Cheapest Liability Only Car Insurance

Cheapest Liability Only Car Insurance

Are you looking for a cheaper way to insure your car? Liability only car insurance may be the perfect option for you. Liability only car insurance covers only the costs associated with damage you cause to others and their property, such as medical bills and repair costs. It does not cover any of your own costs, such as repairs to your car. This type of insurance is usually much cheaper than full coverage car insurance and is perfect for those who are on a budget. In this article, we'll discuss what liability only car insurance is and how you can get the cheapest rate.

What Is Liability Only Car Insurance?

Liability only car insurance is a type of car insurance that covers only the costs associated with damage you cause to others and their property. This type of insurance does not cover any of your own costs, such as repairs to your car or medical bills for you and your passengers. Liability only car insurance is usually much cheaper than full coverage car insurance, but it does not provide the same level of protection. Liability only car insurance is typically only recommended for those who are on a tight budget and can't afford full coverage car insurance.

What Does Liability Only Car Insurance Cover?

Liability only car insurance covers the costs of repairing or replacing other people’s property that you may damage in an accident. This includes their car, their home, and their personal belongings. It also covers any medical bills associated with the accident. Liability only car insurance does not cover any of your own costs, such as repairs to your car or medical bills for you and your passengers.

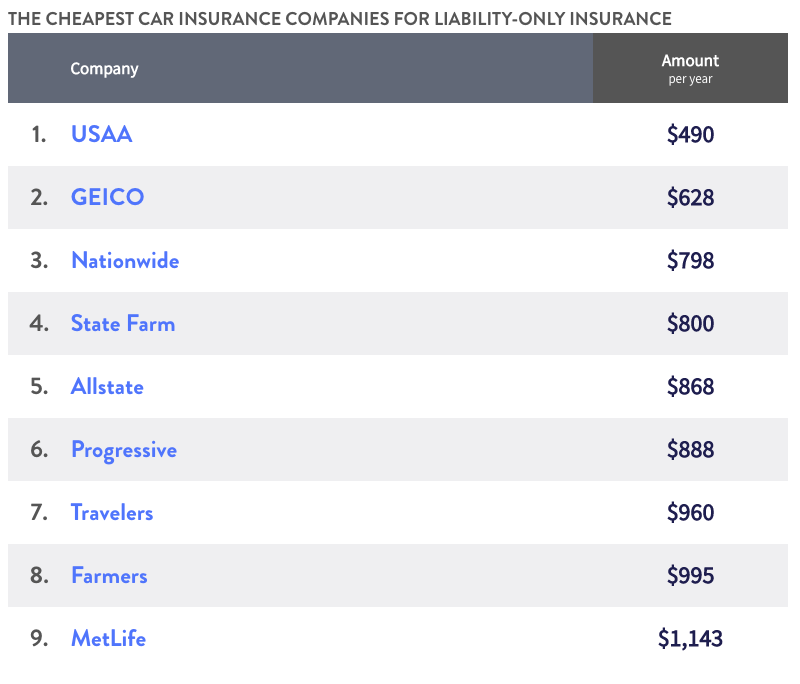

How Can You Get the Cheapest Liability Only Car Insurance?

The best way to get the cheapest liability only car insurance is to shop around and compare quotes from different insurance companies. Be sure to look for discounts and special offers, as some companies may offer cheaper rates for certain drivers. You should also consider raising your deductible, as this can lower your premiums significantly. Finally, you should consider buying only the coverage you need, as this can also help you get the cheapest rate.

What Are the Risks of Liability Only Car Insurance?

The main risk of liability only car insurance is that you are not covered for any of your own costs. This means that if you are in an accident and cause damage to your own car, you will have to pay for the repairs out of pocket. Additionally, if you are liable for medical bills associated with the accident, you will have to pay those costs as well. This is why it is important to make sure you can afford the risks associated with liability only car insurance before you purchase it.

Conclusion

Liability only car insurance is a great option for those who are on a tight budget and can't afford full coverage car insurance. It covers the costs associated with damage you cause to others and their property, but it does not cover any of your own costs. To get the cheapest rate, you should shop around and compare quotes from different insurance companies. Additionally, you should consider raising your deductible and buying only the coverage you need. However, it is important to be aware of the risks associated with liability only car insurance before you purchase it.

Cheapest liability only insurance - Reviews and Tips - Buy Here Buy Here

PPT - Cheapest Liability Car Insurance Texas PowerPoint Presentation

The Cheapest Car Insurance Rate Depends on More Than the Car You Drive

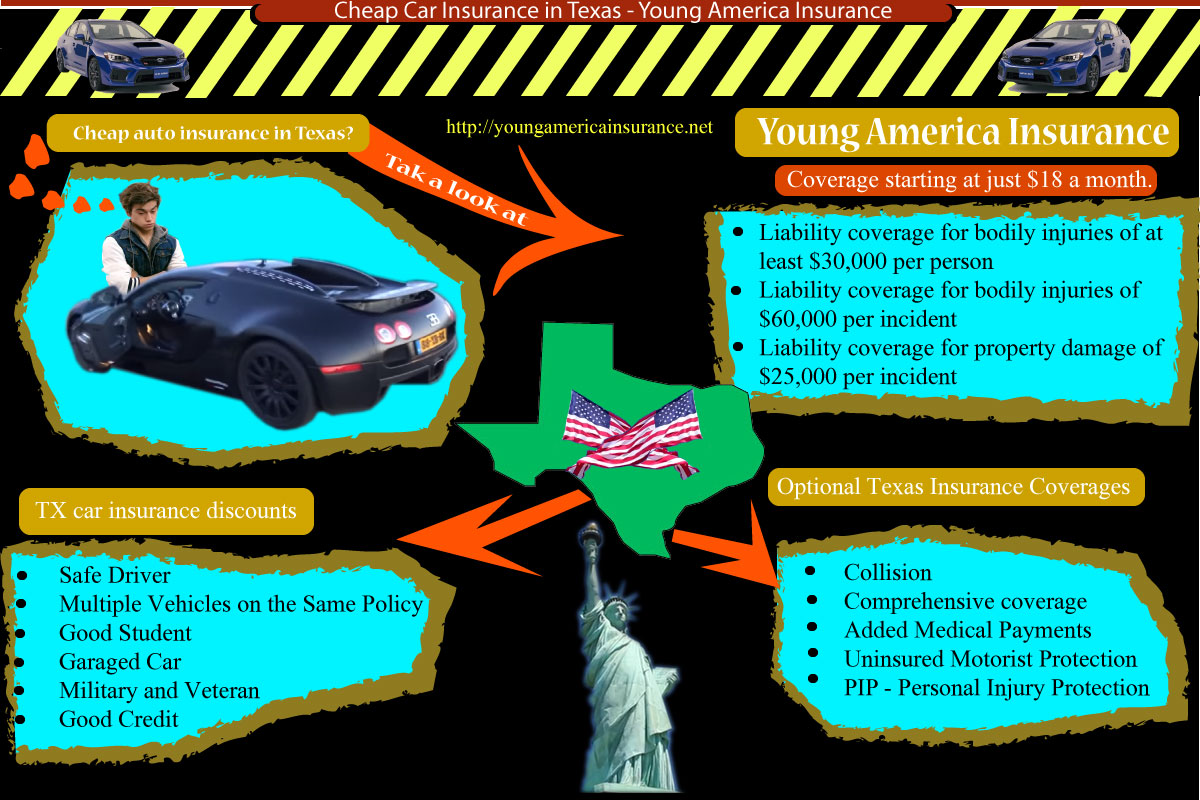

Cheap Car Insurance in Texas | Young America Only Liability Auto Ins

Cheap Liability Only Car Insurance Texas - blog.pricespin.net