Average Car Insurance Cost For Teens

Average Car Insurance Cost For Teens

The Cost of Car Insurance for Teens

Car insurance for teens can be expensive, but there are ways to reduce the cost. While it is true that adding a teen driver to an existing policy can be costly, there are things you can do to reduce the cost. The cost of car insurance for teens varies greatly depending on the age of the driver, the type of car, and the insurance company. However, there are some general guidelines that can help you understand the cost of car insurance for teens.

Factors That Influence Car Insurance Cost for Teens

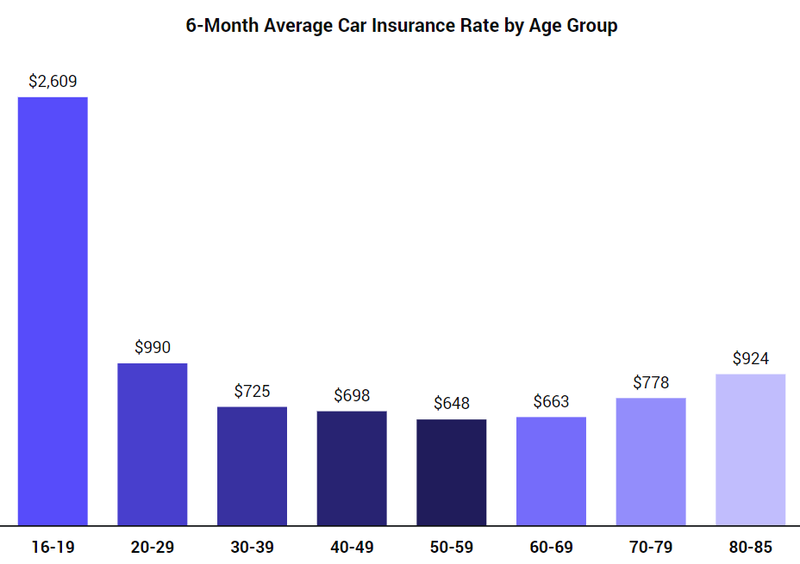

The first factor that influences car insurance cost for teens is the age of the driver. Generally speaking, younger drivers are more expensive to insure than older drivers. This is because younger drivers are considered to be more of a risk by insurers. They are more likely to be involved in an accident, and they are more likely to be cited for driving violations. As such, they represent a greater risk and thus cost more to insure.

The type of car also plays a role in determining the cost of car insurance for teens. Generally speaking, luxury cars, sports cars, and high-performance vehicles are more expensive to insure than more basic models. This is because these types of vehicles are more likely to be involved in an accident than more basic models. Additionally, luxury cars and sports cars are more likely to be stolen than basic models, so insurers charge more to cover them.

The insurance company that you choose also plays a role in determining the cost of car insurance for teens. Some insurers offer discounts for young drivers, good drivers, and drivers with multiple cars on one policy. Additionally, some insurers offer discounts for drivers who have taken driver safety courses. These discounts can vary greatly between insurers, so it is important to shop around to find the best deal.

Ways to Reduce Car Insurance Cost for Teens

There are several ways to reduce the cost of car insurance for teens. The first is to have the teen driver take a driver safety course. These courses are usually offered by local driving schools and can help to reduce the costs of car insurance. Additionally, some insurance companies offer discounts for young drivers who have taken a driver safety course.

Another way to reduce the cost of car insurance for teens is to have the teen driver get a part-time job. Many insurance companies offer discounts for young drivers who are employed. Additionally, some insurance companies offer discounts for good grades. By having the teen driver get good grades in school, they can qualify for a discount on their car insurance.

Finally, shop around for the best deal. Different insurance companies offer different discounts and rates, so it is important to compare the different options. Additionally, it may be beneficial to combine the car insurance for teens with the parents' policy. This can help to reduce the cost of car insurance for teens, as the parents' policy can often be less expensive than the teen's separate policy.

Conclusion

Car insurance for teens can be expensive, but there are ways to reduce the cost. Factors such as the age of the driver, the type of car, and the insurance company all play a role in determining the cost of car insurance for teens. Additionally, there are things that teens can do to reduce the cost of their car insurance, such as taking a driver safety course, getting a part-time job, and getting good grades. Finally, it is important to shop around to find the best deal.

Average Cost of Car Insurance for Young Drivers 2020 | NimbleFins

Teenage Car Insurance Average Cost Per Month ~ artfirstdesign

2021 Car Insurance Rates by Age and Gender - NerdWallet

Average Car Insurance in Maryland - NerdWallet

Average Cost of Car Insurance (2019) | Car insurance, Best car