reason, it is important for any business or individual who may be held liable for any damages to another person’s property to consider third party property insurance.

What is the Cost of Third Party Property Insurance?

The cost of third party property insurance will vary depending on the amount of coverage needed, the type of business being covered, and the risk associated with the business. Generally, businesses and individuals can expect to pay an annual premium for this type of insurance.

The premium will be based on the estimated risk associated with the business or individual, as well as the amount of coverage needed. It is important to note that the cost of third party property insurance can vary significantly depending on the type of business being covered, so it is important to shop around and compare quotes from multiple insurers before making a decision.

Conclusion

Third party property insurance is an important type of insurance for any business or individual who may be held liable for any damages to another person’s property. This type of insurance can provide coverage for any costs associated with repairing or replacing damaged property, as well as any costs associated with the disruption of the business caused by the damage.

The cost of third party property insurance will vary depending on the amount of coverage needed, the type of business being covered, and the risk associated with the business. It is important to shop around and compare quotes from multiple insurers before making a decision.

Third Party Property Car Insurance | iSelect

What Is Third-party Insurance?

PPT - INSURANCE LAW : What Every Practitioner Should Know PowerPoint

What Does 3rd Party Insurance Cover - WOPROFERTY

Third Party Property Damage Insurance Definition - PRFRTY