Two Wheeler Insurance Third Party Price

Two Wheeler Insurance Third Party Price

What is Two Wheeler Insurance?

Two Wheeler Insurance is a type of insurance policy that provides financial protection to an individual against any legal liability that may arise due to injury or death of a third party or damage to their property caused by your two-wheeler. It may also include damage caused to your own vehicle due to an accident, theft, or natural disasters.

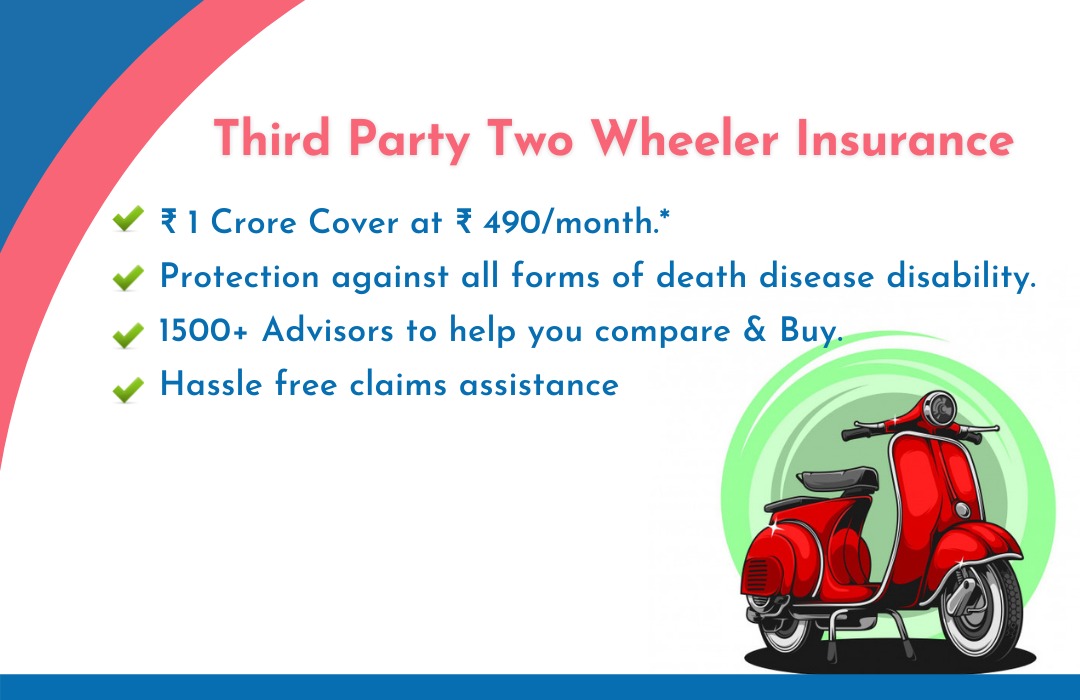

What is Third Party Insurance?

Third Party Insurance is a type of two-wheeler insurance policy that provides protection against any legal liability that may arise due to injury or death of a third party or damage to their property caused by your two-wheeler. It is mandatory for all two-wheelers in India to have at least third party insurance as per the Motor Vehicles Act, 1988.

What are the Benefits of Third Party Insurance?

The main benefit of third party insurance is that it provides financial protection against any legal liability that may arise due to injury or death of a third party or damage to their property caused by your two-wheeler. This can help to avoid any hefty fines that may be imposed by the court in case of any legal proceedings. Additionally, it also provides peace of mind knowing that you are covered in case of any unfortunate event.

What is the Price of Third Party Insurance?

The price of two-wheeler third party insurance depends on several factors such as the make and model of the two-wheeler, the capacity of the engine, the area of registration, and the age of the vehicle. Generally, the third party insurance premiums range from Rs. 750 to Rs. 2000 per annum.

Tips to Lower the Price of Two Wheeler Third Party Insurance

There are several ways to lower the price of two-wheeler third party insurance. Here are a few tips to help you save money on your two-wheeler insurance:

- Opt for a higher deductible: A higher deductible can help to lower the premium amount.

- Install anti-theft devices: Installing anti-theft devices can help to lower the premium amount.

- Compare different policies: Comparing different policies can help to find the best policy at the best price.

- Maintain a good driving record: A good driving record can help to lower the premium amount.

Conclusion

Two Wheeler Third Party Insurance is a great way to provide financial protection against any legal liability that may arise due to injury or death of a third party or damage to their property caused by your two-wheeler. It is important to understand the different factors that can affect the price of two-wheeler third party insurance and to use the tips mentioned above to help you save money on your two-wheeler insurance.

I want to make Article for seo perpouse and ranking on google search engine. Create a news blog article about Two Wheeler Insurance Third Party Price, in relaxed English. The article consists of at least 6 paragraphs. Every paragraphs must have a minimum 200 words. Create in html file form without html and body tag. first title using

tag. sub title using and tags. Paragraphs must use

tags. Paragraphs must use

tags.

Two Wheeler Insurance Third Party Price

What is Two Wheeler Insurance?

Two Wheeler Insurance is a type of insurance policy that provides financial protection to an individual against any legal liability that may arise due to injury or death of a third party or damage to their property caused by your two-wheeler. It may also include damage caused to your own vehicle due to an accident, theft, or natural disasters. Two Wheeler Insurance policies typically come with various benefits such as personal accident cover, 24/7 roadside assistance, cashless repair services, and more. It is important to understand the various benefits offered by different insurers and compare them to find the best policy.

What is Third Party Insurance?

Third Party Insurance is a type of two-wheeler insurance policy that provides protection against any legal liability that may arise due to injury or death of a third party or damage to their property caused by your two-wheeler. It is mandatory for all two-wheelers in India to have at least third party insurance as per the Motor Vehicles Act, 1988. Third Party Insurance provides financial protection against any legal liability that may arise due to injury or death of a third party or damage to their property caused by your two-wheeler. It does not provide any coverage for damage caused to your own vehicle.

What are the Benefits of Third Party Insurance?

The main benefit of third party insurance is that it provides financial protection against any legal liability that may arise due to injury or death of a third party or damage to their property caused by your two-wheeler. This can help to avoid any hefty fines that may be imposed by the court in case of any legal proceedings. Additionally, it also provides peace of mind knowing that you are covered in case of any unfortunate event. Third party insurance also offers other benefits such as zero depreciation cover, 24/7 roadside assistance, cashless repair services, and more.

What is the Price of Third Party Insurance?

The price of two-wheeler third party insurance depends on several factors such as the make and model of the two-wheeler, the capacity of the engine, the area of registration, and the age of the vehicle. Generally, the third party insurance premiums range from Rs. 750 to Rs. 2000 per annum. The exact amount of premium payable depends on the type and model of the two-wheeler, the area of registration, and the age of the vehicle.

Tips to Lower the Price of Two Wheeler Third Party Insurance

There are several ways to lower the price of two-wheeler third party insurance. Here are a few tips to help you save money on your two-wheeler insurance:

- Opt for a higher deductible: A higher deductible can help to lower the premium amount.

- Install anti-theft devices: Installing anti-theft devices can help to lower the premium amount.

- Compare different policies: Comparing different policies can help to find the best policy at the best price.

- Maintain a good driving record: A good driving record can help to lower the premium amount.

Conclusion

Two Wheeler Third Party Insurance is a great way to provide financial protection against any legal liability that may arise due to injury or death of a third party or damage to their property caused by your two-wheeler. It is important to understand the different factors that can affect the price of two-wheeler third party insurance and to use the tips mentioned above to help you save money on your two-wheeler insurance.

Third Party Two wheeler insurance.

Third Party Two Wheeler Insurance Cost in India | Policywize

थर्ड पार्टी टू व्हीलर इंश्योरेंस (दो पहिया बीमा) | Third Party Two

Paynearby two wheeler insurance || 3rd party and first party bike

Renewal Of Two Wheeler Insurance » Daily Blog Networks