How Much Is Car Insurance For A Female Under 25

How Much Is Car Insurance For A Female Under 25?

Understanding Car Insurance for Women Under 25

Car insurance for women under 25 can be complicated and expensive. Drivers in this age group pose a higher risk of accidents and theft than older drivers, so their insurance premiums can be higher than what other drivers pay. However, there are several things you can do to save money and get the best coverage for your needs. This article will explain what goes into calculating car insurance rates for women under 25 and how you can get the best deal.

Factors That Impact Insurance Premiums

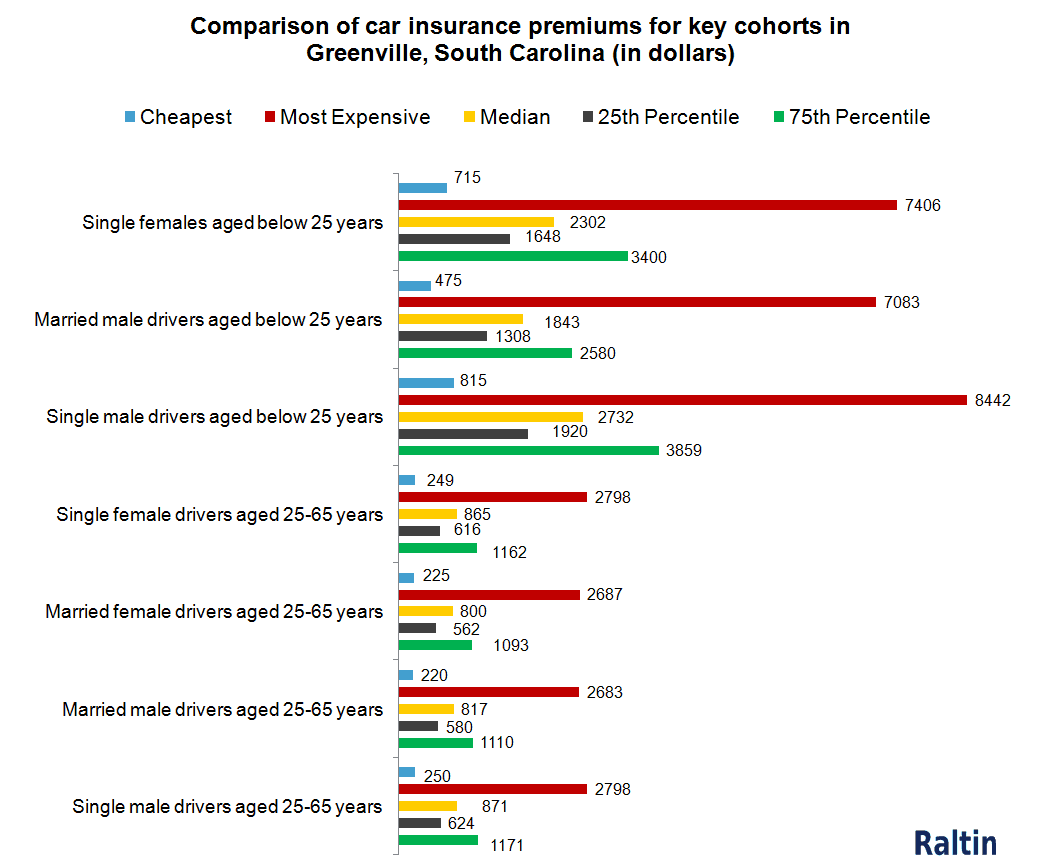

Car insurance companies consider several factors when determining rates for women under 25. This includes the type of vehicle you drive, your driving record, where you live, and your credit score. Insurance companies also factor in the type of coverage you choose, such as liability, collision, and comprehensive. All of these factors can affect your premiums, so it’s important to consider them when shopping for the best deal.

Tips for Getting the Best Rate

There are several things you can do to get the best rate on car insurance for women under 25. First, shop around and compare rates from different companies. Some companies specialize in providing coverage to young drivers, so it pays to shop around. You can also look for discounts and compare different types of coverage. Additionally, consider raising your deductible to lower your premiums. Finally, make sure you have a good driving record and take a defensive driving course to get a better rate.

Insurance Requirements for Young Drivers

Car insurance requirements vary by state, so it’s important to know what your state requires. Generally, you will need to purchase liability insurance to cover any damages you cause to other people or property. Some states also require you to purchase uninsured/underinsured motorist coverage, which covers you if you’re in an accident with someone who doesn’t have insurance. Additionally, most states require you to carry a minimum amount of personal injury protection, which covers your medical bills if you’re injured in an accident.

Conclusion

Car insurance for women under 25 can be expensive, but there are several things you can do to get the best rate. Make sure you understand the requirements of your state, shop around for the best deal, and consider raising your deductible to lower your premiums. Additionally, maintain a good driving record and take a defensive driving course to get a better rate. By following these tips, you can make sure you get the best coverage for your needs at the best rate.

Average Car Insurance Rates Under 25 - Rating Walls

Under 25 Car Insurance - car insurance for females under 25 - YouTube

Car Insurance Under 25: Can I Get Cheap Car Insurance? - Cover

Average Cost of Car Insurance (2019) | Average Cost of Insurance

Under 25 Car Insurance – The Housing Forum