Cheap Liability Car Insurance Oklahoma

Getting Cheap Liability Car Insurance in Oklahoma

Finding affordable car insurance in Oklahoma is easy if you know what to look for. Most states require drivers to carry a certain amount of liability car insurance, but in Oklahoma the minimum requirement is lower than most. This means that you can get a good deal on your car insurance coverage if you shop around and compare rates. Here are a few tips to help you save money on your Oklahoma liability car insurance.

Shop Around and Compare Rates

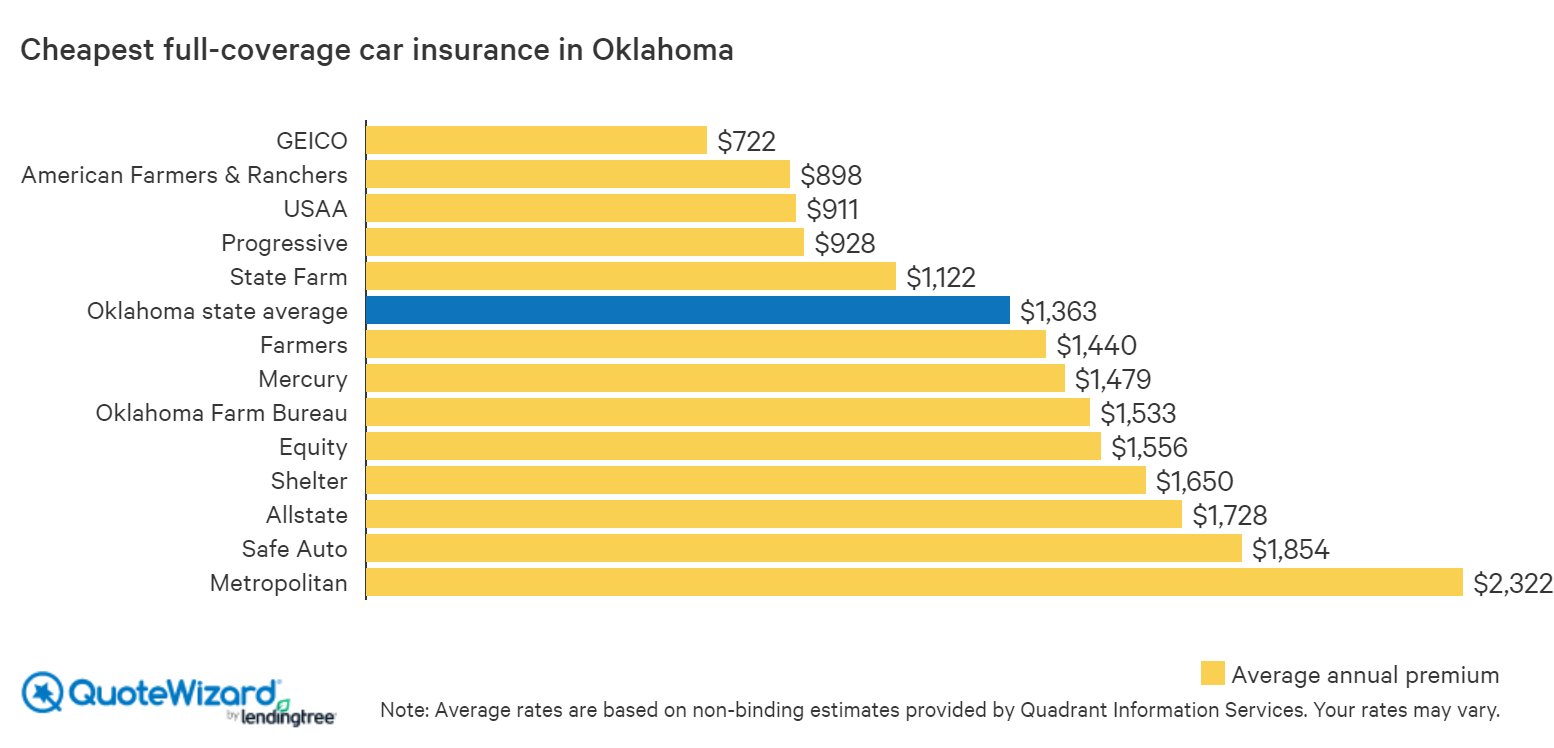

The best way to find the cheapest liability car insurance in Oklahoma is to shop around and compare rates. Make sure you get quotes from several different companies so that you can compare coverage, deductibles, and premiums. Also, make sure you look at the discounts that each company offers, such as multi-car discounts, good driver discounts, and more. By shopping around and comparing rates you can make sure you’re getting the best possible deal on your Oklahoma liability car insurance.

Increase Your Deductible

Another way to save money on your Oklahoma liability car insurance is to increase your deductible. The deductible is the amount of money that you must pay out-of-pocket before the insurance company starts covering any costs. If you increase your deductible, you can lower your monthly premiums, but make sure you can afford to pay the higher deductible amount if you are ever in an accident.

Look for Discounts

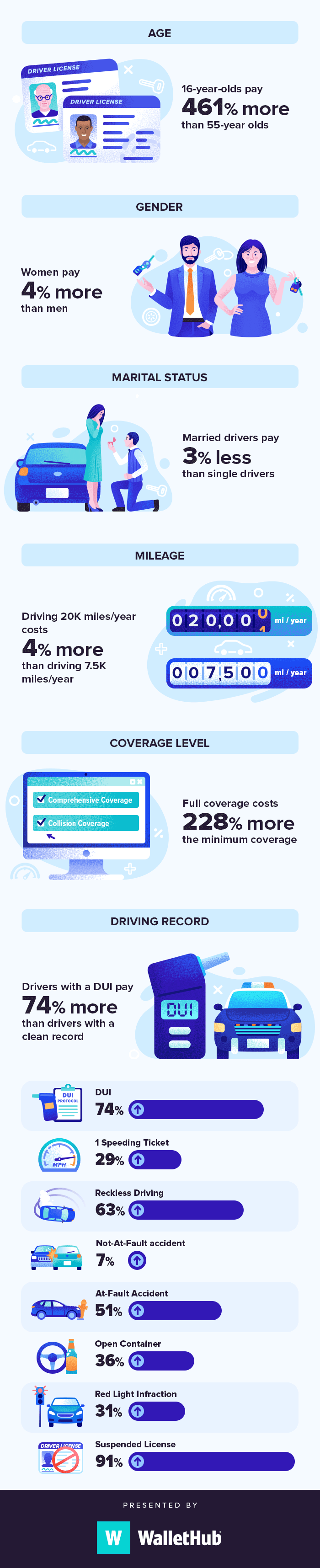

Most car insurance companies offer discounts to their customers, so make sure you look for discounts that you may qualify for. Some of the most common discounts include good driver discounts, multi-car discounts, safe driver discounts, and more. You may also qualify for a discount if you are a student, have a good credit score, or if you are a member of certain organizations. Ask your insurance company about the discounts they offer and see if you qualify for any.

Take Advantage of Low Mileage Discounts

If you are an occasional driver or don’t drive a lot, you may qualify for a low mileage discount. Many car insurance companies offer discounts to drivers who drive fewer than a certain number of miles per year. Ask your insurance company if they offer a low mileage discount and make sure you are taking advantage of it if you qualify.

Pay Your Premiums On Time

Finally, make sure you pay your premiums on time. Most car insurance companies charge late fees and may even cancel your policy if you are late on your payments. So, set up a payment plan that works for you and make sure you always pay your premiums on time to avoid any unnecessary fees or penalties.

By following these tips, you can find cheap liability car insurance in Oklahoma. Shop around and compare rates, increase your deductible, look for discounts, take advantage of low mileage discounts, and pay your premiums on time. By doing these things, you can save money on your Oklahoma liability car insurance and make sure you are getting the best coverage for the best price.

Cheap Car Insurance in Oklahoma

Buy Cheap Car Insurance in Oklahoma | QuoteWizard

Cheap Car Insurance in Oklahoma City - Auto Insurance Agency by Ben

Cheapest Car Insurance in Oklahoma (August 2022) - WalletHub | Cheapest

Liability Only Car Insurance | Liability goodtogo car insurance