Pay For Car Insurance By The Mile

Sunday, December 22, 2024

Edit

Pay For Car Insurance By The Mile

Mileage-Based Car Insurance: The Basics

Mileage-based car insurance is a new way to pay for car insurance that is becoming increasingly popular. Instead of paying a fixed premium, you pay only for the miles you drive. This is a great way to save money if you don't drive a lot, as you can pay only for the miles you actually drive. It's also a great way to get more coverage when you need it, such as when you're traveling long distances.

Mileage-based car insurance works by tracking your mileage with a special device installed in your car. This device records the miles you drive and sends the information to your insurance company. Based on the information, your insurer will then calculate a premium for you, which is usually much lower than the traditional fixed premiums.

The Benefits of Mileage-Based Car Insurance

Mileage-based car insurance has many benefits for drivers. First, it can save you a lot of money if you don't drive very much. Instead of paying a fixed premium, you can pay only for the miles you actually drive. This can mean significant savings for drivers who don't drive very often.

Second, mileage-based car insurance can be more flexible than traditional insurance. With traditional insurance, you are locked in to a fixed premium and coverage. With mileage-based insurance, you can get more coverage when you need it, such as when you're traveling long distances. You can also reduce your coverage when you don't need it, such as when you're not driving very much.

Third, it can be easier to manage your car insurance with mileage-based coverage. You don't have to worry about renewing your policy or making payments each month. Your insurance company will simply track your mileage and bill you according to the miles you drive. This makes it much easier to manage your car insurance.

The Downsides of Mileage-Based Car Insurance

Mileage-based car insurance is not for everyone. There are some downsides to this type of insurance that you should be aware of. First, it can be difficult to get accurate readings from the mileage tracking device. This can lead to inaccurate readings and inaccurate premiums. Second, if your car is stolen or totaled, your mileage-based insurance may not cover all of the costs. Third, if you drive a lot, you may end up paying more than you would with traditional fixed premiums.

Who Should Consider Mileage-Based Car Insurance?

Mileage-based car insurance is best suited for drivers who don't drive a lot. If you drive less than 10,000 miles a year, you can save a significant amount of money by switching to mileage-based insurance. It's also a good option for drivers who need more coverage when they're traveling long distances or for drivers who need more flexibility in their coverage.

Should You Get Mileage-Based Car Insurance?

Mileage-based car insurance can be a great way to save money and get more coverage when you need it. However, it's important to weigh the pros and cons before you decide to switch. If you drive a lot, you may end up paying more than you would with traditional fixed premiums. On the other hand, if you don't drive a lot, you can save a lot of money by switching to mileage-based car insurance.

Ultimately, the decision is up to you. Consider your driving habits and needs, and then decide if mileage-based car insurance is right for you.

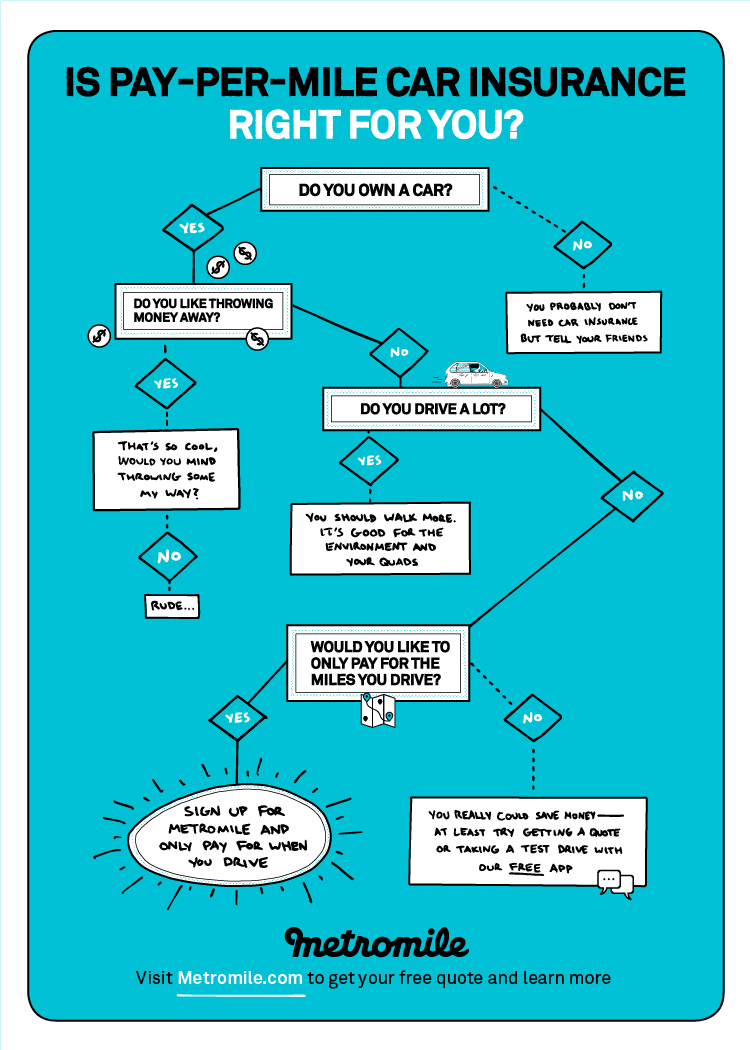

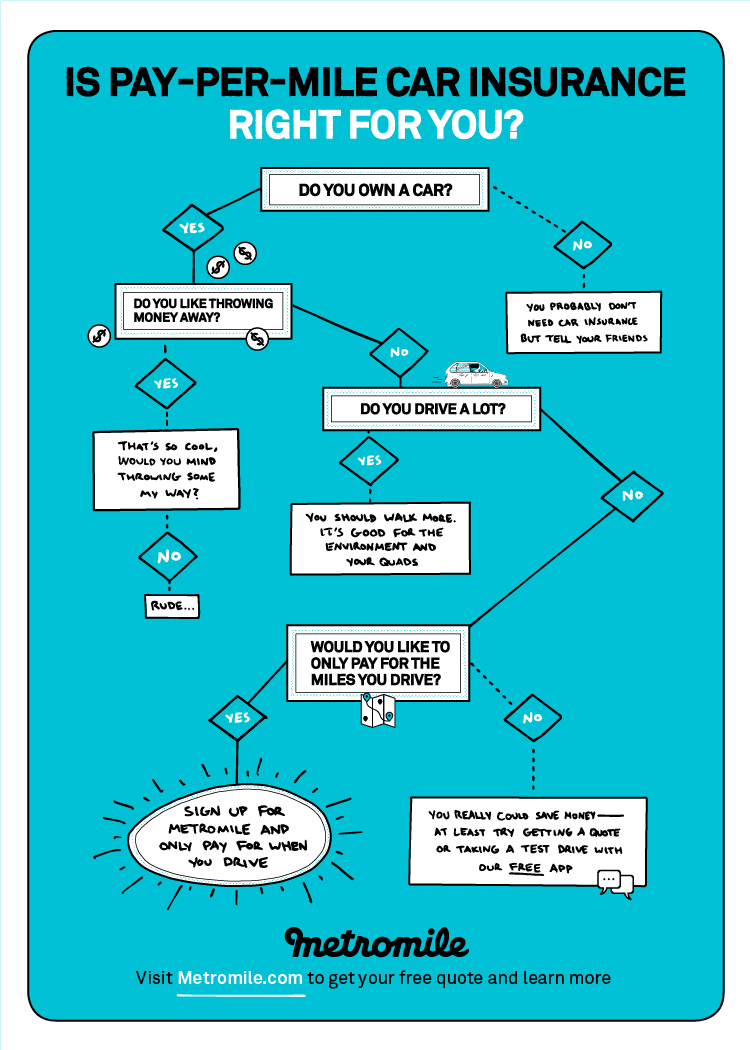

Quiz: Is Pay-per-mile Car Insurance Right for You?

Pay-Per-Mile Car Insurance Could Cut Your Bill in Half - YouTube

Sardilli Says: A Family Insurance Agency: Pay-Per-Mile Auto Insurance

Car Insurance Like Metromile

A look at pay-per-mile insurance - One News Page VIDEO