Cheapest Liability Only Insurance Idaho

Cheapest Liability Only Insurance Idaho – An Overview

Insurance is an important part of life in Idaho, as the state is known for its rugged outdoors and stunning landscapes. But while the state's stunning beauty can be enjoyed, it can also come with certain risks. This is why it's important to make sure you have the right insurance policy in place. Liability only insurance in Idaho is one of the most popular types of coverage for those looking to protect themselves and their assets.

Liability only insurance covers the costs of property damage or injury to other people that may arise from your own negligence. This type of coverage is typically chosen by individuals who don't wish to pay for full coverage, as liability only insurance does not cover the costs associated with damage to the vehicle or to the driver. In Idaho, liability only insurance can be found at a variety of different companies, with some offering cheaper rates than others.

The Benefits of Cheapest Liability Only Insurance Idaho

Cheapest liability only insurance in Idaho is a great way to protect yourself and your assets without having to pay a large premium. Liability only insurance can provide coverage for medical costs, lost wages, and other damages that may arise from an accident. It also covers the cost of repairs to the vehicle, though this is usually much lower than full coverage.

With liability only insurance in Idaho, you won't have to worry about paying for the damages that may be caused to another person's property. This type of coverage is great for those who don't want to pay for full coverage, as it offers a great way to protect yourself and your assets.

How to Find the Cheapest Liability Only Insurance Idaho

Finding the cheapest liability only insurance in Idaho is easy. The first step is to compare insurance quotes from different companies. This can be done online or through an independent insurance agent. Comparing rates from multiple companies will help you determine which one offers the best rates and coverage.

Once you have a few quotes, you can then compare the coverage that each company offers. Make sure to read the fine print to ensure that you understand the coverage you are getting. This will help you make the best possible decision on which company to go with.

What to Look for When Shopping for Cheapest Liability Only Insurance Idaho

When shopping for cheapest liability only insurance in Idaho, it's important to consider your driving history and the type of vehicle you have. Your driving record, age, and the type of vehicle you drive can all affect the cost of your insurance. Additionally, some companies may provide discounts for good driving records, so make sure to ask about this when you shop around.

You'll also want to make sure that you're getting the right type of coverage for your needs. Liability only insurance may not provide enough coverage for those who drive expensive cars or are at risk for accidents. In this case, it's important to consider getting full coverage, which will provide more protection.

Conclusion

Cheapest liability only insurance in Idaho is an important type of coverage for those who want to protect themselves and their assets. By comparing different companies and looking for discounts, you can find the best rates and coverage for your needs. Once you have the right coverage in place, you can enjoy the peace of mind that comes with knowing you're protected.

Cheap Car Insurance in Idaho 2019

Cheap Health Insurance Idaho | Health Insurance

Cheap Car Insurance in Idaho 2019

Idaho Workers Compensation Insurance Basics

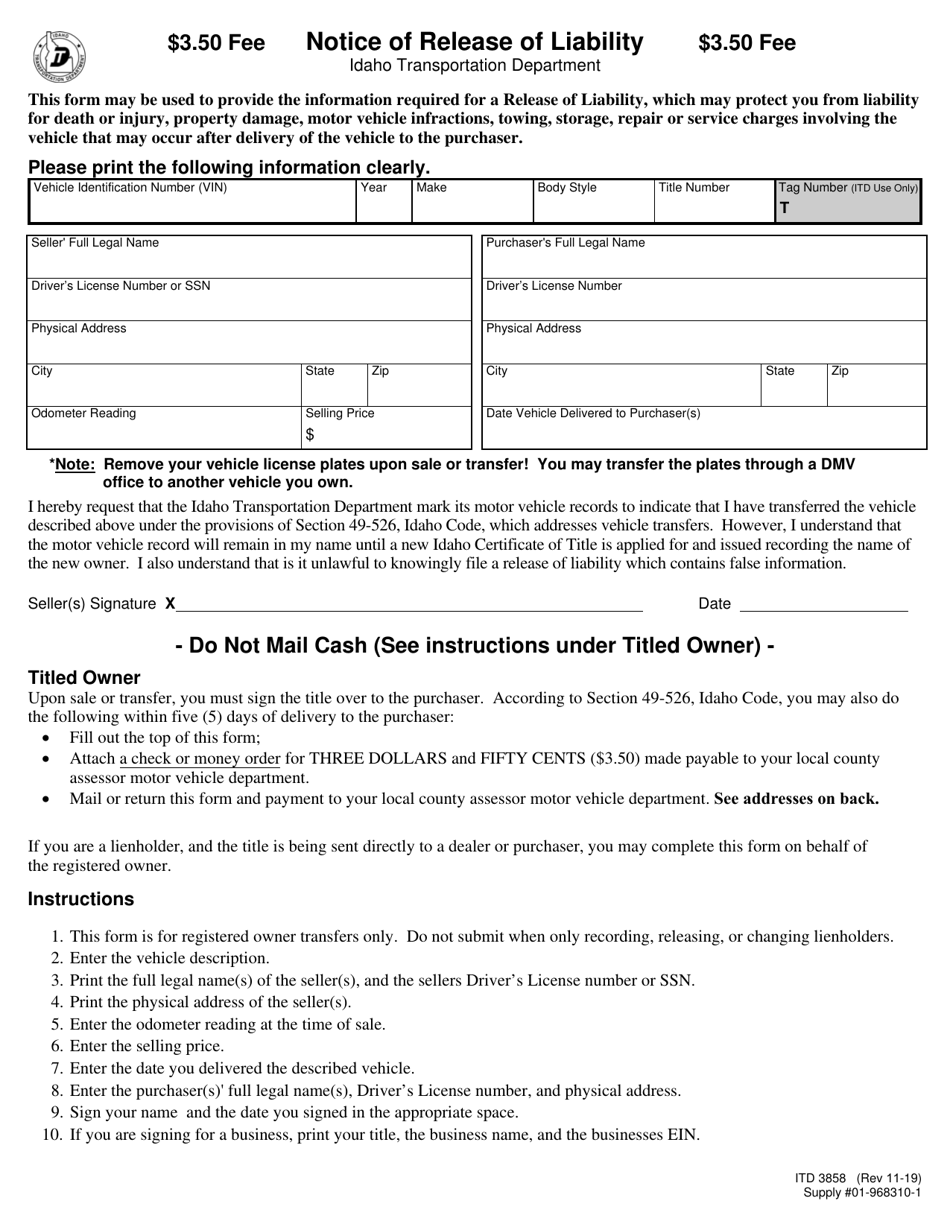

Form ITD3858 Download Fillable PDF or Fill Online Notice of Release of