Home Insurance Average Cost Per Month

How Much Does Home Insurance Cost Per Month?

What Factors Determine Home Insurance Cost?

When it comes to home insurance, the cost is determined by a variety of factors. The most important factor is usually the value of your house. The higher the value of your house, the more expensive your home insurance policy will be. Additionally, the location of your house can also impact the cost. Homes in high-risk areas, such as areas prone to flooding, hurricanes, earthquakes, or other natural disasters, will usually be more expensive to insure. Other factors can include the age of your home and the type of materials used to construct it, as well as any additional features, such as a pool or a trampoline. Lastly, the amount of coverage you choose will also impact the cost of your policy.

Average Cost of Home Insurance Per Month

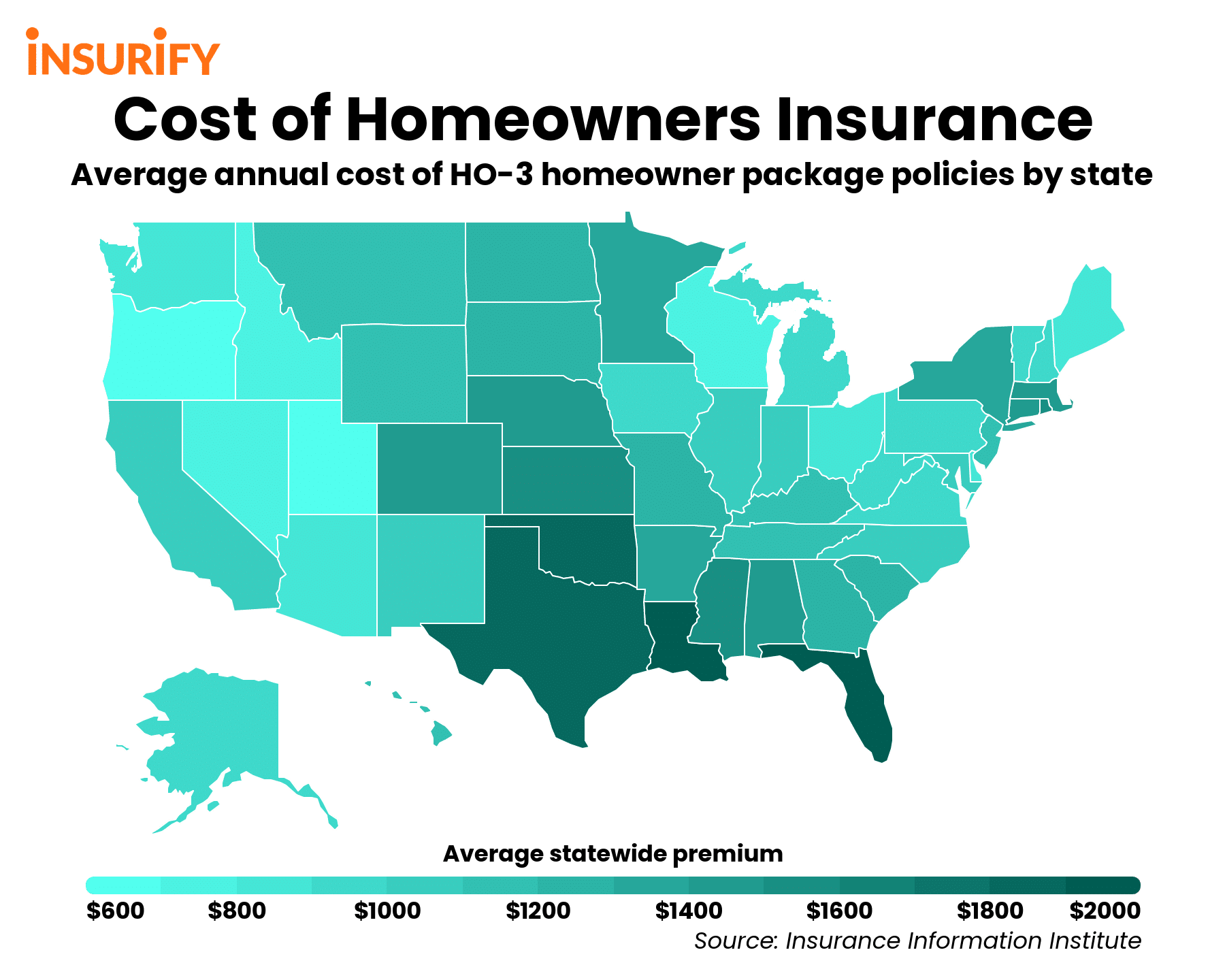

The average cost of home insurance in the United States is around $119 per month. This can vary greatly depending on the factors listed above. In some states, such as Florida, the average cost is much higher, around $231 per month. On the other hand, in states such as Idaho, the average cost is much lower, around $63 per month. If you are looking for the cheapest home insurance coverage, it is important to shop around and compare quotes from different insurers.

Discounts On Home Insurance

Some home insurance companies offer discounts to policyholders who meet certain criteria. For instance, many companies will offer discounts to policyholders who have a home security system installed. Additionally, many companies will also offer discounts to policyholders who bundle their home insurance policy with other policies, such as auto insurance. Lastly, many insurers offer discounts to policyholders who have a good credit score. Be sure to ask your insurer about any discounts they may offer.

How Much Home Insurance Do You Need?

The amount of home insurance you need will depend on a variety of factors. The most important factor is the value of your home. You should also consider any additional structures on your property, such as a shed or a pool. Additionally, you should consider any valuables you may have, such as jewelry, electronics, or artwork. You should also consider any liability risks, such as a trampoline or a swimming pool. Lastly, you should consider any additional living expenses you may have, such as temporary housing if your home is damaged or destroyed.

Compare Quotes To Find The Best Home Insurance

When it comes to finding the best home insurance policy, it is important to shop around and compare quotes from different insurers. Be sure to pay attention to the coverage offered, as well as the cost of the policy. Additionally, be sure to ask about any discounts that may be available. Finally, be sure to read the fine print of any policy you are considering, as there may be exclusions or limitations that could affect your coverage.

Here's Why It Costs $1,204 a Month to Maintain the Average Home

Average Home Insurance Cost Per Month

How Much Would A Home Equity Loan Cost Per Month

These States Have the Cheapest Home Insurance Premiums | KHXS-FM