Cheap Liability Car Insurance Colorado

Cheap Liability Car Insurance Colorado

Colorado is one of the most beautiful states in the US. The state offers a variety of outdoor activities, outdoor adventures, and stunning landscapes that make it a popular destination for travelers. But when it comes to driving, Coloradoans need to be aware of the state's car insurance requirements. Liability car insurance is mandatory in Colorado, but that doesn't mean that you have to break the bank to get the coverage you need. There are plenty of ways to find cheap liability car insurance in Colorado.

Shop Around

The easiest way to find cheap liability car insurance in Colorado is to shop around. Different insurance providers offer different rates, so it pays to compare quotes from a variety of companies. Most major insurers offer online quotes, so you can easily compare rates from the comfort of your own home. You can also talk to an insurance agent or broker to get detailed information about the available policies and rates.

Choose the Right Coverage

When shopping for liability car insurance, it's important to choose the right coverage for your needs. Liability coverage is divided into two categories: bodily injury and property damage. Bodily injury coverage pays for medical and rehabilitation expenses for people injured in an accident you are found to be at fault for, while property damage covers damage to the other person's property, such as their car. Different policies offer different levels of coverage, so it's important to choose the right policy for your needs.

Take Advantage of Discounts

Insurance companies offer a variety of discounts to help make their policies more affordable. For example, many companies offer a discount for installing an anti-theft device in your vehicle. If you're a safe driver, you may also be eligible for a good driver discount. Other discounts may be available for students, seniors, and members of certain organizations.

Raise Your Deductible

One of the best ways to save money on car insurance is to raise your deductible. The deductible is the amount of money you pay out of pocket before your insurance kicks in. Raising your deductible can significantly lower your premiums, but it's important to make sure you can afford to pay the higher deductible if you need to make a claim.

Look for Low-Mileage Discounts

If you don't drive very often, you may be able to get a discount on your car insurance. Many insurance companies offer low-mileage discounts for drivers who don't drive more than a certain number of miles per year. Make sure to ask your insurer if they offer any low-mileage discounts so you can take advantage of the savings.

Check Your Credit Score

Your credit score can have a big impact on your car insurance rates. Insurance companies use credit scores to determine how likely you are to file a claim. If you have a poor credit score, you may be charged higher rates than someone with a good credit score. Check your credit score before shopping for car insurance to make sure you're getting the best rate.

Get Cheap Car Insurance in Colorado Springs, CO by Cheap Car Insurance

Texas Minimum Car Insurance Requirements - dailydesigns2

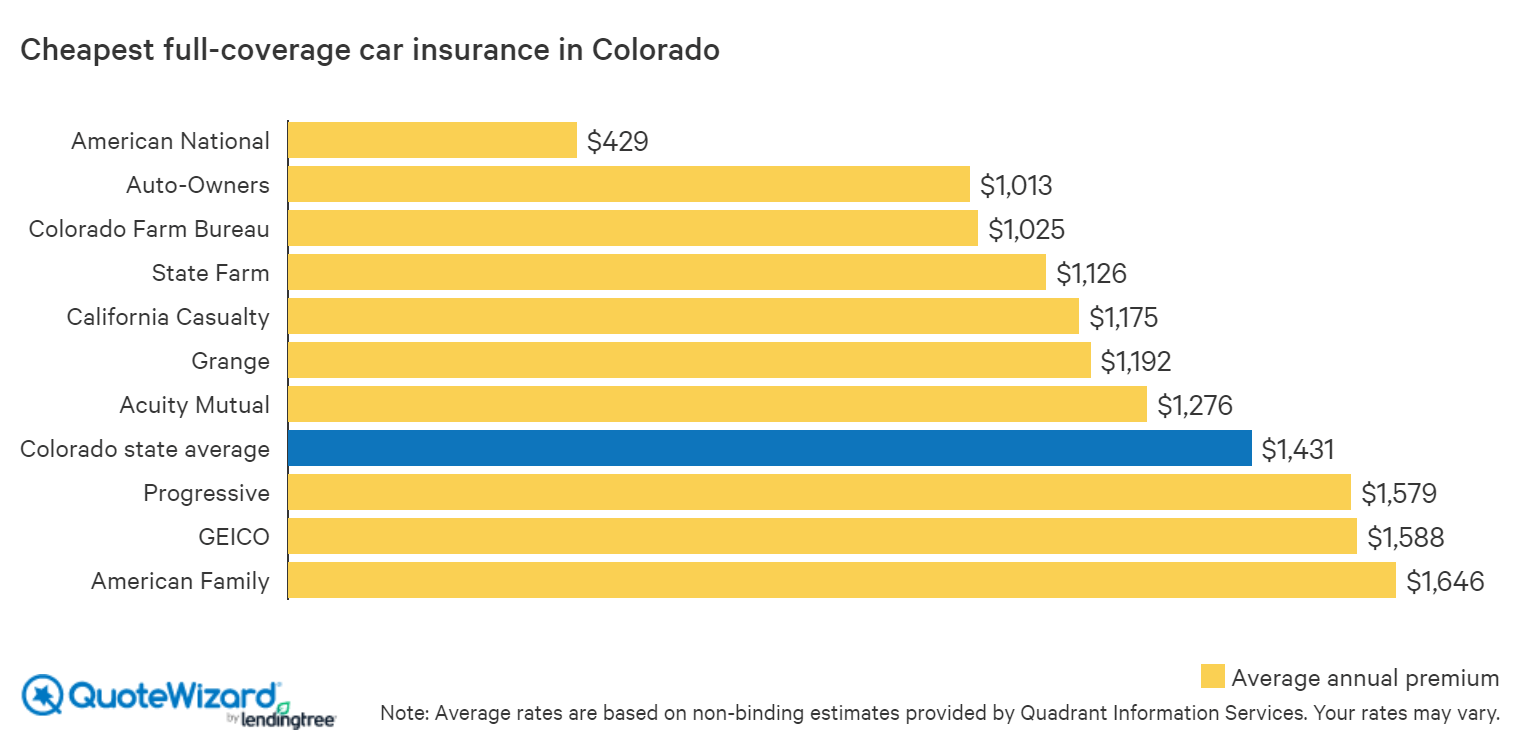

Cheap Car Insurance in Colorado | QuoteWizard

What is Liability Car Insurance? - YouTube